How Investors Are Reacting To Itron (ITRI) Profit Growth Amid Flat Revenue and Updated 2025 Guidance

- Itron, Inc. recently reported its second quarter 2025 financial results, showing net income growth to US$68.34 million from US$51.32 million a year earlier, with earnings per share also rising, despite virtually flat revenues.

- The company also released updated revenue guidance for both the third quarter and full year, offering investors new expectations for its sales outlook in 2025.

- We’ll examine how Itron’s improved profitability, supported by resilient margins amid stable revenues, influences the company’s investment narrative.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Itron Investment Narrative Recap

To be a shareholder in Itron, you need confidence that rising global demand for smart grid solutions and continued margin strength can offset the risk of regulatory project delays and muted revenue growth. The latest earnings report shows profitability improvement despite virtually flat revenues, but updated revenue guidance for Q3 and full year 2025 suggests near-term growth uncertainty remains; neither materially shifts the balance between the strongest short-term catalyst, outcomes segment expansion, and the chief risk of project deferrals tied to regulatory or client delays.

Among Itron’s recent announcements, the Q3 and 2025 full-year revenue guidance is most relevant, as the company now expects US$2.35 billion to US$2.4 billion for the year. This update tempers previous optimism and highlights the ongoing exposure to revenue shifts in large, backlog-driven projects, a recurring theme for Itron as utilities rebalance capital budgets and regulatory timelines. The contrast worth noting for investors is the sustainability of recent margin gains should...

Read the full narrative on Itron (it's free!)

Itron's narrative projects $2.8 billion in revenue and $388.8 million in earnings by 2028. This requires 5.2% yearly revenue growth and a $118.9 million earnings increase from $269.9 million today.

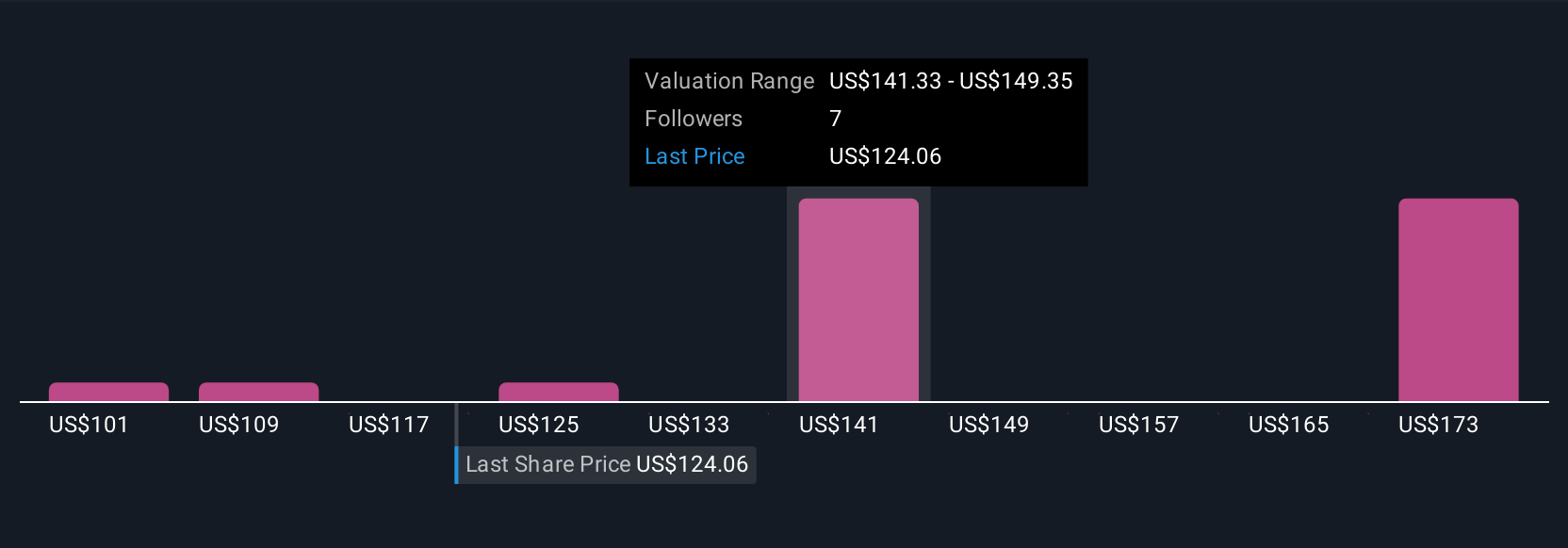

Uncover how Itron's forecasts yield a $144.40 fair value, a 12% upside to its current price.

Exploring Other Perspectives

Five fair value estimates from the Simply Wall St Community range from US$101.21 to US$180.82. While participants offer a broad set of views, keep in mind that Itron’s reliance on a smooth regulatory approval process may influence long-term outcomes in ways consensus does not fully capture.

Explore 5 other fair value estimates on Itron - why the stock might be worth as much as 41% more than the current price!

Build Your Own Itron Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Itron research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Itron research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Itron's overall financial health at a glance.

No Opportunity In Itron?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Rare earth metals are the new gold rush. Find out which 27 stocks are leading the charge.

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal