Magna International (TSX:MG) Is Up 5.6% After Raising 2025 Sales Outlook and Profit Guidance - Has The Bull Case Changed?

- Magna International recently announced improved second quarter 2025 results, with net income rising to US$379 million, while also raising its full-year sales outlook to US$40.4 billion–US$42.0 billion and declaring a quarterly dividend of US$0.485 per share, payable August 29, 2025.

- Despite slightly lower sales year-on-year, Magna's increased profitability and upwardly revised guidance highlight resilience in cost management and an ability to boost margins even amid softening revenues.

- We'll now look at how Magna's raised full-year sales guidance and stronger profitability may reshape its investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Magna International Investment Narrative Recap

To be a shareholder in Magna International, you need to believe in the company’s ability to drive margin expansion through operational improvements and innovation, even when auto sector volumes soften. The recent announcement of stronger profitability and raised full-year sales guidance reinforces the near-term catalyst of margin growth, yet does little to lessen ongoing risks from foreign exchange headwinds and volatile global vehicle production.

Of Magna's latest announcements, its upcoming showcase at IAA Mobility 2025 stands out. The event highlights fresh advances in electric drive, sustainable materials, and advanced driver assistance systems, all of which have the potential to enhance Magna’s position as a key supplier amid industry shifts toward electrification and smarter mobility.

However, in contrast, investors should be aware that persistent foreign exchange pressures could still weigh on reported results...

Read the full narrative on Magna International (it's free!)

Magna International's narrative projects $41.6 billion revenue and $1.7 billion earnings by 2028. This requires a 1.0% annual revenue decline and an earnings increase of $0.7 billion from the current $1.0 billion.

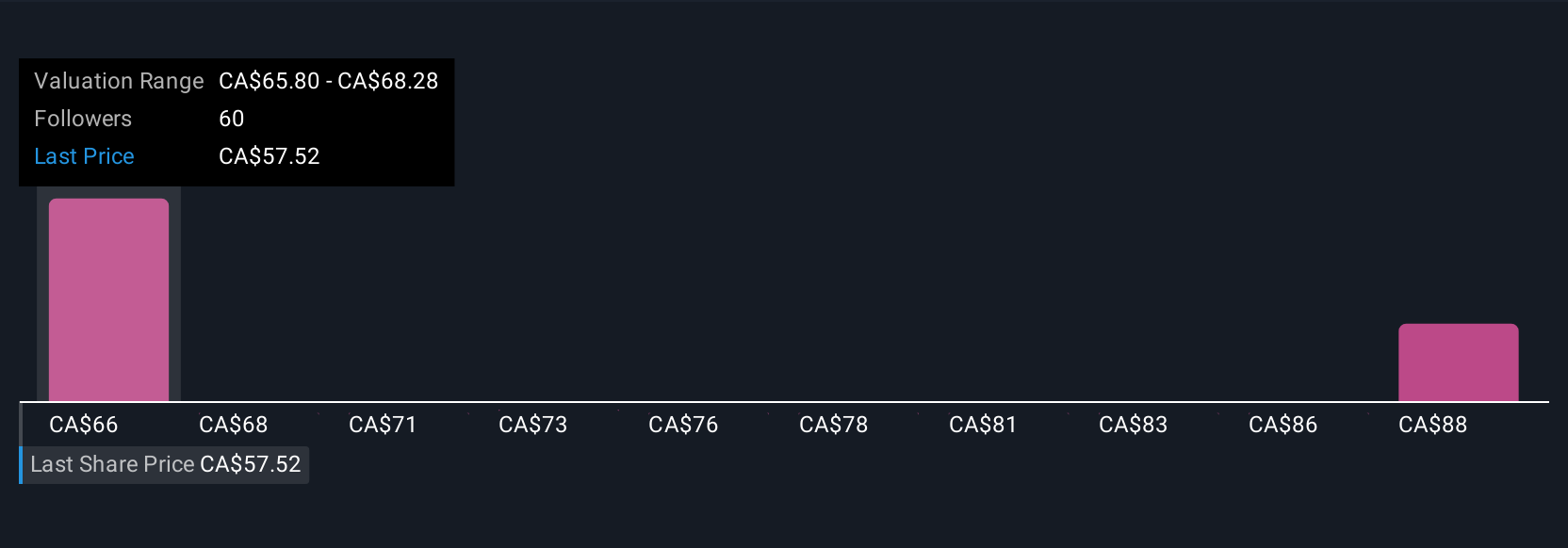

Uncover how Magna International's forecasts yield a CA$65.80 fair value, a 8% upside to its current price.

Exploring Other Perspectives

Four fair value estimates from the Simply Wall St Community span US$65.80 to US$90.74 per share. As you weigh this broad range, keep in mind that ongoing FX volatility remains a real hurdle for the company’s reported earnings, take the time to explore the range of opinions on how these risks could play out.

Explore 4 other fair value estimates on Magna International - why the stock might be worth just CA$65.80!

Build Your Own Magna International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Magna International research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Magna International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Magna International's overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 27 best rare earth metal stocks of the very few that mine this essential strategic resource.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal