Did Rumble's (RUM) Cumulus Partnership and Q2 Results Just Shift Its Growth Narrative?

- Rumble Inc. recently announced its second quarter 2025 results, reporting sales of US$25.08 million and a net loss of US$30.22 million, as well as a strategic partnership with Cumulus Media focused on content distribution and new advertising opportunities.

- This combination of revenue growth, operational improvement, and expanded digital media collaboration with Cumulus Media highlights Rumble's commitment to strengthening its platform and broadening monetization pathways.

- We'll examine how Rumble's latest results and the Cumulus partnership may shift its investment narrative and future growth assumptions.

AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Rumble Investment Narrative Recap

To be a Rumble shareholder right now, you need conviction in the company’s ability to scale user engagement and monetize digital content partnerships amid ongoing competition from larger media platforms. The Q2 2025 results highlighted continued revenue progress but also ongoing losses, which means the central short term catalyst remains Rumble’s ability to accelerate monetization – while the largest risk continues to be concentrated exposure to leading influencers and the slow path toward profitability. The latest announcements do not materially shift these near-term dynamics.

The recent partnership with Cumulus Media stands out, since it directly addresses opportunities to expand Rumble’s advertising reach and diversify content, potentially supporting the company’s monetization efforts and partially mitigating exposure to individual creators who hold significant influence on the platform. As brand and content distribution deals gain traction, the pace at which these partnerships improve top line results remains a critical area to watch for investors expecting tangible progress.

However, investors should be aware that despite new collaborations, the underlying risk of reliance on a few top creators …

Read the full narrative on Rumble (it's free!)

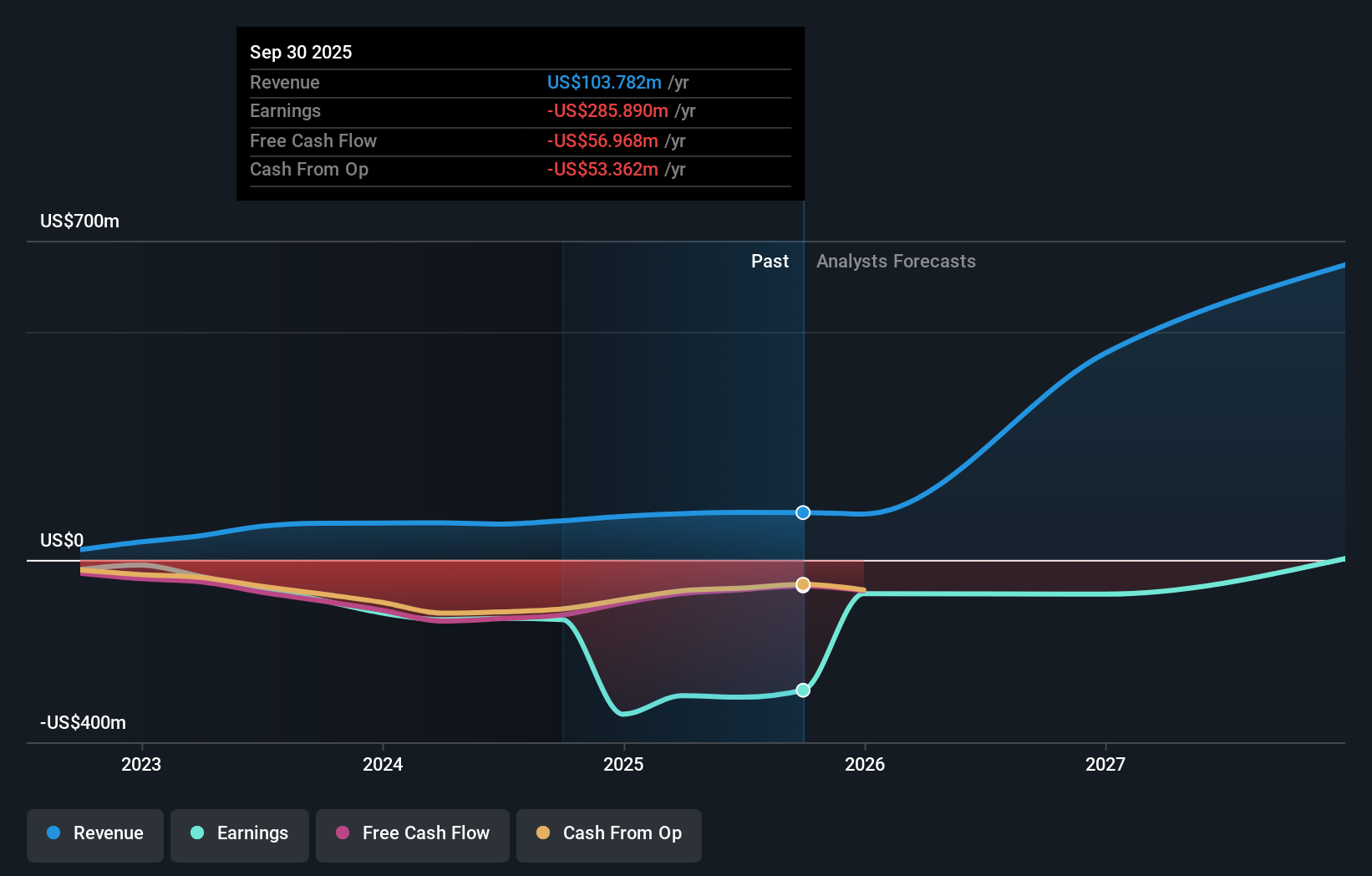

Rumble's narrative projects $191.2 million revenue and $20.8 million earnings by 2028. This requires 23.5% yearly revenue growth and a $318.5 million increase in earnings from -$297.7 million.

Uncover how Rumble's forecasts yield a $15.00 fair value, a 85% upside to its current price.

Exploring Other Perspectives

Fair value opinions from the Simply Wall St Community range from US$1.84 to US$15 across just two estimates. With user concentration risk highlighted in recent results, readers can compare sharply varied market views.

Explore 2 other fair value estimates on Rumble - why the stock might be worth as much as 85% more than the current price!

Build Your Own Rumble Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Rumble research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Rumble research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Rumble's overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal