Does SPG’s Bigger Dividend and New Debt Offering Signal Deeper Confidence in Cash Flows?

- Simon Property Group recently reported strong second quarter results, increased its quarterly dividend to US$2.15 per share, announced new executive appointments, and launched a US$1.5 billion senior notes offering for debt refinancing and general corporate purposes.

- These moves highlight Simon's proactive approach to capital structure management and leadership succession, signaling confidence in operational momentum and future cash flow generation.

- With the dividend increase underscoring management's outlook for steady income, we'll examine how these developments shape Simon's investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Simon Property Group Investment Narrative Recap

To be a shareholder in Simon Property Group, you need to believe in the enduring relevance of top-tier, experience-driven retail and mixed-use centers. Recent strong earnings and executive changes do not fundamentally shift the main short-term catalyst, maintaining high occupancy through robust leasing activity, or the biggest risk, which remains retail tenant health and bankruptcy exposure. The positive earnings and proactive leadership transitions reinforce Simon’s ability to execute on its core strategy, but the most influential factors for the investment case are largely unchanged.

Among recent announcements, the increase in Simon's quarterly dividend to US$2.15 per share stands out. This move reflects the management's confidence in cash flow sustainability and the current level of operating performance, supporting income-focused investors but also drawing more attention to the company’s ability to withstand ongoing tenant turnover risks in retail real estate.

In contrast, the pace at which retail bankruptcies could impact both occupancy and future cash flows is something every investor should be aware of as...

Read the full narrative on Simon Property Group (it's free!)

Simon Property Group's outlook projects $6.2 billion in revenue and $2.4 billion in earnings by 2028. This assumes a 0.6% annual revenue decline and a $0.3 billion increase in earnings from the current $2.1 billion.

Uncover how Simon Property Group's forecasts yield a $182.25 fair value, a 8% upside to its current price.

Exploring Other Perspectives

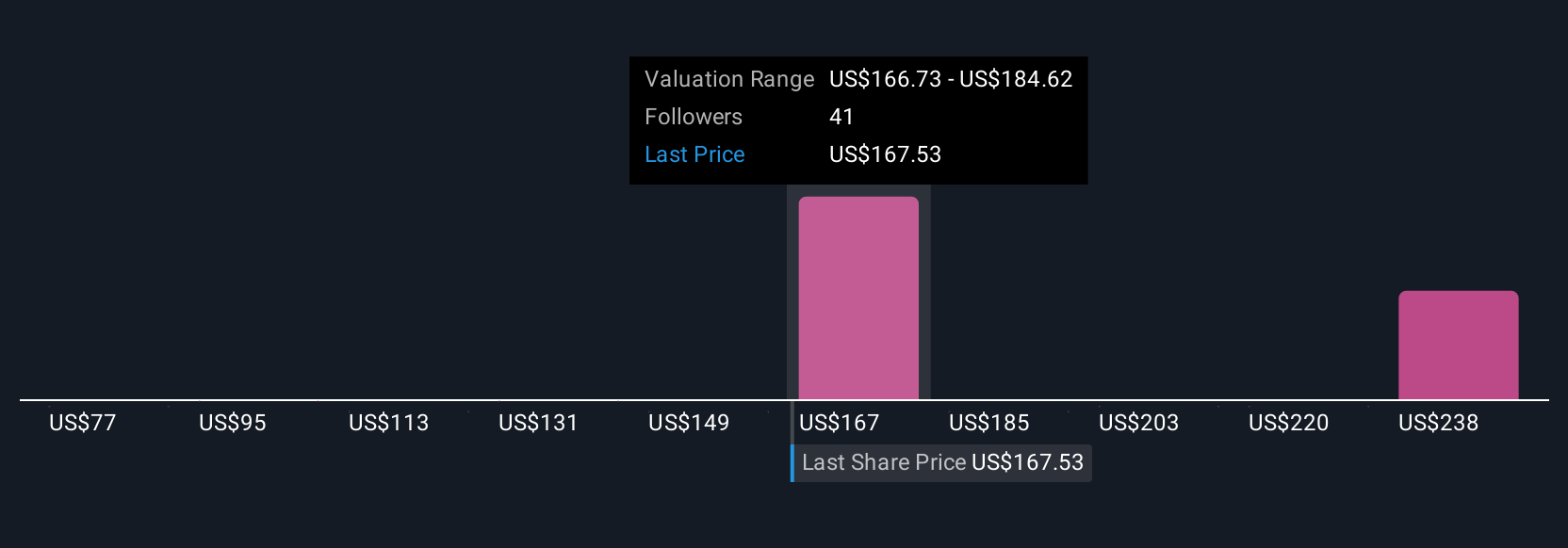

Nine individual perspectives from the Simply Wall St Community place Simon Property Group's fair value estimates between US$77.30 and US$257.29 per share. While occupancy rates remain high, the real test lies in how resilient Simon’s portfolio is to heightened retailer churn and structural shifts in tenant stability, explore the full spectrum of opinion to understand what could matter most next.

Explore 9 other fair value estimates on Simon Property Group - why the stock might be worth as much as 52% more than the current price!

Build Your Own Simon Property Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Simon Property Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Simon Property Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Simon Property Group's overall financial health at a glance.

Searching For A Fresh Perspective?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 27 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal