US car premiums, which have skyrocketed 60% in five years, are finally entering a “cooling period,” but tariffs may reignite the flames

The Zhitong Finance App learned that economists are looking for signs of price increases caused by tariffs in the US monthly inflation data, but they may have overlooked the good news: car insurance costs, which have been soaring for a long time, have finally begun to fall steadily.

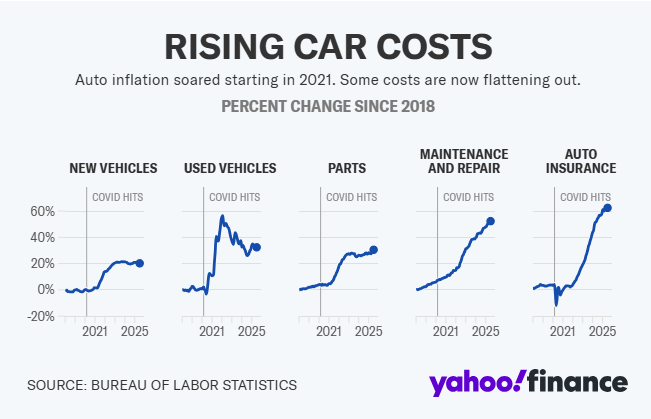

In the past few years, car maintenance costs in the US have risen sharply, and car owners are under pressure from many sources. The average price of a new car has now reached $49,000, and the Trump administration's tariff policy could push this price above $50,000. As the price of new cars rises, the price of used cars is also soaring. At the same time, factors such as the application of new high-end technology are driving up the cost of automobile parts, repair and maintenance.

However, the biggest increase was in insurance costs: over the past five years, car insurance premiums have increased by 60%, with an average monthly premium of about $213. What used to be an insignificant expense now amounts to nearly $3,000 a year, and premiums for some models and car owners are even higher.

A turning point is coming. The annual inflation rate of auto insurance, which peaked at 23% in April 2024, has now fallen to a moderate 5.3%, and this low annual increase is expected to continue.

Auto insurance is different from most products and services people buy: car owners only buy insurance once or twice a year, and the premiums are fixed during the policy's validity period. The car price data that insurance companies refer to when setting premiums is lagging behind. At the same time, they also need to deal with regulators, which may resist premium adjustments that increase too much.

This surge in car premiums began in the early days of the COVID-19 pandemic in 2020. Supply chain disruptions (such as a shortage of semiconductors) have caused new car prices to rise, while consumers who are unable to buy new cars have switched to the used car market, which has also boosted used car prices. This means that replacement costs for vehicles after an accident have risen dramatically.

New cars are equipped with various digital technologies (such as cameras, sensors, and processors), which also increase maintenance costs. At the same time, extreme weather due to global warming has increased, causing more vehicles to be damaged in floods and storms. Furthermore, the severity of car accidents is also rising for reasons that researchers have yet to fully understand.

All of these factors have driven up costs for insurance companies, and the entire industry has experienced several years of net losses in the auto insurance underwriting business. As a result, insurance companies continue to raise premiums to make a profit. But this process takes time because they only adjust prices once or twice a year. In some cases, regulators will also require insurers to spread premium increases over several years to prevent consumers from being pressured too much in the short term.

After experiencing a sharp rise from 2021 to 2023, the prices of automobiles and auto parts have stabilized relatively. Insurance prices have leveled off, indicating that most insurance companies have raised their premiums to the level they deem necessary. Insurance companies may try to drive up prices and unnecessarily raise rates, but most consumers can easily switch insurers, which helps curb excessive increases in premiums.

However, Trump's tariff policy may reverse this improving trend. For example, tariffs will increase the cost of parts, which in turn will increase the maintenance costs that insurance companies need to bear, which will eventually be passed on to policyholders through higher rates. However, this impact may still be at an inflection point and is not yet fully felt.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal