3 Prominent ASX Dividend Stocks Yielding Up To 7.6%

The Australian market showed positive momentum with the ASX200 trading higher, driven by strong performances in the Materials, Financials, and Telecommunication sectors. In this environment, dividend stocks remain a key focus for investors seeking steady income streams; they often provide stability and potential returns even when other sectors like Discretionary and IT experience volatility.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Yancoal Australia (ASX:YAL) | 7.81% | ★★★★☆☆ |

| Super Retail Group (ASX:SUL) | 7.64% | ★★★★★☆ |

| Sugar Terminals (NSX:SUG) | 8.12% | ★★★★★☆ |

| New Hope (ASX:NHC) | 8.99% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.53% | ★★★★★☆ |

| Lycopodium (ASX:LYL) | 6.35% | ★★★★★☆ |

| Lindsay Australia (ASX:LAU) | 6.46% | ★★★★★☆ |

| IPH (ASX:IPH) | 6.46% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 3.79% | ★★★★★☆ |

| Accent Group (ASX:AX1) | 6.71% | ★★★★★☆ |

Click here to see the full list of 31 stocks from our Top ASX Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

Accent Group (ASX:AX1)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Accent Group Limited operates in the retail, distribution, and franchise sectors for lifestyle footwear, apparel, and accessories across Australia and New Zealand with a market cap of A$895.77 million.

Operations: Accent Group Limited generates revenue primarily through its Retail segment, which accounts for A$1.30 billion, and its Wholesale segment, contributing A$475.92 million.

Dividend Yield: 6.7%

Accent Group's dividend yield is in the top quartile of Australian payers, supported by a low cash payout ratio of 31.2%, indicating strong coverage by free cash flow. Despite this, its dividends have been volatile over the past decade, raising concerns about reliability. Recent leadership changes could impact strategic direction and stability. Additionally, a recent A$60.45 million equity offering may affect shareholder value and future dividend policy as it influences capital structure and growth strategies.

- Click to explore a detailed breakdown of our findings in Accent Group's dividend report.

- Upon reviewing our latest valuation report, Accent Group's share price might be too pessimistic.

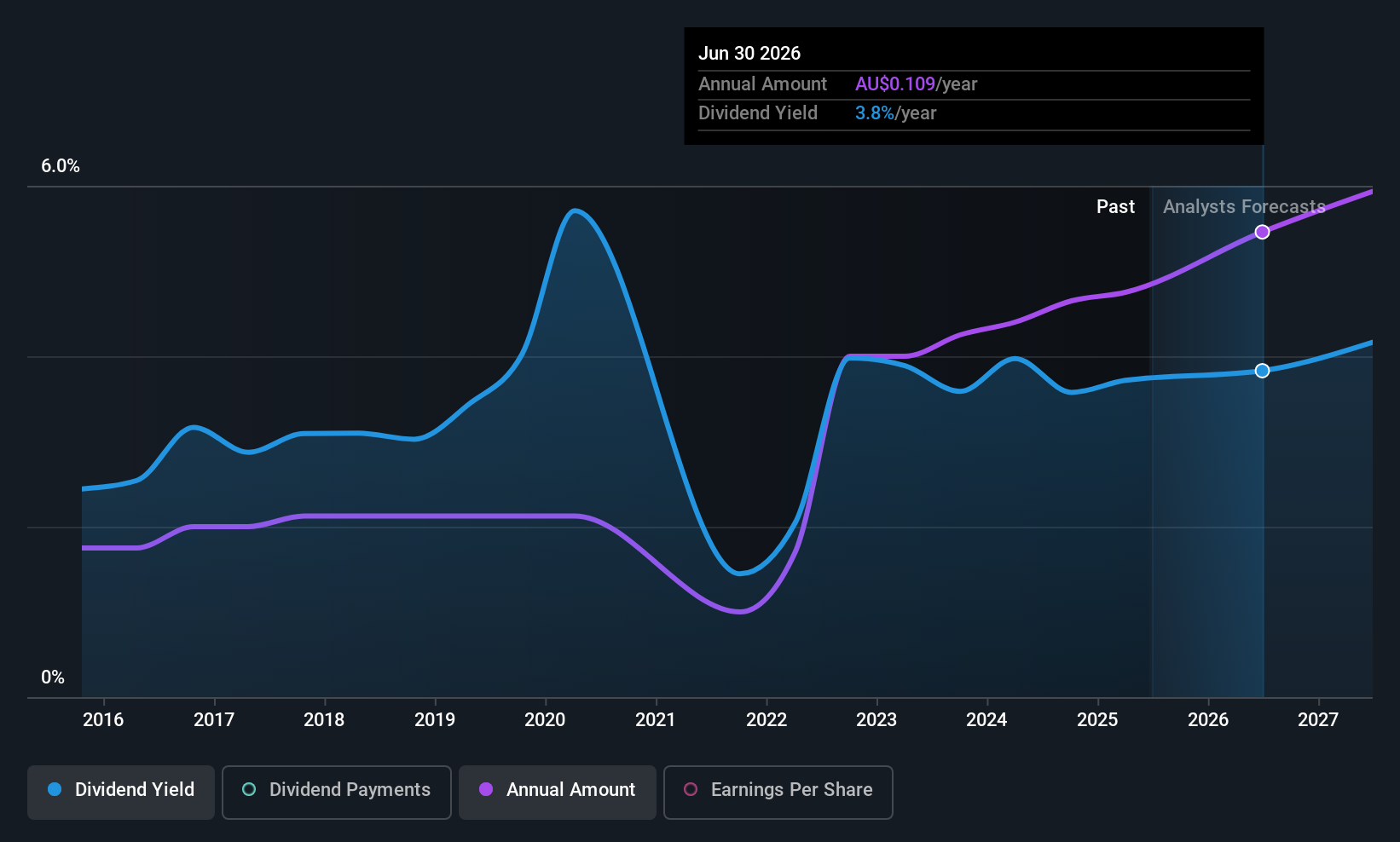

Ridley (ASX:RIC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ridley Corporation Limited, with a market cap of A$1.09 billion, provides animal nutrition solutions in Australia through its subsidiaries.

Operations: Ridley Corporation Limited generates revenue through its Bulk Stockfeeds segment, which contributes A$894.26 million, and its Packaged/Ingredients segment, contributing A$389.70 million.

Dividend Yield: 3.3%

Ridley's dividend yield of 3.28% is below the top tier in Australia, and its dividends have been unstable over the past decade. Despite this volatility, dividends are well covered by a 75% earnings payout ratio and a 41.6% cash payout ratio, indicating sustainability from financial operations. Recent strategic moves include a A$125.68 million equity offering and an upcoming CFO transition to support the acquisition of Incitec Pivot Fertilisers' distribution business, potentially influencing future dividend stability.

- Navigate through the intricacies of Ridley with our comprehensive dividend report here.

- Our valuation report unveils the possibility Ridley's shares may be trading at a discount.

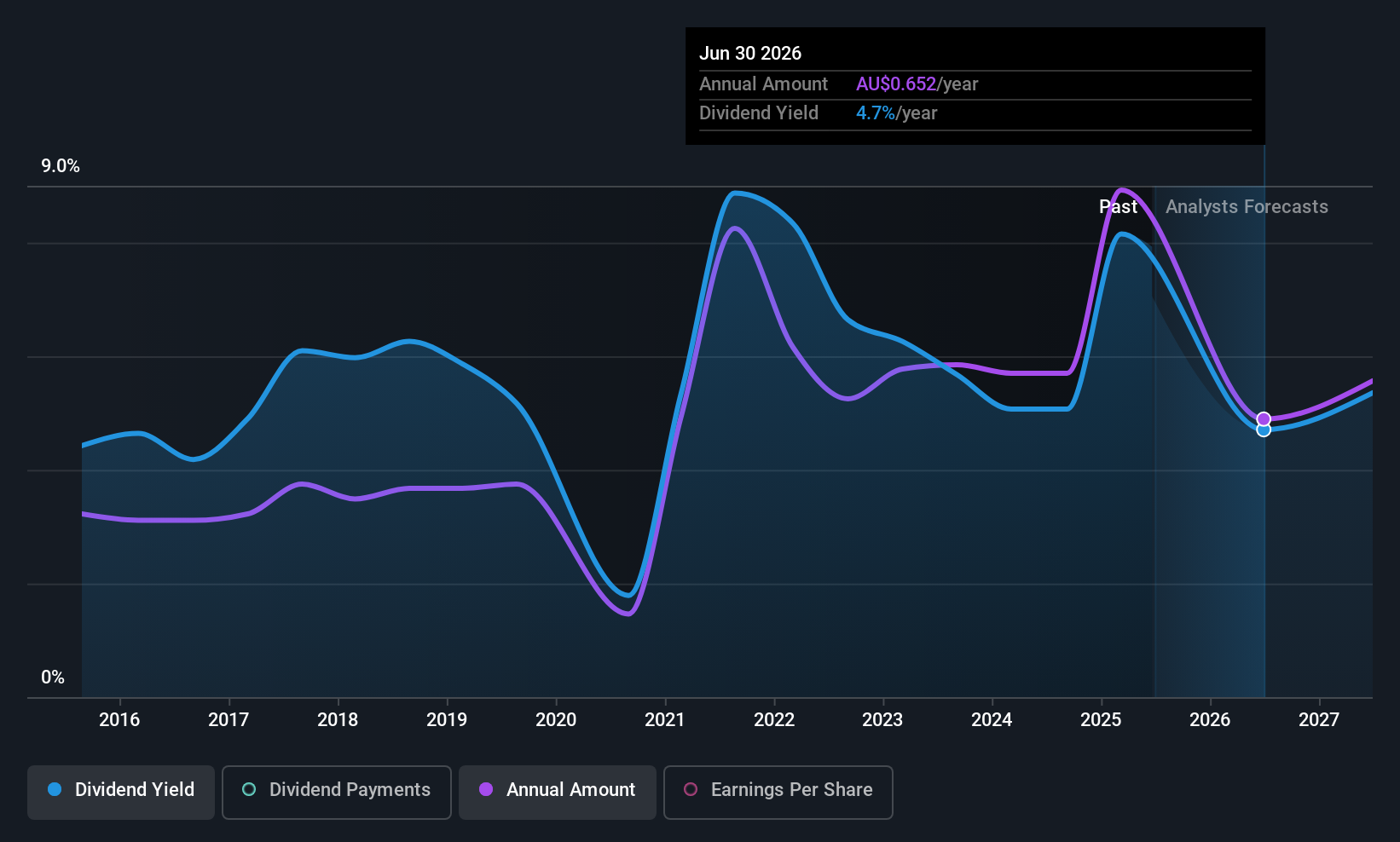

Super Retail Group (ASX:SUL)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Super Retail Group Limited operates as a retailer of auto, sports, and outdoor leisure products in Australia and New Zealand, with a market cap of A$3.52 billion.

Operations: Super Retail Group Limited's revenue is primarily derived from its segments: Super Cheap Auto at A$1.51 billion, Rebel at A$1.32 billion, Boating, Camping and Fishing (excluding Macpac) at A$912.60 million, and Macpac at A$215.80 million.

Dividend Yield: 7.6%

Super Retail Group's dividend yield of 7.64% ranks it among the top 25% in Australia, supported by a reasonable earnings payout ratio of 68.8%. Despite this, dividends have been volatile over the past decade with occasional drops exceeding 20%, raising concerns about reliability. The company's cash flow coverage is solid at a 68% cash payout ratio, and its price-to-earnings ratio of 15.5x suggests good value relative to peers and the broader market.

- Get an in-depth perspective on Super Retail Group's performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Super Retail Group shares in the market.

Summing It All Up

- Gain an insight into the universe of 31 Top ASX Dividend Stocks by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal