What Sprott (TSX:SII)'s Revenue Gains and Steady Profits Mean for Shareholder Value

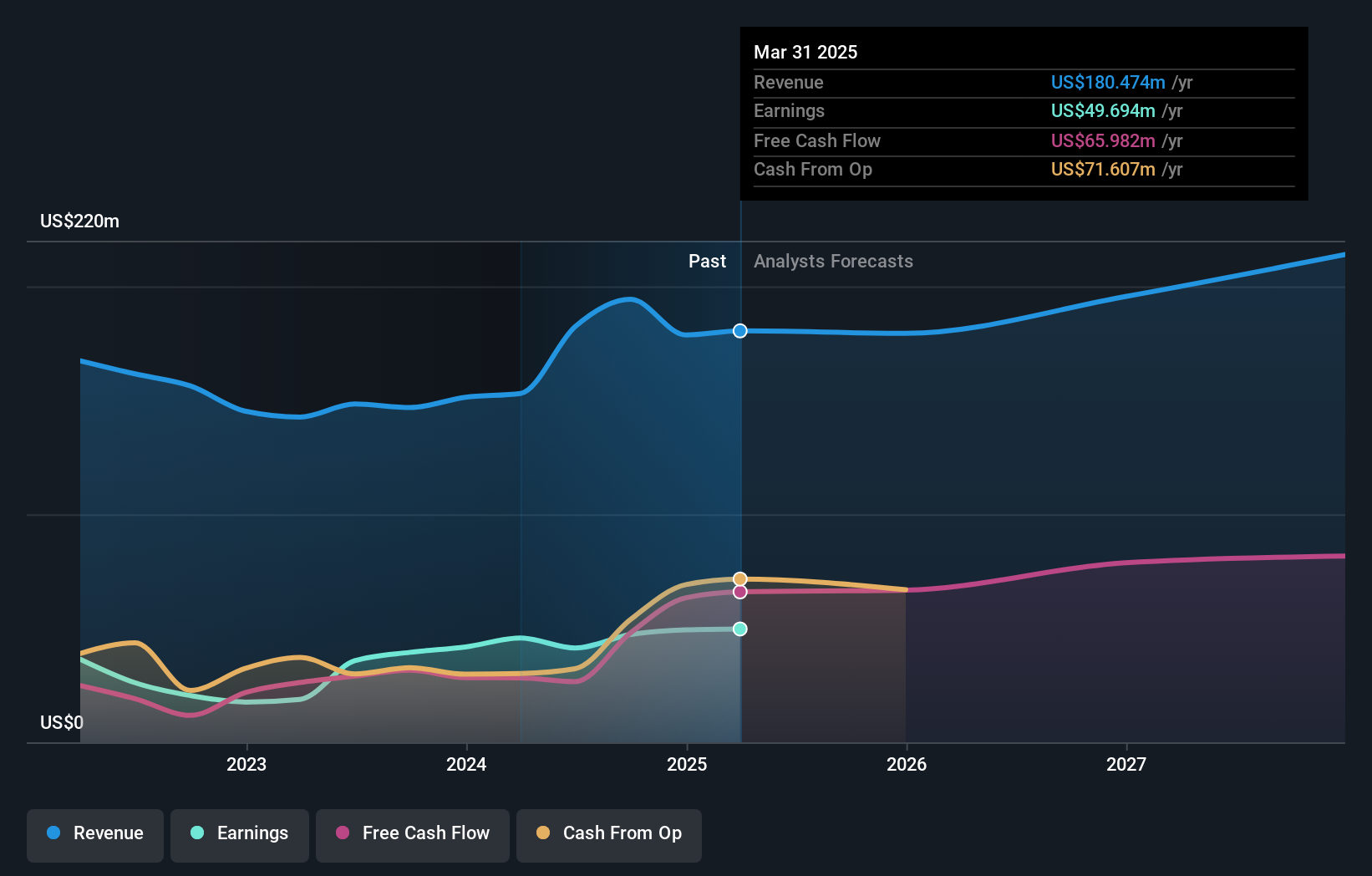

- Sprott Inc. recently announced its second quarter 2025 earnings, reporting revenue of US$65.17 million and net income of US$13.5 million, alongside a quarterly dividend of US$0.30 per common share payable in September.

- While revenue rose compared to the same period last year, net income and earnings per share remained steady, highlighting consistency in the company’s financial performance.

- To assess how these results shape Sprott's investment narrative, we'll focus on the impact of strong revenue growth amid stable profitability.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 27 best rare earth metal stocks of the very few that mine this essential strategic resource.

What Is Sprott's Investment Narrative?

To be a Sprott shareholder, you generally have to believe in the company’s ability to capture value as a specialized asset manager in precious metals and natural resources, areas that often draw investor attention during macroeconomic uncertainty. The latest results show revenue growth of US$65.17 million for the quarter, with net income holding steady and the dividend maintained at US$0.30 per share. This points to near-term catalysts centering on Sprott’s ongoing asset gathering success, new fund launches, and shareholder returns through buybacks and dividends. The strong revenue trend may ease concerns over slowing growth, but the absence of meaningful earnings expansion highlights that margin pressure and cost control will remain key to results. Right now, the most important risks, such as potential valuation stretch and recent insider selling, remain relevant, although the recent sell-off has tempered overvaluation worries. Investors still need to weigh if revenue momentum can translate into lasting profit growth. But while revenue is trending higher, insider selling is one risk that shouldn’t be ignored.

Sprott's share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore 3 other fair value estimates on Sprott - why the stock might be worth as much as 9% more than the current price!

Build Your Own Sprott Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sprott research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Sprott research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sprott's overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal