What Alliant Energy (LNT)'s Strong Q2 and Reaffirmed Guidance Mean for Shareholders

- Alliant Energy Corporation recently reported strong second quarter results, with revenue rising to US$961 million and net income doubling to US$174 million from a year earlier, while reaffirming its 2025 consolidated earnings guidance of US$3.15 to US$3.25 per share.

- This combination of improved profitability and sustained earnings outlook may signal management's confidence in continued demand growth and operational execution.

- We'll explore how Alliant Energy's reaffirmed full-year guidance and robust earnings performance shape its current investment outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Alliant Energy Investment Narrative Recap

To be a shareholder in Alliant Energy, you need to believe in persistent, regulated utility demand growth, especially due to data center expansion, and the company's ability to maintain strong execution and regulatory support. The latest reaffirmation of earnings guidance, alongside rising revenues and profits, reinforces near-term optimism but does not materially diminish the biggest risk: heavy reliance on large-scale data center projects, where delays or cancellations could quickly alter expectations.

Among recent developments, the June 2025 completion of a follow-on equity offering for US$177.23 million stands out. While this move supports funding for capital projects to meet new load demand, a key catalyst, it also spotlights concerns about shareholder dilution if the pace or profitability of new projects disappoints relative to projections.

However, investors should be aware that, even with robust recent financials, the risk of concentrated exposure to data center project delays remains...

Read the full narrative on Alliant Energy (it's free!)

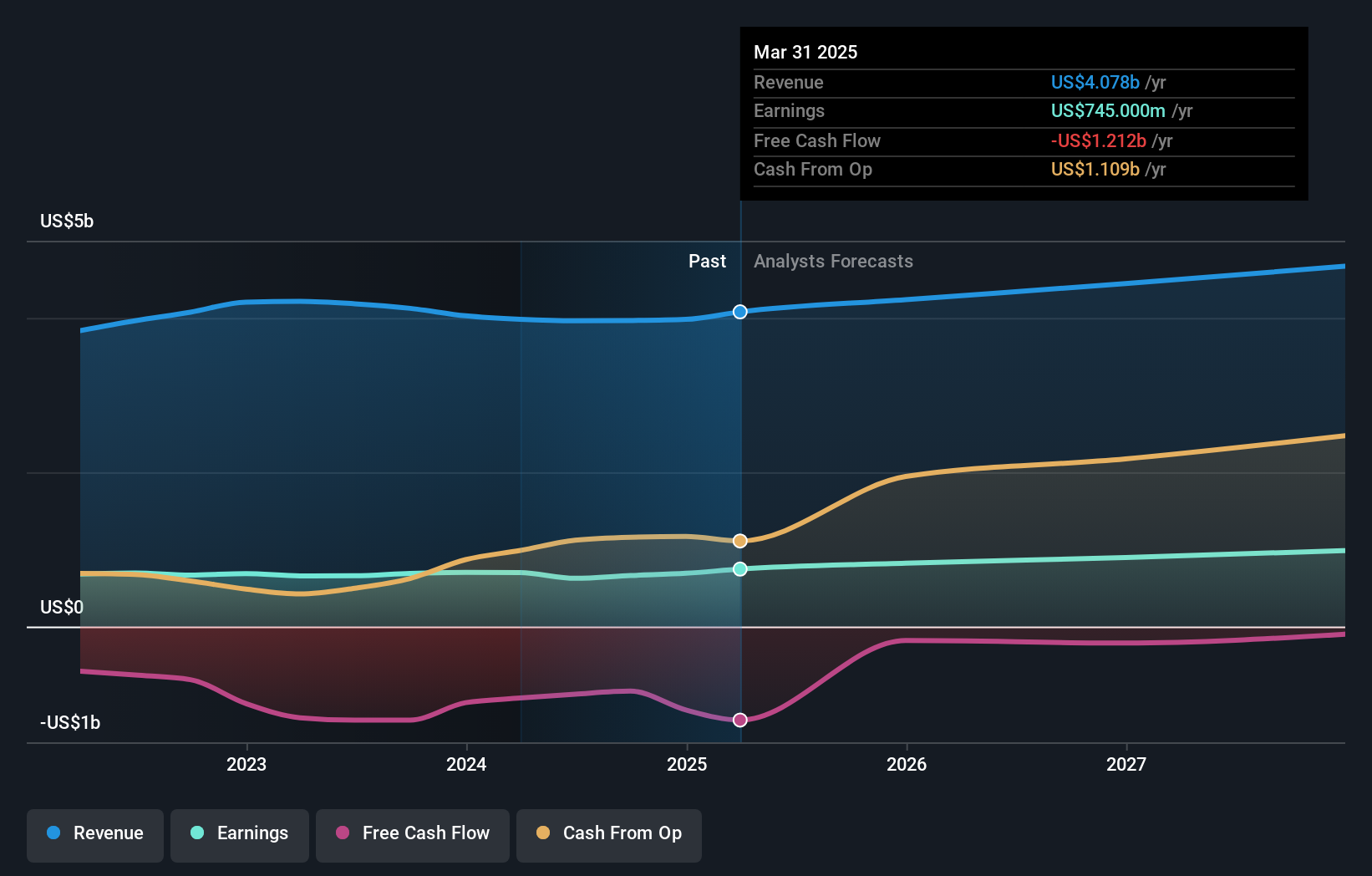

Alliant Energy is projected to reach $4.8 billion in revenue and $1.0 billion in earnings by 2028. This outlook assumes a 5.1% annual revenue growth rate and a $168 million increase in earnings from the current $832.0 million.

Uncover how Alliant Energy's forecasts yield a $67.50 fair value, a 3% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have two fair value estimates for Alliant Energy ranging from US$61.26 to US$67.50. These diverse perspectives highlight how the company's heavy focus on data center growth is interpreted in very different ways, so consider several viewpoints before making your own judgment.

Explore 2 other fair value estimates on Alliant Energy - why the stock might be worth 6% less than the current price!

Build Your Own Alliant Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Alliant Energy research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Alliant Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Alliant Energy's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 27 companies in the world exploring or producing it. Find the list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal