Should Paramount Resources’ Q2 Earnings Drop Prompt a Reevaluation From TSX:POU Investors?

- Paramount Resources reported its second quarter 2025 earnings, revealing revenue of C$199 million and net income of C$4.2 million, both sharply lower than the same period last year.

- Despite the quarterly downturn, the company’s net income for the first half of 2025 reached C$1.29 billion, an unusually large increase compared to the previous year.

- We’ll explore how the sharp drop in quarterly results could shape investor perceptions of Paramount Resources’ near-term outlook.

AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Paramount Resources' Investment Narrative?

To own Paramount Resources, you must have conviction in the company's resilience amid sometimes volatile results. The sharp downturn in second quarter 2025 revenue and profit may prompt renewed questions about the durability of near-term operational momentum, especially after a previously eye-catching surge in first-half net income to over C$1.29 billion. While analysts previously pointed to catalysts like production guidance reaffirmation and share buybacks, the latest quarter’s setback could bring risks such as continued weak commodity prices or operational hiccups to the forefront, potentially muting some earlier optimism about stable cash flows and dividends. If the quarterly miss is seen as a one-off, key catalysts could remain intact, but a pattern of profitability swings might temper enthusiasm for aggressive capital returns and set a more cautious tone for future performance. Yet, based on recent trends, dividend sustainability has become a sharper concern for investors.

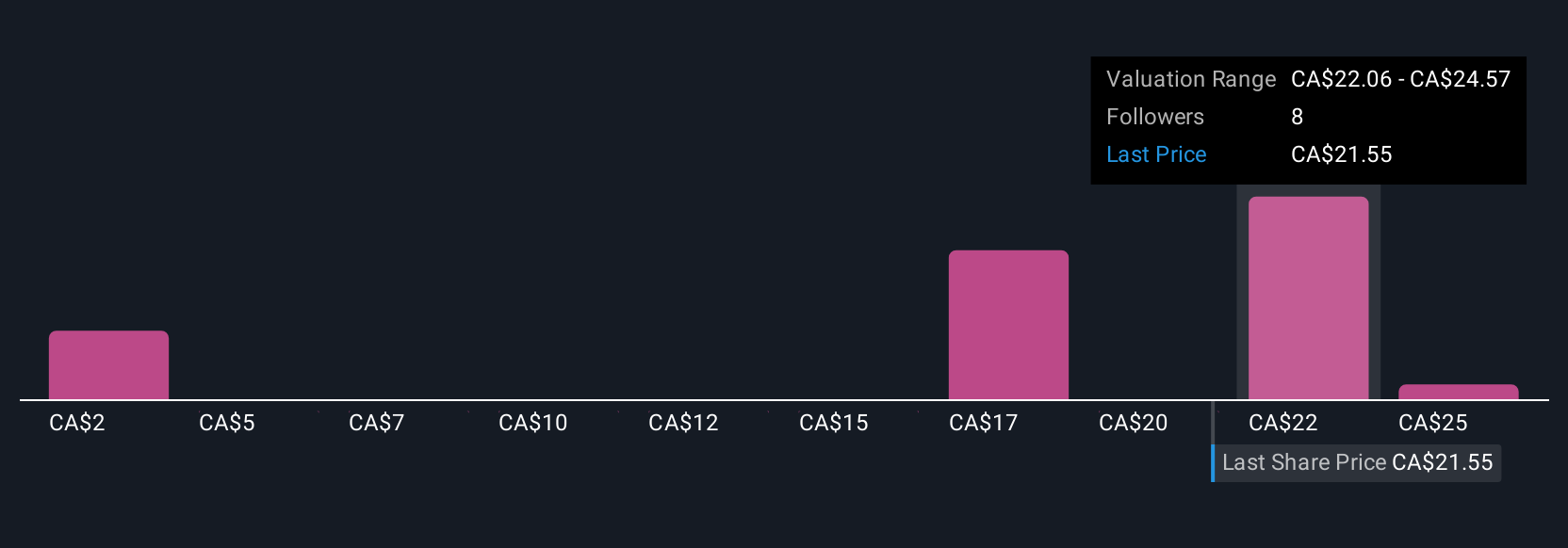

Paramount Resources' share price has been on the slide but might be up to 15% below fair value. Find out if it's a bargain.Exploring Other Perspectives

Explore 6 other fair value estimates on Paramount Resources - why the stock might be worth as much as 32% more than the current price!

Build Your Own Paramount Resources Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Paramount Resources research is our analysis highlighting 4 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Paramount Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Paramount Resources' overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 18 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal