Why Rayonier (RYN) Is Up 9.9% After New Zealand Exit and Surge in Timber Earnings

- Earlier this month, Rayonier Inc. reported second quarter 2025 earnings showing a significant increase in net income, driven by the completed sale of its New Zealand joint venture for US$710 million and a robust performance in Pacific Northwest Timber and Real Estate segments.

- This asset sale has allowed Rayonier to focus on its core U.S. operations, strengthen its balance sheet, and pursue capital returns to shareholders through buybacks and potential debt reduction.

- We'll examine how Rayonier's exit from New Zealand operations and resulting operational focus could reshape its investment narrative and future prospects.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Rayonier Investment Narrative Recap

To be a Rayonier shareholder today, you need to believe in the value of a streamlined U.S.-focused timberland and real estate portfolio, with the recent New Zealand exit allowing for renewed capital deployment and potential operational upside. The completed sale has freed up resources for share buybacks and debt reduction, but the biggest short-term catalyst remains further capital returns, while the chief risk is continued pressure in the Southern Timber segment; the impact of the sale on these is meaningful but not fully settled yet.

The company's August 8 announcement of completing its share buyback program, repurchasing 1,567,928 shares for US$37.72 million, directly connects to these themes, capitalizing on the liquidity boost from the New Zealand divestiture and aligning with investor interest in immediate capital returns.

In contrast, investors should not overlook the ongoing uncertainties and risks in Rayonier’s Southern Timber segment, particularly as...

Read the full narrative on Rayonier (it's free!)

Rayonier’s outlook anticipates $515.6 million in revenue and $97.1 million in earnings by 2028. This assumes a 25.2% annual revenue decline and a $261.5 million decrease in earnings from current earnings of $358.6 million.

Uncover how Rayonier's forecasts yield a $29.86 fair value, a 14% upside to its current price.

Exploring Other Perspectives

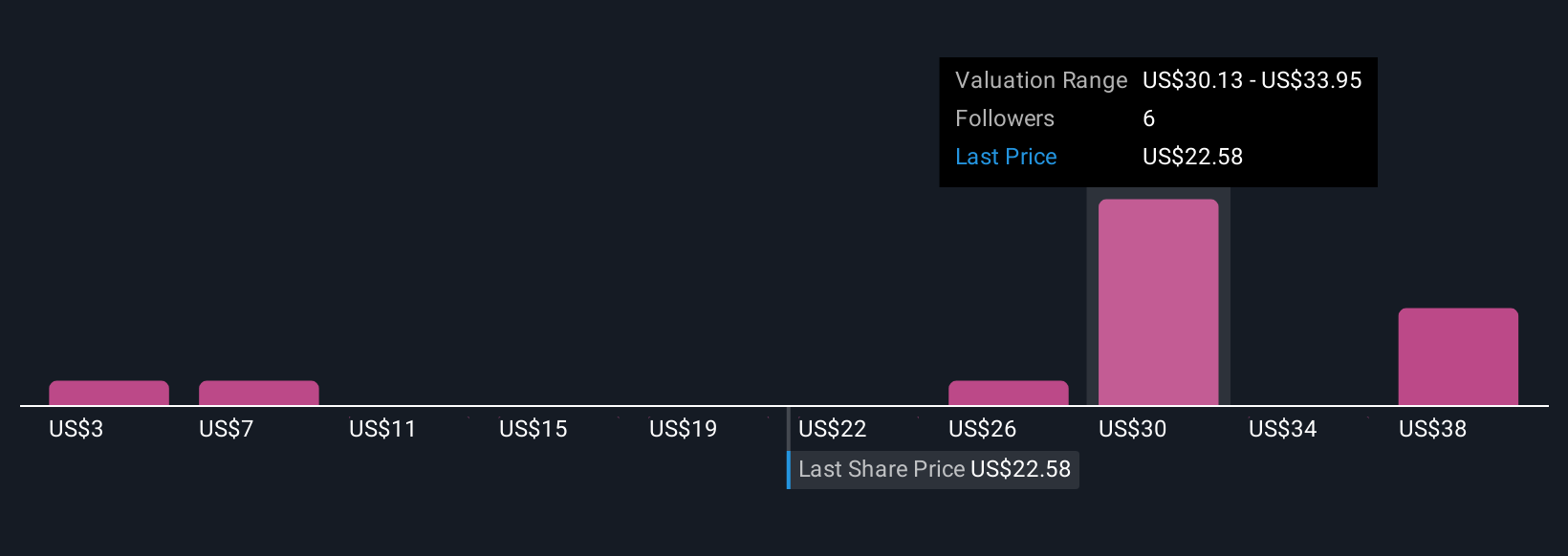

Four perspectives from the Simply Wall St Community set fair value between US$3.37 and US$29.86, capturing wide disagreement about Rayonier’s outlook. With revenue and earnings forecast to decline, you can see why many investors seek alternate views on the company’s future.

Explore 4 other fair value estimates on Rayonier - why the stock might be worth as much as 14% more than the current price!

Build Your Own Rayonier Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Rayonier research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Rayonier research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Rayonier's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 18 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal