Does the CDW Distribution Deal Change the Bull Case for Penguin Solutions (PENG)?

- PENGUIN Solutions recently announced a new agreement with CDW to expand access to its AI infrastructure portfolio for a larger customer base.

- This collaboration, paired with renewed confidence from research analysts, highlights Penguin Solutions’ efforts to broaden distribution channels and strengthen its position in the rapidly evolving AI infrastructure market.

- We’ll explore how expanding distribution through CDW could impact Penguin Solutions’ investment narrative and long-term market potential.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Penguin Solutions Investment Narrative Recap

To be a shareholder in Penguin Solutions, you need to believe in the long-term growth potential of AI infrastructure demand and Penguin’s ability to capture a larger share of this expanding market. The new CDW distribution agreement may help address concerns about customer concentration and revenue lumpiness, currently the key short-term catalyst and risk, but a single partnership alone does not fully mitigate these challenges or guarantee more predictable earnings in upcoming quarters.

The recent launch of Stratus ztC Endurance® is especially relevant, as it aligns with growing enterprise demand for ultra-reliable, fault-tolerant platforms for AI workloads. Coupled with expanded CDW access, this product introduction could support greater sales diversification and build a stronger foundation for recurring solution revenue if adoption accelerates from new channel partners. In contrast, investors should still keep a close eye on...

Read the full narrative on Penguin Solutions (it's free!)

Penguin Solutions' outlook anticipates $1.8 billion in revenue and $316.1 million in earnings by 2028. This projection is based on a 10.4% annual revenue growth rate and reflects a $331 million increase in earnings from the current -$14.9 million.

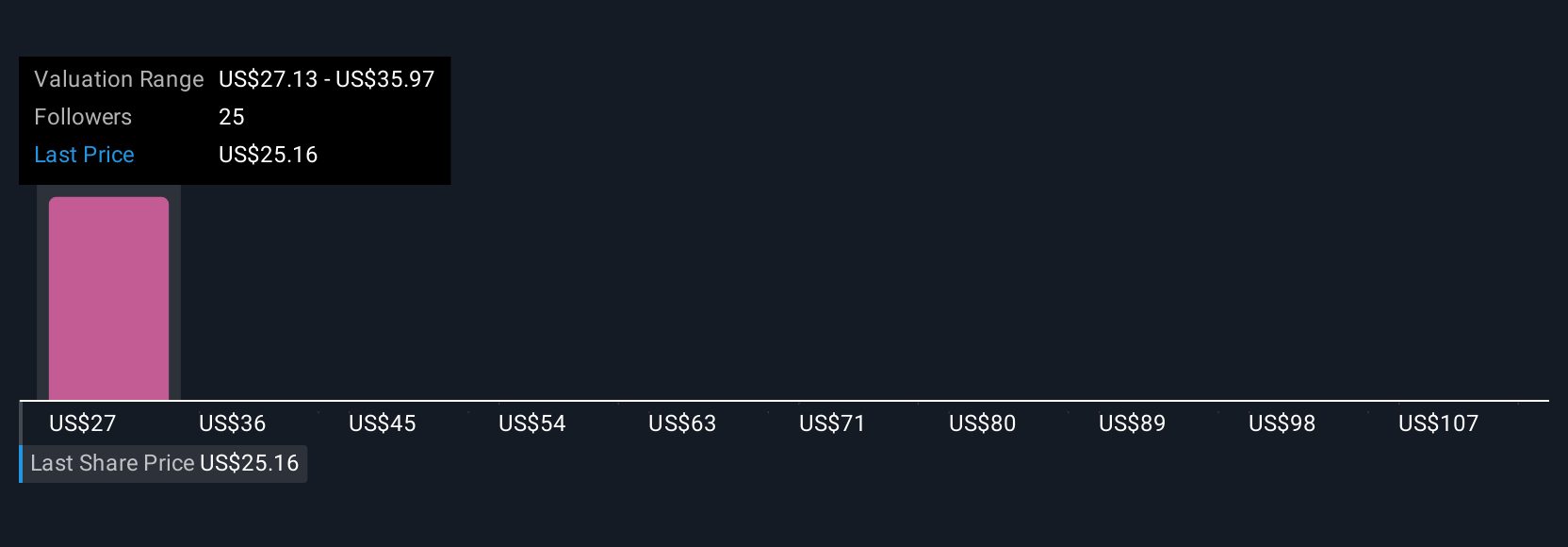

Uncover how Penguin Solutions' forecasts yield a $27.12 fair value, a 12% upside to its current price.

Exploring Other Perspectives

Six private investors in the Simply Wall St Community provide fair value estimates for Penguin Solutions ranging from US$27.13 to US$156.06 per share. While views differ widely, many focus on Penguin's efforts to decrease revenue unpredictability by expanding distribution channels, an area that remains under close scrutiny when forecasting future performance.

Explore 6 other fair value estimates on Penguin Solutions - why the stock might be worth over 6x more than the current price!

Build Your Own Penguin Solutions Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Penguin Solutions research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Penguin Solutions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Penguin Solutions' overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal