DigitalBridge (DBRG) Is Up 10.4% After Reporting Rare Negative Revenue and Earnings Drop—Has the Narrative Shifted?

- DigitalBridge Group reported second quarter 2025 results showing negative revenue of US$3.21 million, in contrast to revenue of US$390.34 million a year earlier, with net income at US$31.62 million versus US$91.42 million previously.

- This dramatic change highlights a rare occurrence of negative revenue alongside a significant contraction in profitability for the company.

- We'll explore how the sharp decline in revenue and earnings affects DigitalBridge Group's future investment narrative and industry positioning.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

DigitalBridge Group Investment Narrative Recap

To be a shareholder in DigitalBridge Group, you must believe in the long-term demand for digital infrastructure and the company's ability to harness secular trends in AI, data centers, and real asset management. The recent report of negative revenue and a sharp drop in earnings stands out as a rare and significant development, intensifying scrutiny on short-term earnings visibility, especially as disruptions like one-off charges have already impacted results, while heightening risks around revenue stability and margin pressure. For now, the negative revenue appears to materially impact the most important catalyst: the ability to convert strong sector tailwinds into consistent, fee-based growth.

Among recent announcements, DigitalBridge affirmed a quarterly dividend of US$0.0100 per share, continuing its established payout even in a quarter marked by sharply lower revenues and profits. While this serves as a gesture of ongoing shareholder commitment, it will likely draw attention to the sustainability of returns if future cash flows stay volatile or pressured by similar negative revenue events. In contrast, investors should be aware of...

Read the full narrative on DigitalBridge Group (it's free!)

DigitalBridge Group's narrative projects $493.7 million in revenue and $197.3 million in earnings by 2028. This requires 41.7% annual revenue growth and an increase in earnings of $195.6 million from the current $1.7 million.

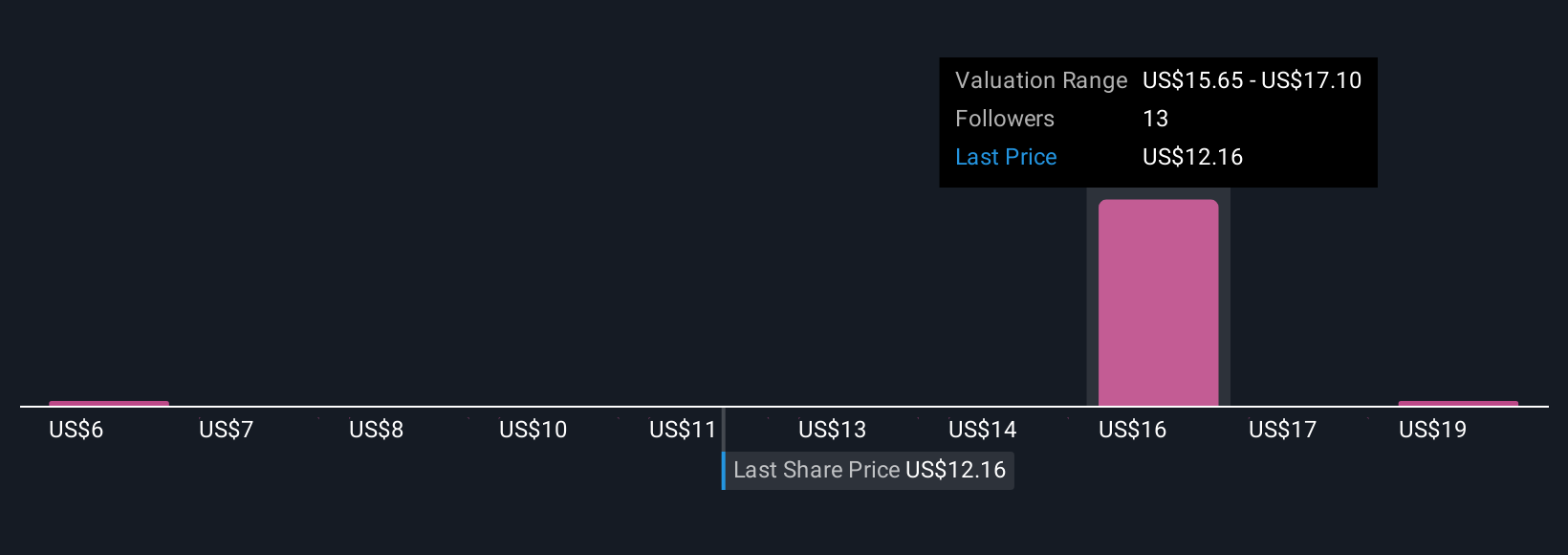

Uncover how DigitalBridge Group's forecasts yield a $16.78 fair value, a 46% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members estimated fair values for DigitalBridge Group between US$5.49 and US$16.78, based on two independent analyses. Amid this range, many are also aware that fee and margin pressure remain central risks given recent revenue volatility.

Explore 2 other fair value estimates on DigitalBridge Group - why the stock might be worth less than half the current price!

Build Your Own DigitalBridge Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DigitalBridge Group research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free DigitalBridge Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DigitalBridge Group's overall financial health at a glance.

No Opportunity In DigitalBridge Group?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Outshine the giants: these 18 early-stage AI stocks could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal