How APi Group's (APG) Upgraded 2025 Revenue Forecast Highlights Its Recurring Revenue and Infrastructure Momentum

- APi Group Corporation recently raised its full-year 2025 net revenue guidance to US$7.65 billion–US$7.85 billion and reported second quarter results showing increased sales to US$1.99 billion and higher net income compared to the previous year.

- The company's improved outlook and robust quarterly performance reflect ongoing business momentum, likely supported by recurring revenues and continued infrastructure investment activity.

- We'll consider how APi Group's upgraded revenue forecast highlights the impact of recurring contracts and infrastructure demand on its investment story.

Find companies with promising cash flow potential yet trading below their fair value.

APi Group Investment Narrative Recap

Owning APi Group stock means believing in the power of recurring safety and specialty services contracts and the company’s exposure to infrastructure upgrades. The recent uplift in full-year 2025 revenue guidance and solid second-quarter earnings support the story of continued momentum, but these results do little to address ongoing risks. In the short term, margin pressure from rising input costs remains a key concern, while recurring service revenues and infrastructure activity stand out as the most important catalyst for near-term performance.

The most relevant recent announcement is APi Group’s decision to raise its full-year net revenue guidance, moving the range to US$7.65 billion to US$7.85 billion. This upgraded outlook highlights the significant role of steady contract-based revenue and infrastructure spending as important supports for the company's financial performance, reinforcing the foundation for the ongoing investment story.

But while top-line growth appears resilient, investors should not overlook the risk posed by continued material cost inflation, which may still pressure margins and...

Read the full narrative on APi Group (it's free!)

APi Group's outlook anticipates $8.9 billion in revenue and $717.3 million in earnings by 2028. This is based on a projected annual revenue growth rate of 6.3% and an earnings increase of $576.3 million from the current earnings of $141.0 million.

Uncover how APi Group's forecasts yield a $40.57 fair value, a 16% upside to its current price.

Exploring Other Perspectives

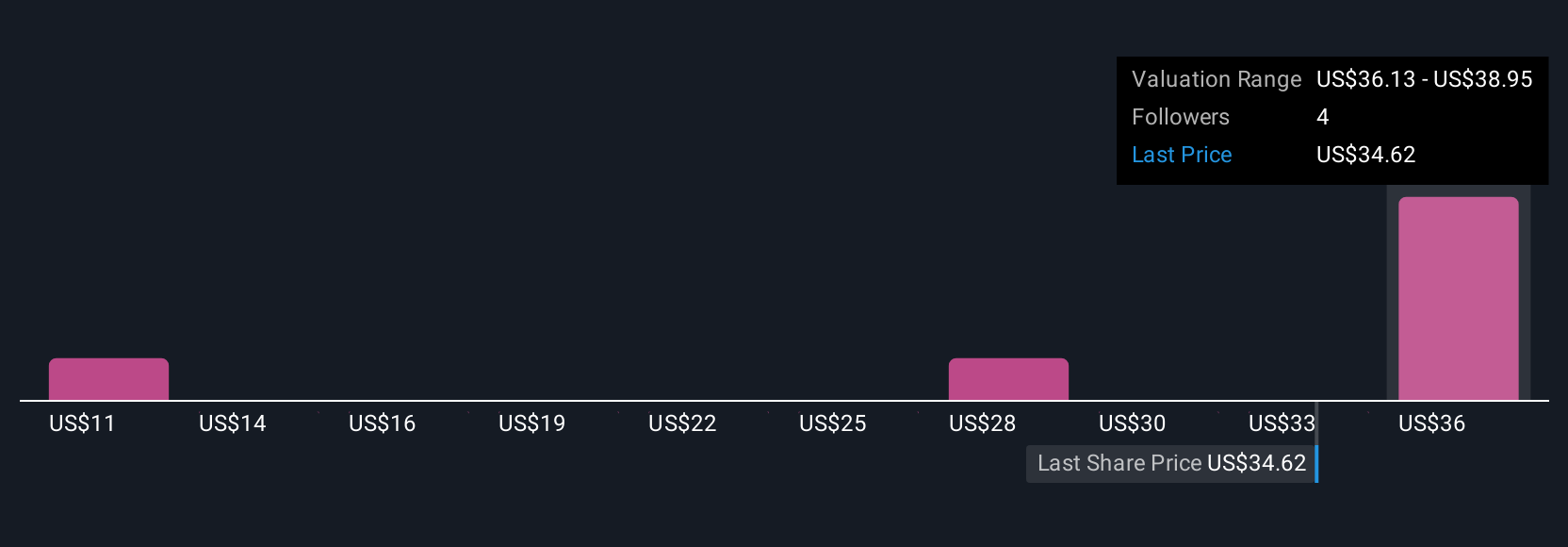

Fair value estimates from the Simply Wall St Community range widely, from US$10.74 to US$40.57, based on four individual perspectives. While project-driven contract growth supports the investment case, you can see that opinions differ and it pays to consider multiple viewpoints before deciding on your next step.

Explore 4 other fair value estimates on APi Group - why the stock might be worth less than half the current price!

Build Your Own APi Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your APi Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free APi Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate APi Group's overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal