CTS (CTS) Is Up 10.9% After Inflation Data and Small Business Optimism Spark Rate Cut Hopes

- After the July Consumer Price Index report showed annual inflation holding steady at 2.7% and the National Federation of Independent Business Small Business Optimism Index rose to a five-month high, hopes strengthened for a Federal Reserve interest rate cut.

- This combination of stable inflation and improved small business sentiment provided a boost to confidence and activity in sectors such as IT services, manufacturing, and staffing.

- With the prospect of reduced interest rates supporting manufacturing demand, we’ll explore how this positive macroeconomic backdrop affects CTS’s investment outlook.

Rare earth metals are the new gold rush. Find out which 27 stocks are leading the charge.

CTS Investment Narrative Recap

To be a shareholder in CTS, you need to believe in its ability to diversify beyond traditional transportation markets into higher-growth sectors like medical and industrial technology. While July’s inflation report and increased small business optimism have improved the macro backdrop and may support a rebound in demand, the most immediate catalyst remains recovery in manufacturing activity. However, persistent weaknesses in transportation sales, notably linked to external factors like tariffs and China market trends, still pose a significant risk and the impact of recent news is encouraging but not immediately material to this concern.

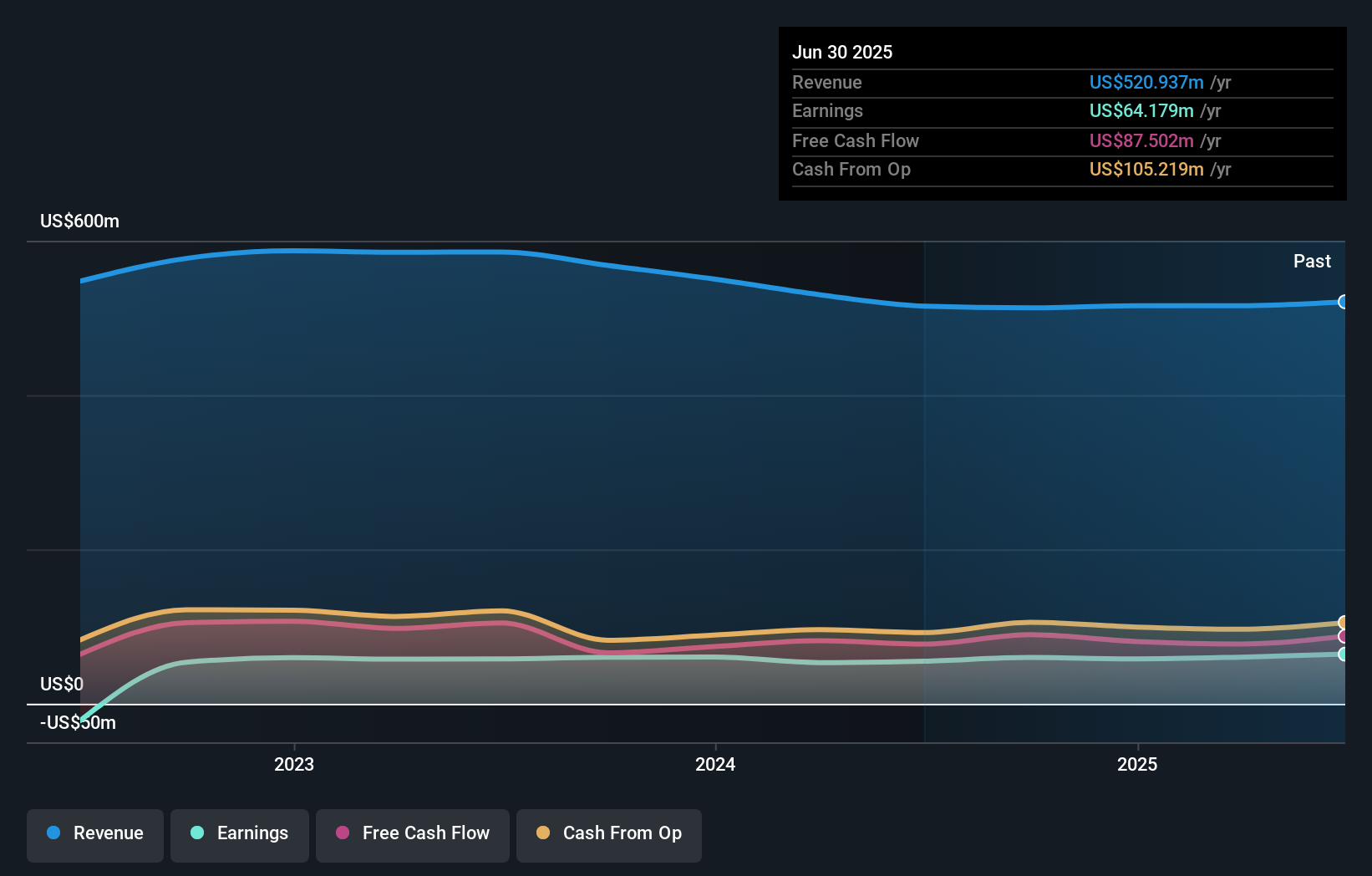

Among recent announcements, CTS’s Q2 earnings release is most relevant to the improving economic outlook. The company reported continued revenue and net income growth, Q2 sales rose to US$135.31 million and net income reached US$18.53 million, suggesting that its diversification strategy and operational discipline help offset ongoing industry volatility. Consistent performance in this environment will remain pivotal as investors assess if near-term recovery can outpace structural headwinds and validate the company’s sales guidance.

Yet, in contrast to the positive momentum, investors should keep an eye on how ongoing softness in transportation sales could ...

Read the full narrative on CTS (it's free!)

CTS’ narrative projects $610.6 million revenue and $78.8 million earnings by 2028. This requires 5.4% yearly revenue growth and a $14.6 million earnings increase from $64.2 million currently.

Uncover how CTS' forecasts yield a $43.00 fair value, in line with its current price.

Exploring Other Perspectives

All one members of the Simply Wall St Community valued CTS at US$43, showing no divergence in retail investor outlooks. With macro conditions looking more supportive, you may want to see how others factor lingering transportation market risks into their analysis.

Explore another fair value estimate on CTS - why the stock might be worth as much as $43.00!

Build Your Own CTS Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CTS research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free CTS research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CTS' overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal