Orla Mining (TSX:OLA) Rides Strong Q2 Earnings and High-Grade Discoveries at Camino Rojo—Is Growth Momentum Building?

- Orla Mining reported second quarter results showing sales of US$263.75 million and net income of US$48.21 million, along with an exploration update confirming high-grade mineralization at its Camino Rojo Zone 22 in Mexico following completion of a 15,000-metre drilling program.

- While the company slightly reduced its gold production guidance for the year, consistent exploration success and resource growth potential at Camino Rojo took the spotlight in recent corporate developments.

- Let’s explore how the strong quarterly earnings and high-grade exploration results at Camino Rojo could influence Orla Mining’s investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Orla Mining Investment Narrative Recap

To invest in Orla Mining, shareholders need conviction in the company’s multi-asset production growth and successful exploration pipeline, especially at Camino Rojo and Musselwhite. The recent quarterly earnings reveal strong revenue and profit numbers, paired with high-grade drill results at Camino Rojo. While the revised gold production guidance is a modest step down, it does not appear to materially affect the company’s near-term outlook. The largest current risk remains the integration and performance of the acquired Musselwhite Mine, given its cost structure and impact on profitability.

The August 7 exploration update at Camino Rojo stands out, confirming high-grade mineralization in Zone 22 after a 15,000-metre drill program. These findings directly support resource growth potential and could serve as an underpinning for future production upgrades, reinforcing the significance of successful ongoing exploration as a key driver for Orla’s short- to medium-term catalysts.

However, with production guidance now trimmed and Musselwhite’s costs and integration continuing to loom, investors should also be aware that ...

Read the full narrative on Orla Mining (it's free!)

Orla Mining's narrative projects $1.1 billion revenue and $574.3 million earnings by 2028. This requires 38.6% yearly revenue growth and a $572.6 million earnings increase from $1.7 million today.

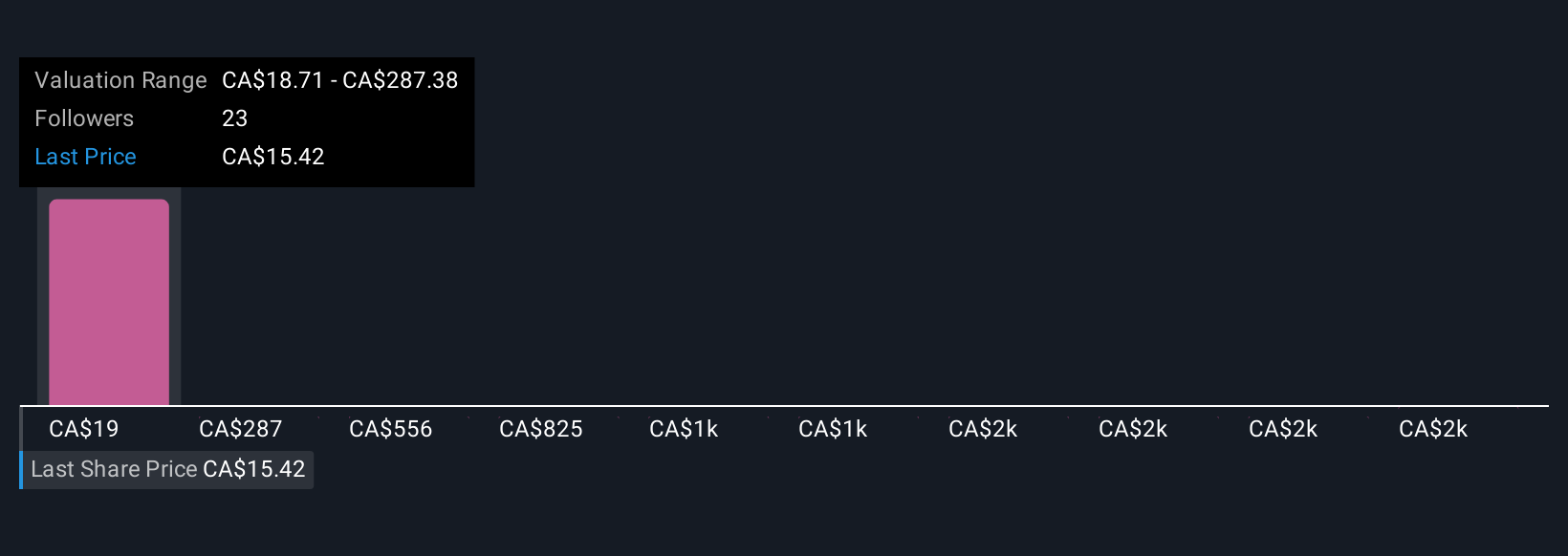

Uncover how Orla Mining's forecasts yield a CA$18.55 fair value, a 31% upside to its current price.

Exploring Other Perspectives

Five fair value estimates from the Simply Wall St Community ranged from US$17.13 to an outlier above US$2,700. These varied forecasts are set against Orla Mining's ongoing operational integration challenges at Musselwhite, a factor influencing both potential and perceived risk in performance.

Explore 5 other fair value estimates on Orla Mining - why the stock might be worth just CA$17.13!

Build Your Own Orla Mining Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Orla Mining research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Orla Mining research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Orla Mining's overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal