Does Google Pay Integration Widen Affirm's (AFRM) Path to User Growth and Market Reach?

- Affirm announced it has expanded its collaboration with Google Pay, now enabling flexible payment options through autofill on Chrome, allowing eligible U.S. shoppers to access pay-over-time plans seamlessly across more online stores without extra merchant integration.

- This integration could significantly broaden Affirm’s reach by making its payment solutions conveniently available at checkout for Chrome and Android users, potentially expanding its user base and supporting continued transaction growth.

- We’ll explore how Affirm’s expanded integration with Google Pay’s Chrome autofill could influence its investment outlook and future growth.

AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Affirm Holdings Investment Narrative Recap

To be a shareholder in Affirm Holdings, you need to believe that the broad adoption of flexible, pay-over-time options, powered by leading tech integrations, will continue to drive user growth and transaction volumes, ultimately offsetting rising competitive pressure from major payments players. The recent Google Pay autofill expansion is a meaningful short-term catalyst for wider user access, but it is unlikely to fully resolve the company’s biggest risk: concentrated reliance on key enterprise partners, where contract or volume volatility could still impact earnings stability.

Of the recent announcements, Boot Barn’s multi-year extension with Affirm is particularly relevant, reinforcing the importance of long-term merchant partnerships as catalysts for general merchandise volume and brand presence, and showing that, for now, Affirm is maintaining traction even as merchants face alternative offers from competitors. But in contrast, investors should be aware that persistent margin pressure from rivals’ aggressive pricing could...

Read the full narrative on Affirm Holdings (it's free!)

Affirm Holdings' outlook forecasts $5.6 billion in revenue and $374.4 million in earnings by 2028. This projection assumes a 23.1% annual revenue growth and an increase in earnings of $436.6 million from the current earnings of -$62.2 million.

Uncover how Affirm Holdings' forecasts yield a $73.66 fair value, a 4% downside to its current price.

Exploring Other Perspectives

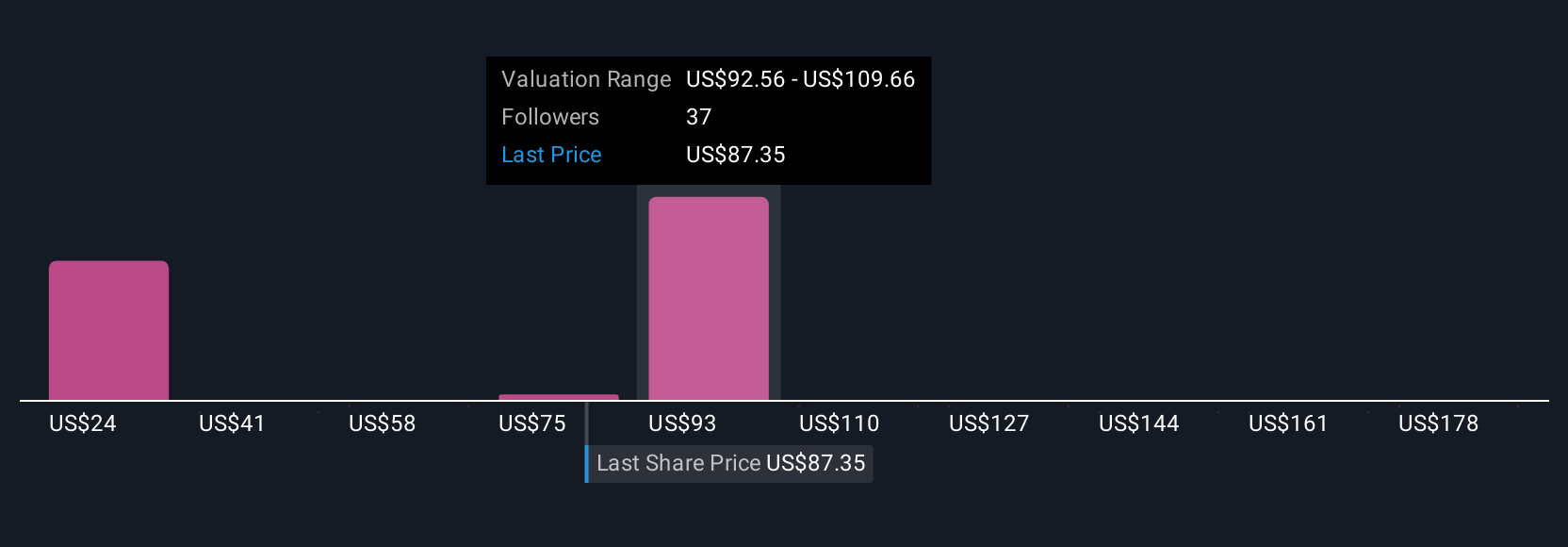

Fifteen Simply Wall St Community estimates place Affirm’s fair value from as low as US$21.02 to as high as US$195.17. While community expectations vary, the sustainability of Affirm’s merchant relationships remains a focal point that could shape results well beyond current forecasts.

Explore 15 other fair value estimates on Affirm Holdings - why the stock might be worth over 2x more than the current price!

Build Your Own Affirm Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Affirm Holdings research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Affirm Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Affirm Holdings' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal