Breaking Down Target: 18 Analysts Share Their Views

In the last three months, 18 analysts have published ratings on Target (NYSE:TGT), offering a diverse range of perspectives from bullish to bearish.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 4 | 11 | 1 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 1 | 0 |

| 2M Ago | 0 | 0 | 1 | 0 | 0 |

| 3M Ago | 2 | 4 | 9 | 0 | 0 |

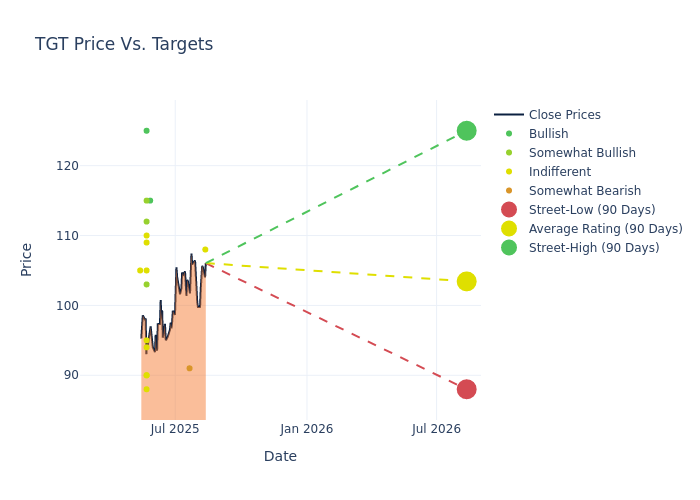

Providing deeper insights, analysts have established 12-month price targets, indicating an average target of $104.06, along with a high estimate of $130.00 and a low estimate of $88.00. Highlighting a 12.31% decrease, the current average has fallen from the previous average price target of $118.67.

Interpreting Analyst Ratings: A Closer Look

The analysis of recent analyst actions sheds light on the perception of Target by financial experts. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Greg Melich | Evercore ISI Group | Raises | In-Line | $108.00 | $104.00 |

| Seth Sigman | Barclays | Maintains | Underweight | $91.00 | $91.00 |

| Seth Sigman | Barclays | Lowers | Equal-Weight | $91.00 | $102.00 |

| Robert Drbul | Guggenheim | Lowers | Buy | $115.00 | $155.00 |

| Joseph Feldman | Telsey Advisory Group | Lowers | Market Perform | $110.00 | $130.00 |

| Paul Lejuez | Citigroup | Lowers | Neutral | $94.00 | $97.00 |

| Robert Ohmes | B of A Securities | Lowers | Neutral | $105.00 | $145.00 |

| David Belinger | Mizuho | Lowers | Neutral | $88.00 | $92.00 |

| Steven Shemesh | RBC Capital | Lowers | Outperform | $103.00 | $112.00 |

| Michael Baker | DA Davidson | Lowers | Buy | $125.00 | $140.00 |

| Kate McShane | Goldman Sachs | Lowers | Neutral | $90.00 | $101.00 |

| Kelly Bania | BMO Capital | Lowers | Market Perform | $95.00 | $100.00 |

| Christopher Horvers | JP Morgan | Raises | Neutral | $109.00 | $105.00 |

| Scot Ciccarelli | Truist Securities | Raises | Hold | $90.00 | $82.00 |

| Edward Kelly | Wells Fargo | Lowers | Overweight | $115.00 | $135.00 |

| Simeon Gutman | Morgan Stanley | Lowers | Overweight | $112.00 | $160.00 |

| Seth Sigman | Barclays | Lowers | Equal-Weight | $102.00 | $140.00 |

| Joseph Feldman | Telsey Advisory Group | Lowers | Outperform | $130.00 | $145.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Target. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Providing a comprehensive analysis, analysts offer qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Target compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of Target's stock. This examination reveals shifts in analysts' expectations over time.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of Target's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on Target analyst ratings.

All You Need to Know About Target

Target serves as the nation's seventh-largest retailer, with its strategy predicated on delivering a gratifying in-store shopping experience and a wide product assortment of trendy apparel, home goods, and household essentials at competitive prices. Target's upscale and stylish image began to carry national merit in the 1990s—a decade in which the brand saw its top line grow threefold to almost $30 billion—and has since cemented itself as a leading US retailer.Today, Target operates over 1,900 stores in the United States, generates over $100 billion in sales, and fulfills over 2 billion customer orders annually. The firm's vast footprint is concentrated in urban and suburban markets as the firm seeks to appeal to a more affluent consumer base.

Target: Delving into Financials

Market Capitalization Analysis: Positioned below industry benchmarks, the company's market capitalization faces constraints in size. This could be influenced by factors such as growth expectations or operational capacity.

Negative Revenue Trend: Examining Target's financials over 3M reveals challenges. As of 30 April, 2025, the company experienced a decline of approximately -2.79% in revenue growth, reflecting a decrease in top-line earnings. When compared to others in the Consumer Staples sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Target's net margin excels beyond industry benchmarks, reaching 4.34%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Target's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 7.0%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): Target's ROA lags behind industry averages, suggesting challenges in maximizing returns from its assets. With an ROA of 1.82%, the company may face hurdles in achieving optimal financial performance.

Debt Management: Target's debt-to-equity ratio surpasses industry norms, standing at 1.27. This suggests the company carries a substantial amount of debt, posing potential financial challenges.

What Are Analyst Ratings?

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Some analysts also offer predictions for helpful metrics such as earnings, revenue, and growth estimates to provide further guidance as to what to do with certain tickers. It is important to keep in mind that while stock and sector analysts are specialists, they are also human and can only forecast their beliefs to traders.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal