3 Middle Eastern Dividend Stocks Yielding Up To 7.5%

In the Middle East, Gulf equity markets have been experiencing modest gains as stronger oil prices help offset mixed earnings reports. Amidst this backdrop, dividend stocks can offer a stable income stream for investors looking to navigate the region's dynamic market conditions.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Saudi Telecom (SASE:7010) | 9.83% | ★★★★★☆ |

| Saudi Awwal Bank (SASE:1060) | 6.26% | ★★★★★☆ |

| Riyad Bank (SASE:1010) | 6.52% | ★★★★★☆ |

| National Bank of Ras Al-Khaimah (P.S.C.) (ADX:RAKBANK) | 6.20% | ★★★★★☆ |

| Emirates NBD Bank PJSC (DFM:EMIRATESNBD) | 3.82% | ★★★★★☆ |

| Emaar Properties PJSC (DFM:EMAAR) | 6.83% | ★★★★★☆ |

| Commercial Bank of Dubai PSC (DFM:CBD) | 5.23% | ★★★★★☆ |

| Banque Saudi Fransi (SASE:1050) | 6.51% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 5.99% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 7.03% | ★★★★★☆ |

Click here to see the full list of 73 stocks from our Top Middle Eastern Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

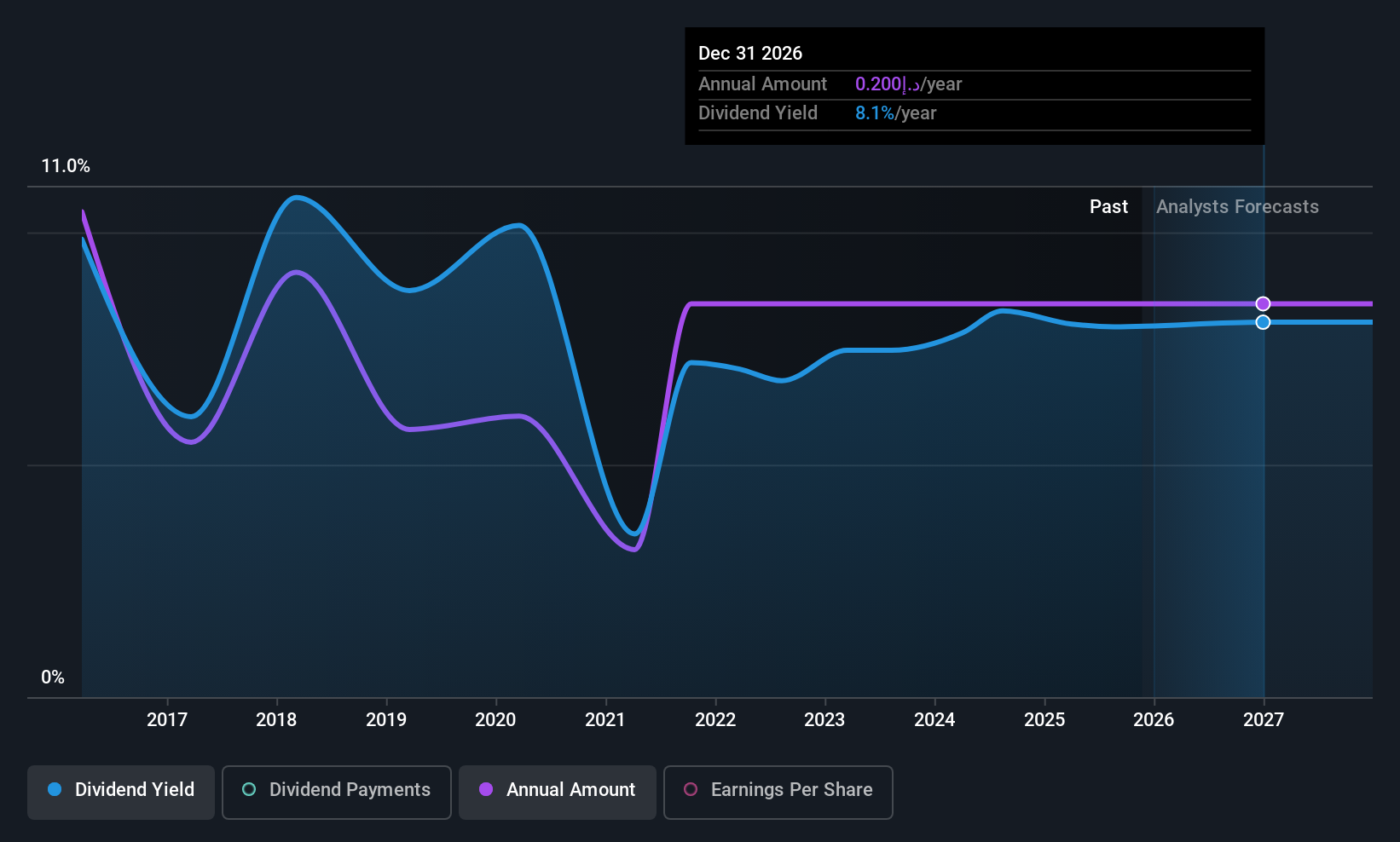

R.A.K. Ceramics P.J.S.C (ADX:RAKCEC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: R.A.K. Ceramics P.J.S.C. manufactures and sells a range of ceramic products across the Middle East, Europe, Asia, and internationally with a market cap of AED2.63 billion.

Operations: R.A.K. Ceramics P.J.S.C. generates revenue through the manufacture and sale of diverse ceramic products across various regions, including the Middle East, Europe, and Asia.

Dividend Yield: 7.5%

R.A.K. Ceramics P.J.S.C. offers a dividend yield of 7.55%, placing it in the top 25% of payers in the AE market, with dividends covered by earnings and cash flows at payout ratios of 88.3% and 66.9%, respectively. However, its dividend track record is unstable with past volatility and decline over ten years, despite recent earnings growth shown by increased sales to AED 826.75 million for Q2 2025 from AED 777.02 million a year ago.

- Click here to discover the nuances of R.A.K. Ceramics P.J.S.C with our detailed analytical dividend report.

- The valuation report we've compiled suggests that R.A.K. Ceramics P.J.S.C's current price could be quite moderate.

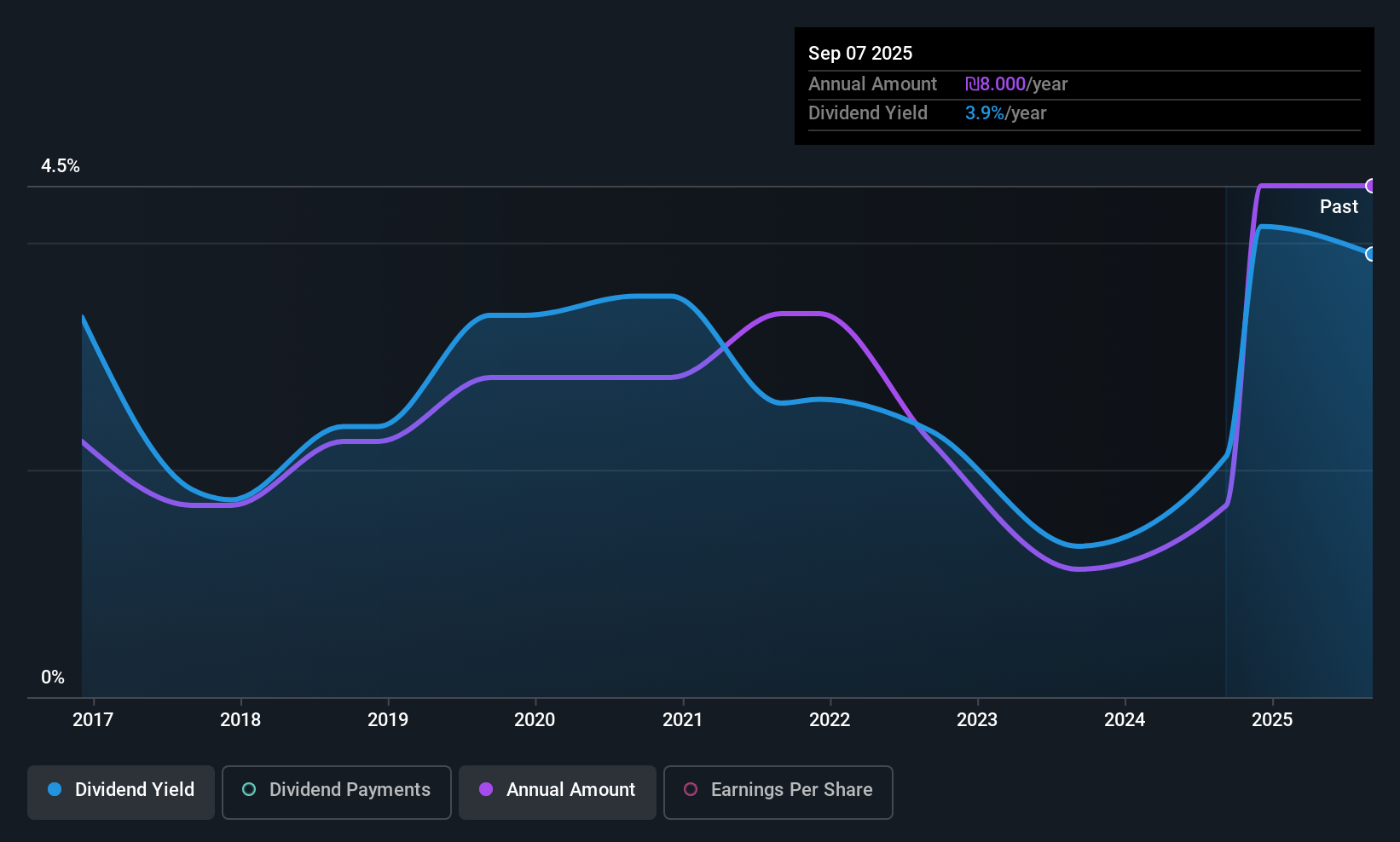

Plasson Industries (TASE:PLSN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Plasson Industries Ltd develops, manufactures, and markets technical products across various global regions, with a market cap of ₪1.88 billion.

Operations: Plasson Industries Ltd generates revenue through its key segments, which include Products for Animals at ₪588.41 million and Connection Accessories for Plumbing at ₪890.61 million.

Dividend Yield: 4.1%

Plasson Industries Ltd's dividend payments have increased over the past decade but remain volatile and unreliable, with a yield of 4.07% below the top 25% in the IL market. Despite this, dividends are well-covered by earnings (payout ratio: 47%) and cash flows (cash payout ratio: 59.9%). Recent Q1 earnings show sales growth to ILS 450.62 million from ILS 421.38 million last year, though net income slightly decreased to ILS 41.21 million from ILS 42.76 million.

- Dive into the specifics of Plasson Industries here with our thorough dividend report.

- The valuation report we've compiled suggests that Plasson Industries' current price could be inflated.

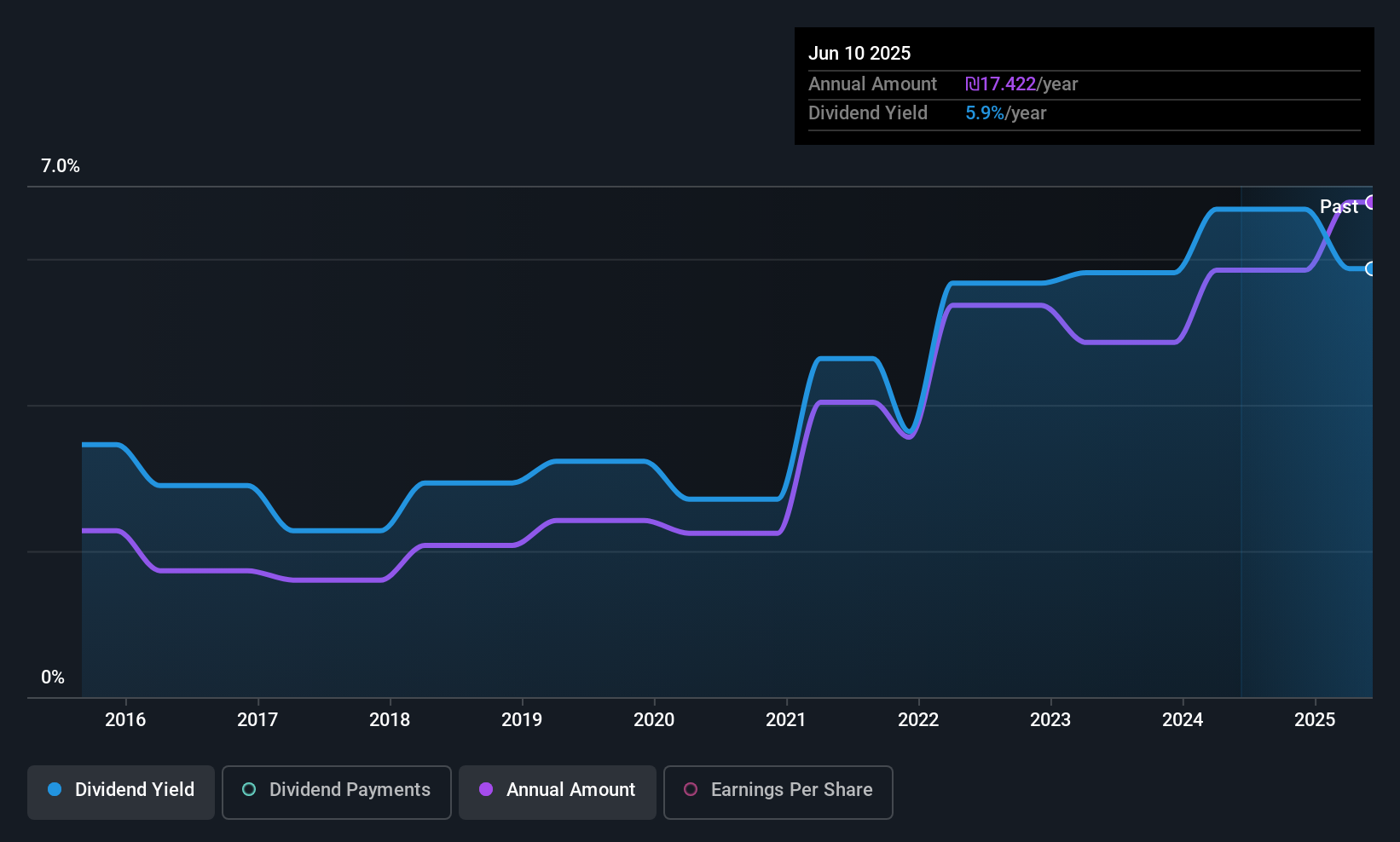

Rami Levi Chain Stores Hashikma Marketing 2006 (TASE:RMLI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Rami Levi Chain Stores Hashikma Marketing 2006 Ltd operates a chain of discount retail stores in Israel and has a market cap of ₪4.22 billion.

Operations: Rami Levi Chain Stores Hashikma Marketing 2006 Ltd generates revenue primarily from its Retail Chains segment, which accounts for ₪6.64 billion, and also earns income from its Good Pharm Wholesale segment totaling ₪455.07 million.

Dividend Yield: 5.7%

Rami Levi Chain Stores Hashikma Marketing 2006 Ltd's dividends are covered by both earnings (payout ratio: 72.7%) and cash flows (cash payout ratio: 47.7%), but they have been volatile over the past decade. The dividend yield of 5.68% is slightly below the top tier in the IL market, and recent Q1 results show sales growth to ILS 1.85 billion, though net income fell to ILS 50.96 million from ILS 58.25 million last year.

- Unlock comprehensive insights into our analysis of Rami Levi Chain Stores Hashikma Marketing 2006 stock in this dividend report.

- In light of our recent valuation report, it seems possible that Rami Levi Chain Stores Hashikma Marketing 2006 is trading beyond its estimated value.

Where To Now?

- Click this link to deep-dive into the 73 companies within our Top Middle Eastern Dividend Stocks screener.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal