Will BlackLine’s (BL) Leadership Shift and Buybacks Reshape Its Long-Term Growth Ambitions?

- BlackLine announced that Co-CEO and Founder Therese Tucker has transitioned out of her executive role as of October 1, 2025, with Owen Ryan continuing as CEO, and also reported earnings for the second quarter and first half of 2025, featuring revenue growth but a sizeable drop in net income compared to the previous year.

- An additional development saw BlackLine complete a significant share buyback tranche, while also naming David Henshall as Lead Independent Director, further reshaping its leadership structure.

- We’ll examine how the leadership transition and earnings volatility may affect BlackLine’s investment narrative and future growth outlook.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

BlackLine Investment Narrative Recap

To be a BlackLine shareholder, you need to believe that enterprise demand for automated finance solutions and deeper ERP integration will overcome competitive and economic headwinds. The recent leadership changes, while significant, do not appear to materially alter the most important near-term catalyst, conversion of a strong sales pipeline into new contracts, or lessen the immediate risk from revenue volatility tied to macroeconomic uncertainty and deal delays.

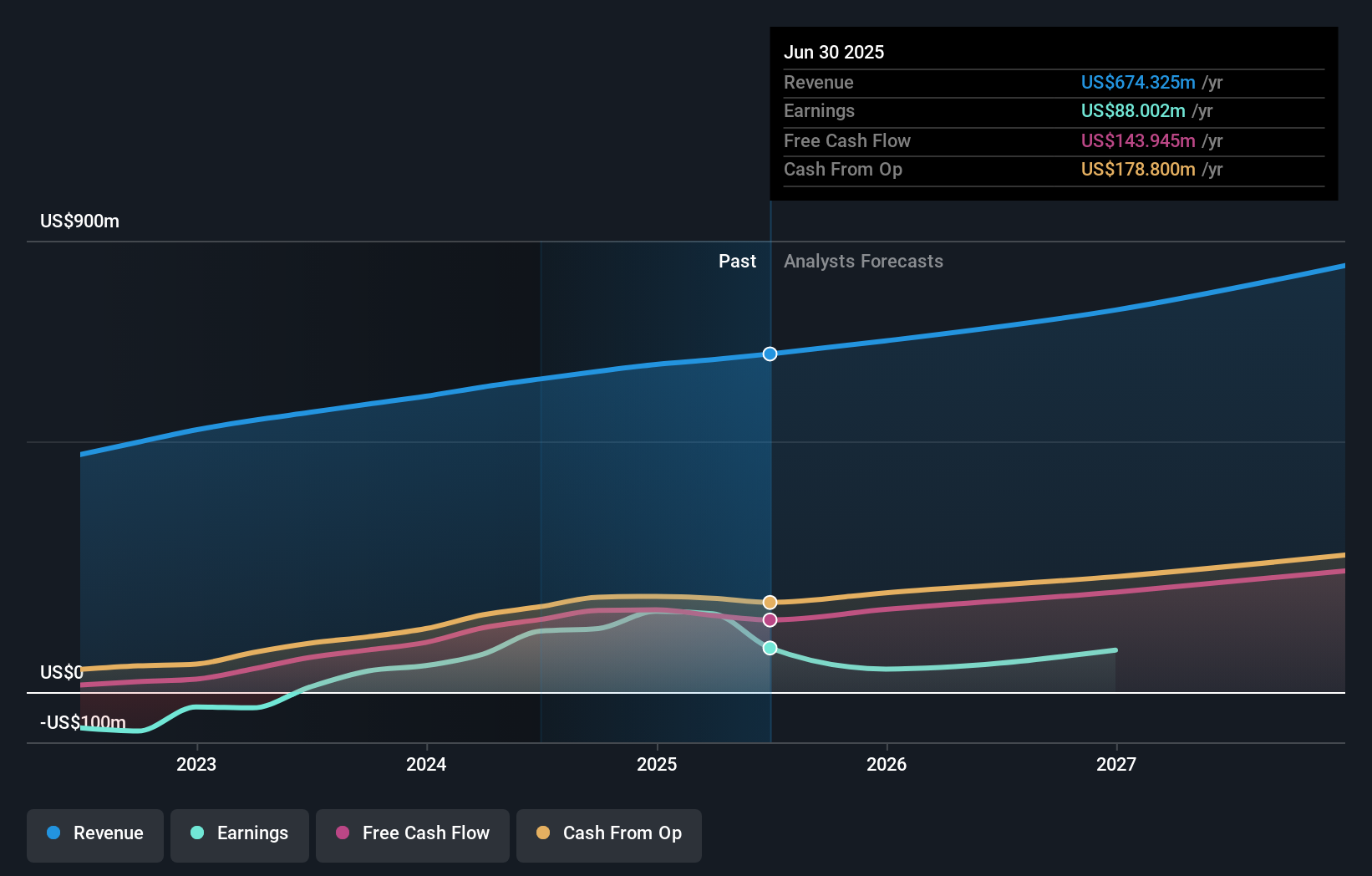

One particularly relevant announcement is the substantial net income decline in Q2 2025 despite revenue growth, which reinforces ongoing challenges in translating top-line expansion into robust bottom-line performance. This dynamic is central to understanding the urgency of BlackLine’s focus on larger enterprise clients and ongoing investments in innovation, as these efforts are aimed at supporting higher-value deals while managing margin pressure.

By contrast, investors should be aware that margin compression and earnings volatility continue to present significant risks to the near-term story, especially if deal cycles lengthen or competitive pressures intensify...

Read the full narrative on BlackLine (it's free!)

BlackLine's narrative projects $885.0 million in revenue and $20.0 million in earnings by 2028. This requires 10.1% yearly revenue growth and a $136.4 million decrease in earnings from $156.4 million today.

Uncover how BlackLine's forecasts yield a $61.83 fair value, a 25% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community fair value targets for BlackLine span from US$38.46 to US$104.47, based on four unique forecasts. With ongoing revenue headwinds and deal delays as core risks, you’ll find many different views on what the future could bring.

Explore 4 other fair value estimates on BlackLine - why the stock might be worth 22% less than the current price!

Build Your Own BlackLine Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BlackLine research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free BlackLine research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BlackLine's overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal