Does Sandstorm Gold's Earnings Surge and Guidance Reaffirmation Alter the Bull Case for TSX:SSL?

- Sandstorm Gold Ltd. recently reported strong second quarter and first-half 2025 results, with sales and net income climbing to US$30.28 million and US$15.46 million respectively for the quarter, alongside reaffirmed production guidance for the year.

- Despite a decrease in attributable gold equivalent ounces produced in the quarter compared to the prior year, both earnings and revenue showed robust growth, signaling solid operational momentum and continued investor confidence.

- We'll explore how Sandstorm Gold's notable earnings growth and guidance confirmation might reshape its outlook and future production narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Sandstorm Gold Investment Narrative Recap

Sandstorm Gold investors are generally drawn to the company's royalty model, which provides exposure to gold price movements and future mine ramp-ups without the direct risks of mining operations. The recent earnings beat and the reaffirmed 2025 production guidance may help sustain confidence in Sandstorm’s operational momentum; however, the lower quarterly gold equivalent output underscores that production delivery remains the central short-term catalyst and risk. For now, the reported results neither materially change the risk profile nor allay concerns regarding production volatility.

The company’s recent confirmation of its 2025 production guidance, amid declining quarterly gold equivalent ounces, is especially relevant. This consistency offers near-term visibility and may support sentiment around the company's capacity to meet projected growth, even as actual quarterly output can fluctuate based on partner mine ramp-ups and commodity price impacts.

Yet, despite consistent guidance, investors should be alert to potential production surprises that could ...

Read the full narrative on Sandstorm Gold (it's free!)

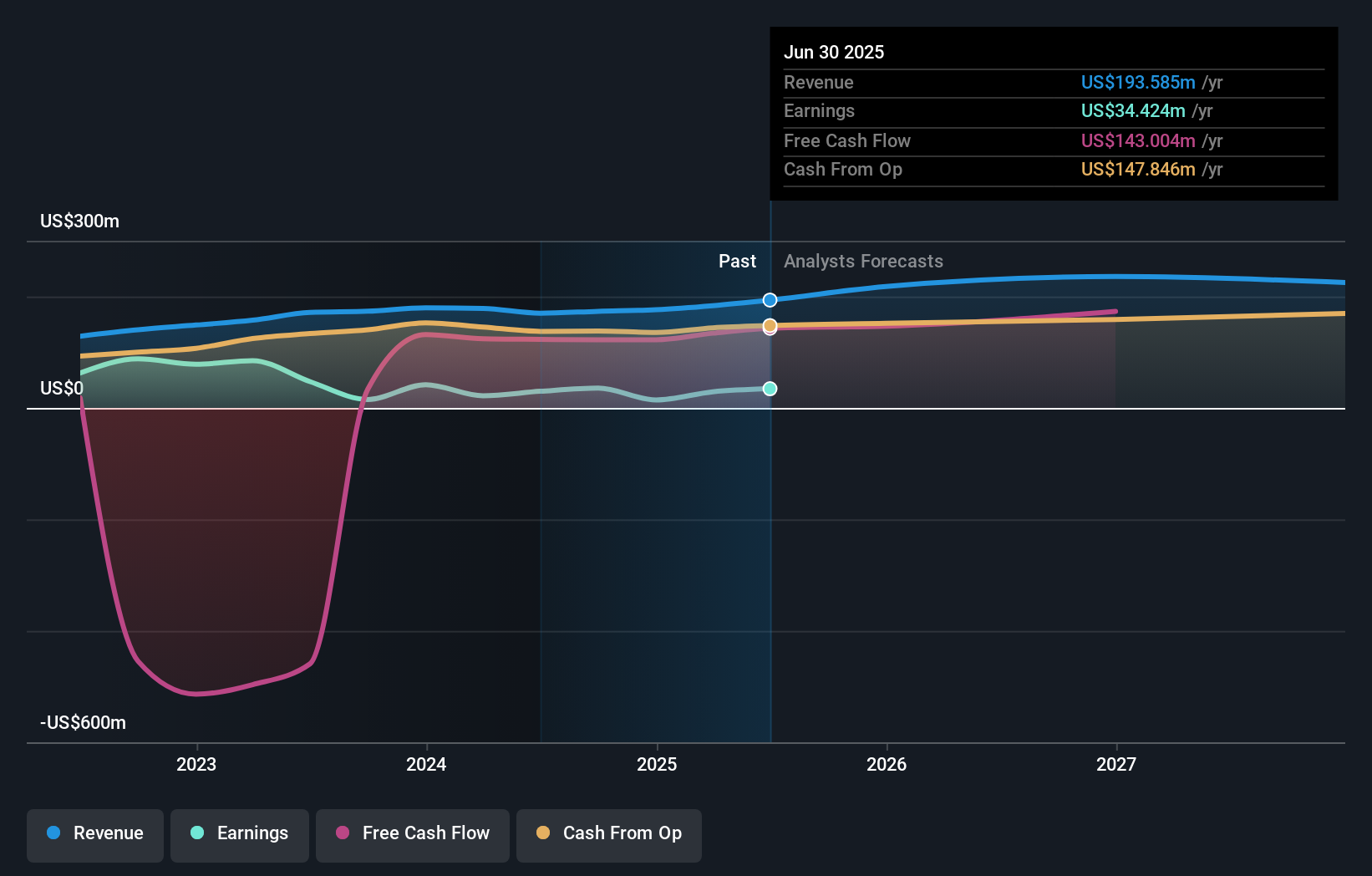

Sandstorm Gold's outlook anticipates $255.5 million in revenue and $105.8 million in earnings by 2028. This is based on a projected 11.7% annual revenue growth and a $76.8 million increase in earnings from $29.0 million today.

Uncover how Sandstorm Gold's forecasts yield a CA$15.90 fair value, a 8% upside to its current price.

Exploring Other Perspectives

Private fair value estimates from four Simply Wall St Community members range from CA$11 to CA$97, underscoring wide disagreement on Sandstorm Gold’s potential. With actual production delivery flagged as a key catalyst, these contrasts highlight how opinions on growth reliability can shape sentiment for the months ahead.

Explore 4 other fair value estimates on Sandstorm Gold - why the stock might be worth 25% less than the current price!

Build Your Own Sandstorm Gold Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sandstorm Gold research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Sandstorm Gold research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sandstorm Gold's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 19 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal