Is US Foods' (USFD) Buyback Emphasis a Sign of Capital Discipline or Growth Limitations?

- US Foods Holding Corp. announced its second quarter 2025 results, reporting sales of US$10,082 million and net income of US$224 million, with year-over-year growth in both metrics, but missed analyst expectations for revenue and earnings per share.

- Despite continued revenue and earnings growth, the unchanged full-year sales guidance and recent share repurchase activity highlight management's focus on disciplined capital allocation amid operational gains.

- We’ll explore how the recent earnings miss, despite robust buybacks and sales growth, influences US Foods Holding’s future outlook.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 27 companies in the world exploring or producing it. Find the list for free.

US Foods Holding Investment Narrative Recap

Owning US Foods Holding stock means believing in the company's ability to balance revenue growth and operational efficiency, even if results occasionally fall short of analyst forecasts. The recent earnings miss has not materially affected US Foods' short-term catalyst, which remains tied to its execution of margin improvements and cost-saving initiatives. The biggest risk to watch right now is how competitive pressures might affect profitability if revenue gains cannot keep pace.

The most relevant recent announcement is management’s reaffirmation of unchanged full-year sales guidance at 4% to 6% growth. This consistent outlook, despite reporting quarterly numbers that missed estimates, underscores a steady approach to performance targets while the company continues to return capital to shareholders through robust buybacks. However, when revenue disappoints even as management is aggressively repurchasing shares, it raises fresh questions about...

Read the full narrative on US Foods Holding (it's free!)

US Foods Holding is projected to reach $44.6 billion in revenue and $1.1 billion in earnings by 2028. This outlook assumes a 5.3% annual revenue growth rate and reflects a $573 million increase in earnings from the current $527 million.

Uncover how US Foods Holding's forecasts yield a $89.47 fair value, a 13% upside to its current price.

Exploring Other Perspectives

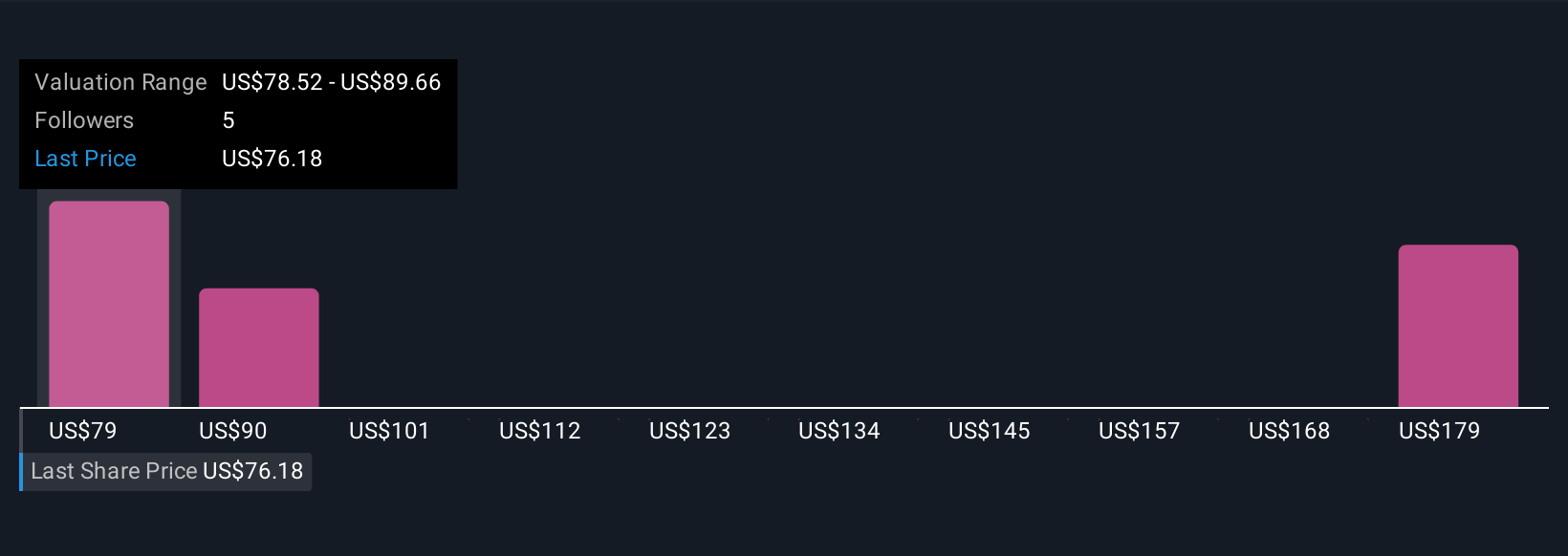

Seven private investors from the Simply Wall St Community estimate fair values for US Foods between US$78.52 and US$121.64 per share. While opinions differ, ongoing margin expansion initiatives could prove pivotal for the company’s performance, see how others weigh the risks and opportunities.

Explore 7 other fair value estimates on US Foods Holding - why the stock might be worth just $78.52!

Build Your Own US Foods Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your US Foods Holding research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free US Foods Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate US Foods Holding's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal