European Undervalued Small Caps With Insider Buying In August 2025

As the pan-European STOXX Europe 600 Index climbed 2.11% amid strong corporate earnings and optimism regarding geopolitical tensions, small-cap stocks in Europe continue to capture investor interest, especially with the Bank of England's recent rate cut aimed at addressing labor market concerns. In this environment, identifying promising small-cap opportunities often involves looking for companies with solid fundamentals and insider buying activity, which can indicate confidence in future growth prospects despite broader market uncertainties.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Foxtons Group | 10.8x | 1.0x | 39.99% | ★★★★★☆ |

| Sabre Insurance Group | 9.3x | 1.7x | -13.97% | ★★★★☆☆ |

| Renold | 10.6x | 0.7x | 3.10% | ★★★★☆☆ |

| NCC Group | NA | 1.4x | 10.95% | ★★★★☆☆ |

| CVS Group | 45.6x | 1.3x | 37.36% | ★★★★☆☆ |

| Stelrad Group | 41.1x | 0.7x | 38.23% | ★★★☆☆☆ |

| Absolent Air Care Group | 34.2x | 2.3x | 48.73% | ★★★☆☆☆ |

| A.G. BARR | 19.2x | 1.8x | 47.02% | ★★★☆☆☆ |

| Hoist Finance | 10.5x | 2.1x | 17.64% | ★★★☆☆☆ |

| Karnov Group | 221.5x | 4.7x | 33.51% | ★★★☆☆☆ |

We'll examine a selection from our screener results.

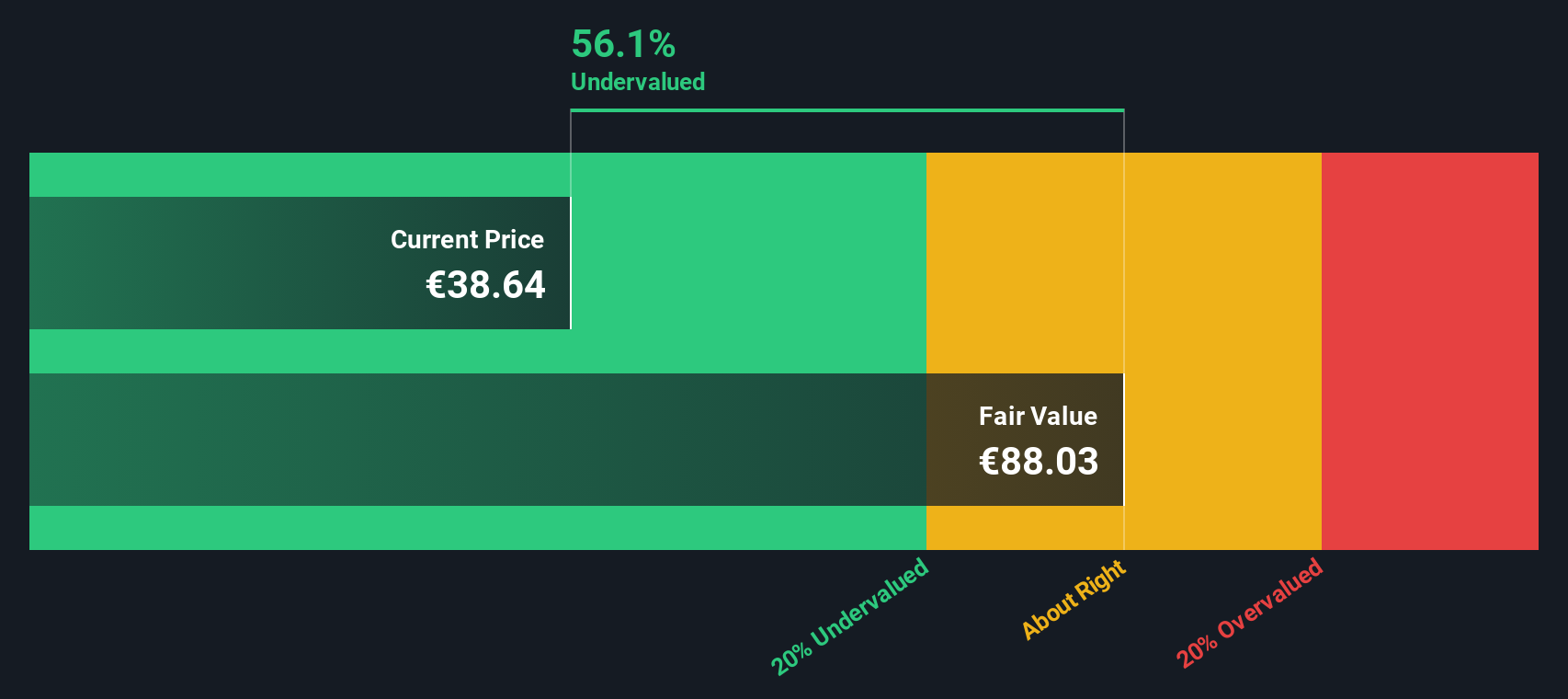

Qt Group Oyj (HLSE:QTCOM)

Simply Wall St Value Rating: ★★★★★★

Overview: Qt Group Oyj is a company specializing in software development tools, with a market capitalization of approximately €1.71 billion.

Operations: Qt Group Oyj generates revenue primarily from software development tools, with recent figures at €209.12 million. The company has shown a notable trend in its gross profit margin, reaching 51.24% by the end of 2024 and slightly decreasing to 48.69% by mid-2025. Operating expenses are significant, including costs such as general and administrative expenses around €3.30 million and sales & marketing expenses approximately €4.27 million in recent periods, impacting overall profitability margins like the net income margin which was reported at 22.97% for mid-2025.

PE: 24.5x

Qt Group Oyj, a European small-cap, recently reported a dip in second-quarter sales to €51.22 million from €53.33 million the previous year, with net income also falling to €6.74 million from €13.38 million. Despite this, they reaffirmed guidance for 2025 with an expected 10% to 20% sales increase at comparable rates, indicating potential growth prospects. Insider confidence is evident as executives have been purchasing shares since early 2025. The company faces volatility but anticipates annual earnings growth of approximately 19%.

- Get an in-depth perspective on Qt Group Oyj's performance by reading our valuation report here.

Gain insights into Qt Group Oyj's past trends and performance with our Past report.

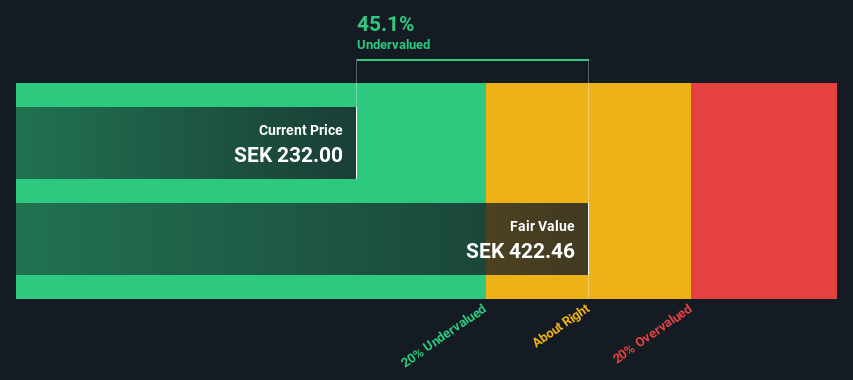

Absolent Air Care Group (OM:ABSO)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Absolent Air Care Group specializes in providing air filtration solutions for industrial and commercial kitchen environments, with a market capitalization of SEK 1.53 billion.

Operations: The company generates revenue primarily from its Industrial and Commercial Kitchen segments, with the Industrial segment contributing significantly more. Over recent periods, there has been a notable trend in the gross profit margin, which reached 44.10% as of September 2023 but later adjusted to 43.54% by December 2024. Operating expenses have consistently included significant allocations towards sales and marketing as well as general and administrative functions, impacting overall profitability.

PE: 34.2x

Absolent Air Care Group, a European small-cap company, faces challenges with declining sales and profits; Q2 2025 sales dropped to SEK 314.4 million from SEK 367.44 million the previous year, while net income fell to SEK 19.33 million from SEK 40.35 million. Despite these figures and lower profit margins (6.6% vs last year's 10.3%), insider confidence is evident as insiders purchased shares in recent months, indicating potential future growth optimism amidst leadership changes with Peter Unelind set to become CEO by January 2026, bringing extensive industrial experience from Sandvik Rock Processing.

- Navigate through the intricacies of Absolent Air Care Group with our comprehensive valuation report here.

Understand Absolent Air Care Group's track record by examining our Past report.

Diös Fastigheter (OM:DIOS)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Diös Fastigheter is a Swedish real estate company focused on owning and managing properties across several regions in Sweden, with a market capitalization of approximately SEK 10.95 billion.

Operations: The company generates revenue across various regions, with significant contributions from areas like Luleå and Dalarna. Its cost of goods sold (COGS) has consistently increased over time, impacting its gross profit margin, which reached 69.07% in September 2024. Operating expenses have shown slight fluctuations but remain a smaller portion of total costs compared to non-operating expenses, which have significantly influenced net income outcomes. The company's net income margin has experienced considerable volatility, with recent negative margins indicating challenges in managing non-operating expenses effectively.

PE: 15.5x

Diös Fastigheter, a European real estate company, has captured attention with insider confidence as Independent Director Ragnhild Backman acquired 15,000 shares for around SEK 987,450 in May 2025. This purchase increased their holdings by over 27%, signaling potential value. The company's strategic lease agreement with AcadeMedia to convert retail space into educational facilities boosts its economic occupancy rate and income from property management. Despite higher risk funding due to reliance on external borrowing, earnings are forecasted to grow annually by nearly 19%.

Seize The Opportunity

- Gain an insight into the universe of 51 Undervalued European Small Caps With Insider Buying by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal