Should Kinetik Holdings' (KNTK) Large-Scale Buyback Amid Lower Profits Influence Investor Outlook?

- Kinetik Holdings Inc. recently reported second quarter 2025 results, highlighting an increase in revenue to US$426.74 million, but a decrease in net income to US$74.42 million compared to the prior year, and completed its US$178.31 million share repurchase program amounting to 7.06% of outstanding shares.

- The completion of this sizeable buyback program may reflect management's ongoing focus on shareholder returns even as profitability moderated during the period.

- We’ll examine how the recently finalized large-scale share buyback influences Kinetik’s ongoing growth and financial outlook.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Kinetik Holdings Investment Narrative Recap

To be a shareholder of Kinetik Holdings, you need to believe that its expansion in the Delaware Basin and investments in new processing projects will translate into sustained revenue and earnings growth, despite recent earnings pressure. The recent completion of a US$178.31 million buyback does not seem to materially affect the immediate catalysts for the business, such as the start-up of Kings Landing II, but heightened execution risks on large projects and cost inflation remain important to watch.

Among recent company announcements, the Q2 2025 results are particularly relevant: while revenue reached US$426.74 million, net income fell to US$74.42 million year-on-year. This outcome places added importance on the execution and ramp-up of new projects to offset margin compression, highlighting the degree to which shareholders are exposed to performance risks if timelines or budgets slip.

However, before committing, investors should also consider how unexpected operational disruptions, such as project execution delays, could impact Kinetik’s ability to deliver on growth...

Read the full narrative on Kinetik Holdings (it's free!)

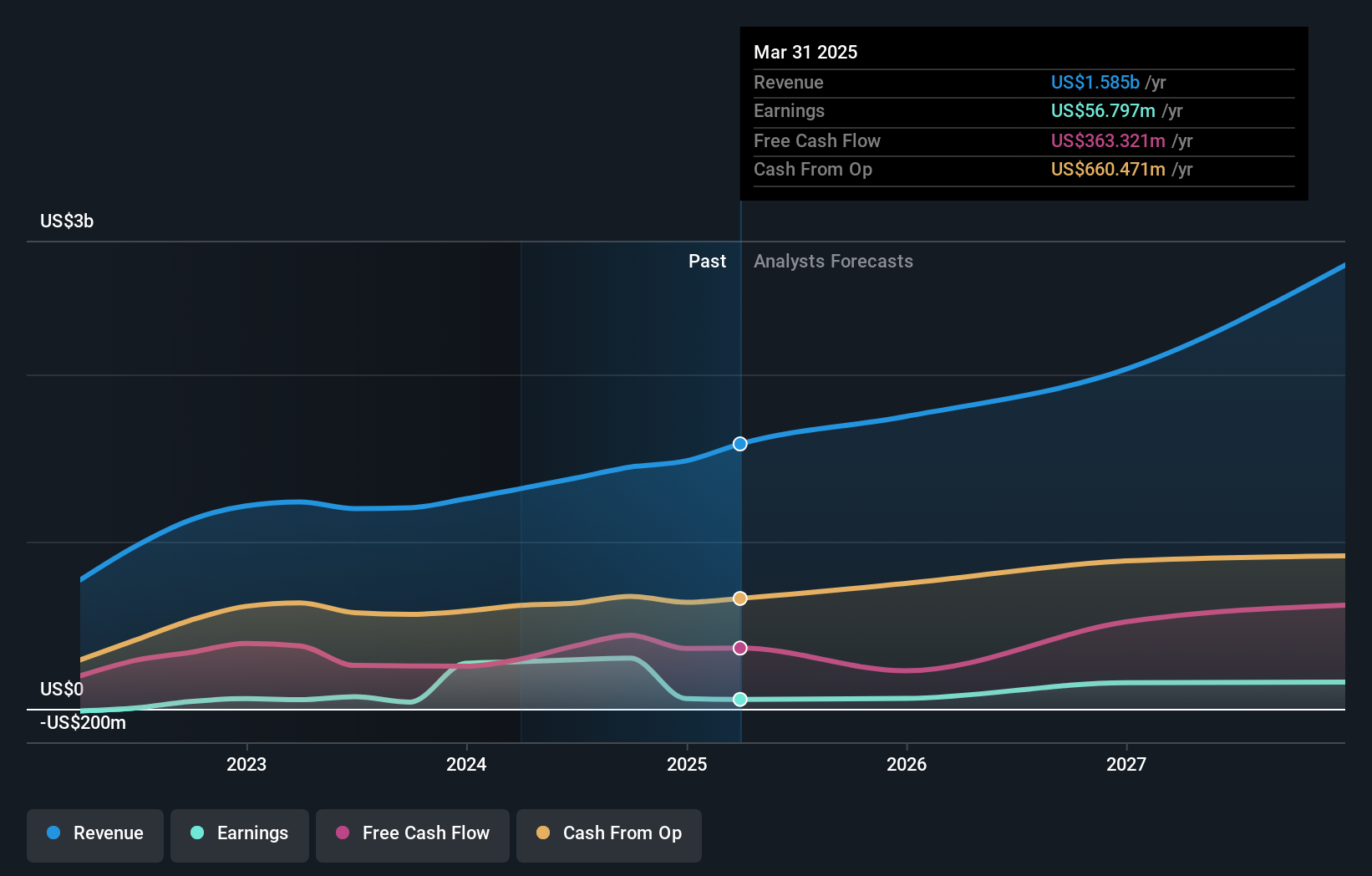

Kinetik Holdings' outlook anticipates $2.5 billion in revenue and $136.4 million in earnings by 2028. This reflects a 16.6% annual revenue growth rate and an $79.6 million increase in earnings from the current $56.8 million.

Uncover how Kinetik Holdings' forecasts yield a $53.73 fair value, a 28% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community posted fair value estimates for Kinetik Holdings ranging from US$53.73 to US$65.85, with 2 perspectives informing these views. Against this backdrop, execution risks tied to new project rollouts could play a critical role in shaping future performance, so you may want to review how different investors weigh such factors when forming opinions.

Explore 2 other fair value estimates on Kinetik Holdings - why the stock might be worth as much as 57% more than the current price!

Build Your Own Kinetik Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kinetik Holdings research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Kinetik Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kinetik Holdings' overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 27 companies in the world exploring or producing it. Find the list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal