Will Vishay Intertechnology’s (VSH) Miniaturization Drive Redefine Its Edge in High-Growth Markets?

- In the past week, Vishay Intertechnology announced the launch of its TSM41 series of industrial-grade, multi-turn, surface-mount cermet trimmers, featuring a compact 4 mm by 4 mm footprint and IP67 sealing for harsh environments, as well as two new automotive-grade inductors designed for high current and temperature operations in electric vehicle systems.

- These product introductions underscore the company's focus on innovation aimed at key growth markets such as automotive electrification, industrial automation, and electronics manufacturing, reflecting ongoing efforts to meet evolving customer requirements for smaller, more reliable, and efficient components.

- We'll examine how the TSM41 series' miniaturization and robust features could reshape Vishay's investment narrative in high-growth market segments.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Vishay Intertechnology Investment Narrative Recap

To invest in Vishay Intertechnology, you have to believe in the company’s ability to return to sustainable profitability by translating major capacity investments and ongoing product innovation into meaningful revenue and margin growth. The recent launch of the TSM41 industrial trimmers illustrates a push toward high-margin markets like automotive and industrial, but this does not materially change the biggest short-term risk: margin pressures from negative free cash flow and operating inefficiencies remain the most immediate challenge for the business.

Amid capacity expansion and product launches, the recent affirmation of a $0.10 dividend per share stands out as a signal of management’s confidence in maintaining shareholder returns, even as the company continues to face profitability challenges and negative cash flows. For investors, the continuation of dividend payments during a period of low profitability spotlights both resilience and the potential stress on near-term financial flexibility.

But while product innovation is moving forward, investors should remain aware of how ongoing manufacturing cost pressures and delayed gross margin recovery could still weigh heavily on Vishay’s...

Read the full narrative on Vishay Intertechnology (it's free!)

Vishay Intertechnology's outlook anticipates $3.5 billion in revenue and $587.0 million in earnings by 2028. This projection relies on a 6.6% annual revenue growth rate and an earnings increase of $674.7 million from current earnings of -$87.7 million.

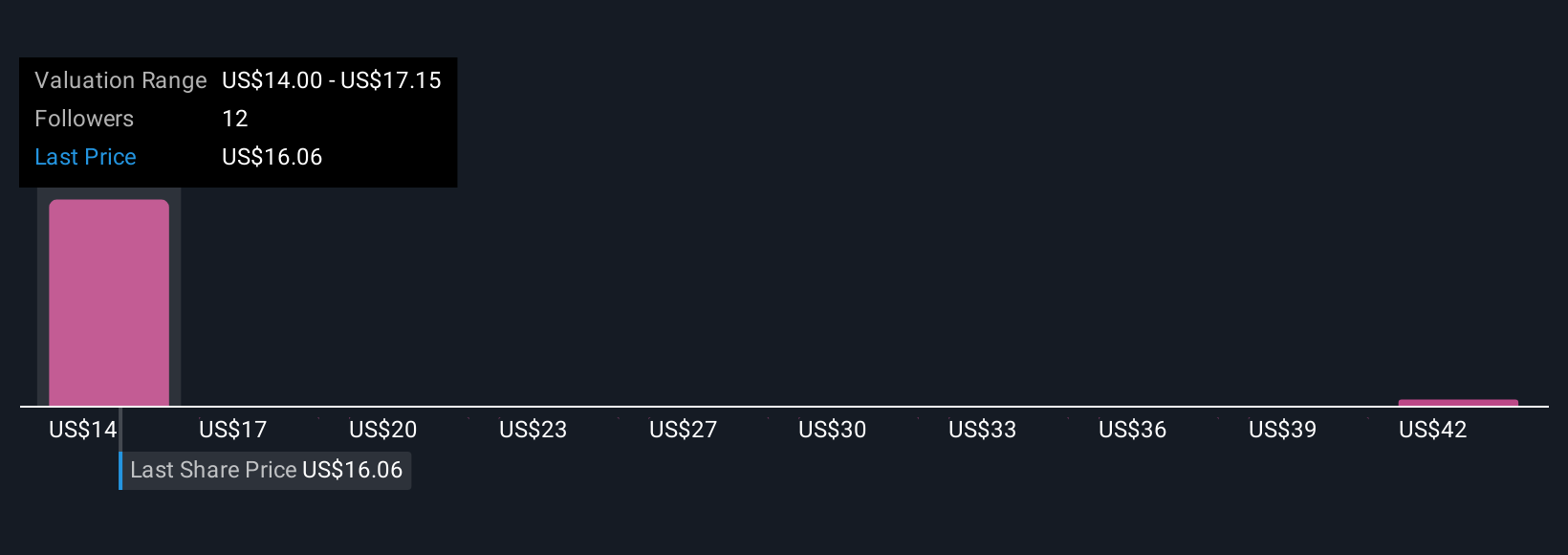

Uncover how Vishay Intertechnology's forecasts yield a $14.00 fair value, a 9% downside to its current price.

Exploring Other Perspectives

Simply Wall St Community contributors estimate Vishay’s fair value between US$14.00 and US$14.79, with 2 distinct perspectives. While product innovation supports optimism, persistent margin pressures could temper any recovery in earnings or valuation. Explore these contrasting views to inform your own outlook.

Explore 2 other fair value estimates on Vishay Intertechnology - why the stock might be worth as much as $14.79!

Build Your Own Vishay Intertechnology Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Vishay Intertechnology research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Vishay Intertechnology research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Vishay Intertechnology's overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 18 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal