Bet on the big market+AI leader! Wells Fargo increased its holdings in the S&P 500 ETF (SPY.US) by nearly 50% in Q2, and Microsoft (MSFT.US) held the top position

The Zhitong Finance App learned that according to the US Securities and Exchange Commission (SEC) disclosure, Wells Fargo Bank (WFC.US) submitted a position report (13F) for the second quarter (Q2) ending June 30, 2025.

According to statistics, the total market value of Wells Fargo's holdings in the second quarter was US$483 billion, compared to US$440 billion in the previous quarter, an increase of 9.77% over the previous quarter. Wells Fargo added 577 new shares to its portfolio in the second quarter and increased its holdings by 3,322 shares. Meanwhile, Wells Fargo also reduced its holdings by 2,427 shares and cleared 474 stocks. Among them, the top ten holdings account for 19.82% of the total market value.

Among the top five major stocks, Microsoft (MSFT.US) ranked first, holding about 33.1 million shares and holding positions with a market value of about US$16.46 billion. The number of positions held increased by 0.81% compared to the previous quarter, accounting for 3.41% of the portfolio.

The SPDR S&P 500 ETF (SPY.US) ranked second, holding about 2004 million shares with a market value of about US$12.38 billion. The number of positions held increased by 47.29% compared to the previous quarter, accounting for 2.56% of the portfolio.

Apple (AAPL.US) ranked third, holding about 577.63 million shares and holding a market value of about US$11.85 billion. The number of positions held increased by 0.56% compared to the previous quarter, accounting for 2.90% of the portfolio.

The iShares S&P 500 ETF (IVV.US) ranked fourth, holding about 17.7 million shares with a market value of about US$10.9 billion. The number of positions held decreased by 0.29% compared to the previous quarter, accounting for 2.27% of the portfolio.

Nvidia (NVDA.US) ranked fifth, holding approximately 57.31 million shares with a market value of about US$9.05 billion. The number of positions held decreased by 4.18% compared to the previous quarter, accounting for 1.87% of the portfolio.

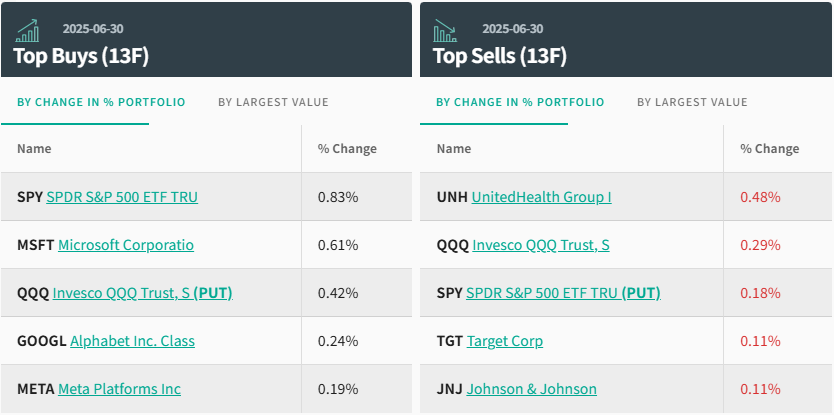

Judging from changes in position ratios, the top five buying targets are: SPDR S&P 500 ETF (SPY.US), Microsoft, NASDAQ 100ETF-Invesco QQQ Trust put options (QQQ.US, PUT ), Google (GOOGL.US), Meta Platform (META.US).

The top five sales targets were: UnitedHealth (UNH.US), NASDAQ 100ETF-Invesco QQQ Trust (QQQ.US), SPDR S&P 500 ETF put options (SPY.US, PUT), Target (TGT.US), and Johnson & Johnson (JNJ.US).

Wells Fargo sharply increased its holdings of the S&P 500 ETF by 47.29% in the second quarter, and its market value jumped to 12.38 billion US dollars (2.56% of the portfolio), unleashing strong confidence in the US stock market. At the same time, it also focused on internal structural opportunities in technology stocks: betting heavily on AI core assets — maintaining Microsoft's top position, and violently increasing Google (GOOGL.US) by 30.89%. Apple “passively reduced its holdings” to third place, reflecting a cautious attitude towards consumer electronics recovery. Notably, Broadcom (AVGO.US) is among the top ten positions for the first time, highlighting the increase in the AI chip circuit.

At the risk hedging level, Wells Fargo showed a keen sense of defense: on the one hand, it increased 3.36% bond ETF (AGG.US) and essential consumer stock market openers (COST.US) to improve the resilience of the portfolio; on the other hand, it aggressively increased its NASDAQ 100 index put options by 92.25% and reduced its holdings by 30.66% over the same period to form a hedging combo It clearly expresses an early warning for short-term pullbacks in regions where technology stocks are overvalued.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal