Asian Market Value Stocks: 3 Companies Estimated Below Intrinsic Worth

As global markets navigate a complex landscape of economic indicators and policy shifts, the Asian market has shown resilience, with indices in China and Japan posting gains amid strong corporate earnings and robust trade data. In this environment, identifying undervalued stocks can be crucial for investors seeking opportunities potentially mispriced by the market; these stocks may offer intrinsic value that is not yet reflected in their current trading prices.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| SRE Holdings (TSE:2980) | ¥3180.00 | ¥6212.44 | 48.8% |

| SILICON2 (KOSDAQ:A257720) | ₩53700.00 | ₩105825.30 | 49.3% |

| Nanya Technology (TWSE:2408) | NT$43.95 | NT$87.08 | 49.5% |

| Jiangsu Yunyi ElectricLtd (SZSE:300304) | CN¥11.08 | CN¥22.02 | 49.7% |

| Heartland Group Holdings (NZSE:HGH) | NZ$0.80 | NZ$1.58 | 49.5% |

| Guangdong Marubi Biotechnology (SHSE:603983) | CN¥40.73 | CN¥79.39 | 48.7% |

| GEM (SZSE:002340) | CN¥6.54 | CN¥13.00 | 49.7% |

| Finger (KOSDAQ:A163730) | ₩13480.00 | ₩26287.68 | 48.7% |

| cottaLTD (TSE:3359) | ¥442.00 | ¥867.58 | 49.1% |

| Andes Technology (TWSE:6533) | NT$276.50 | NT$541.44 | 48.9% |

Let's dive into some prime choices out of the screener.

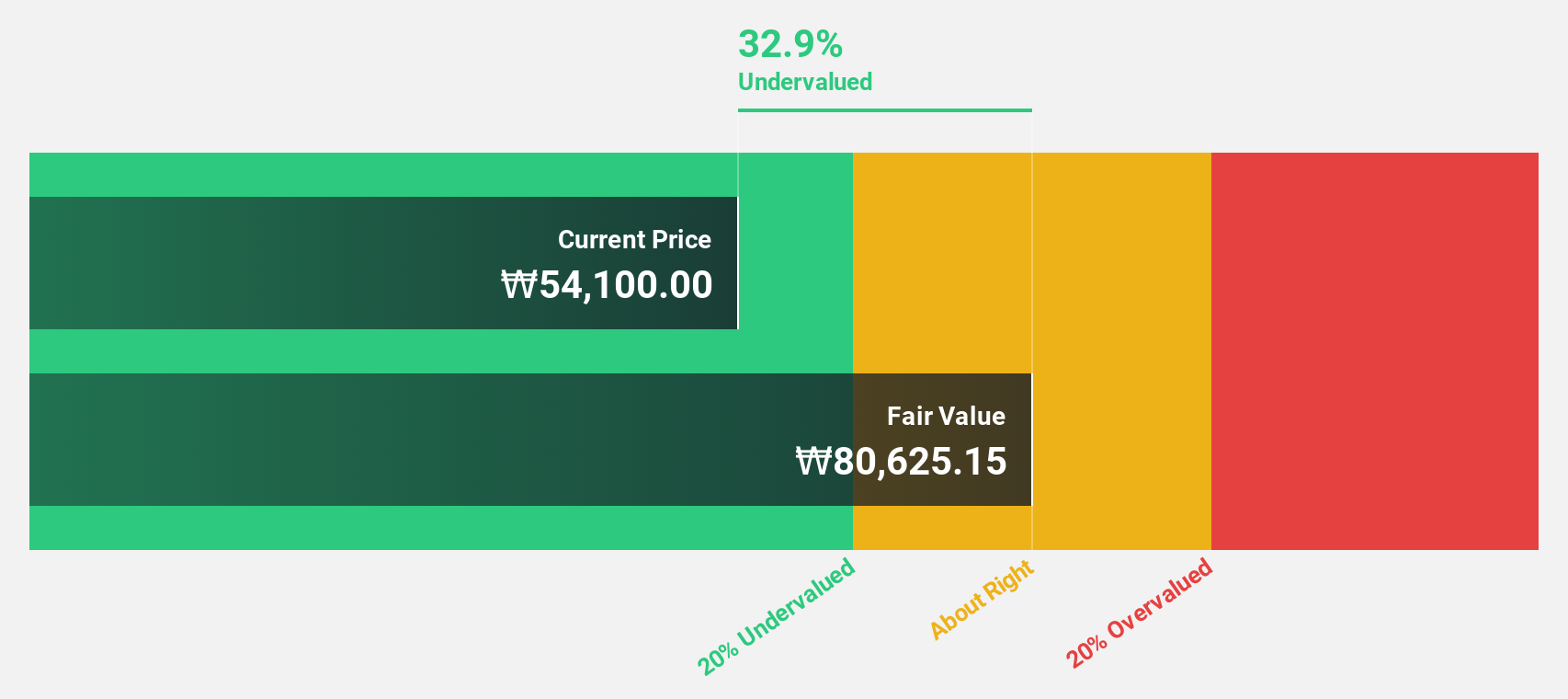

SILICON2 (KOSDAQ:A257720)

Overview: SILICON2 Co., Ltd. is involved in the global distribution of cosmetics products and has a market cap of approximately ₩3.52 trillion.

Operations: The company generates revenue from its wholesale miscellaneous segment, amounting to ₩787.27 million.

Estimated Discount To Fair Value: 49.3%

SILICON2 is trading at ₩53,700, significantly below its estimated fair value of ₩105,825.3, presenting a potential undervaluation based on cash flows. Despite recent earnings volatility and high non-cash earnings, its revenue is expected to grow 20.6% annually—outpacing the Korean market's 7.2% growth rate—while profits are forecasted to increase by 20.75% per year. The company's strong first-quarter net income of KRW 38,785 million supports this outlook despite share price volatility.

- Our comprehensive growth report raises the possibility that SILICON2 is poised for substantial financial growth.

- Navigate through the intricacies of SILICON2 with our comprehensive financial health report here.

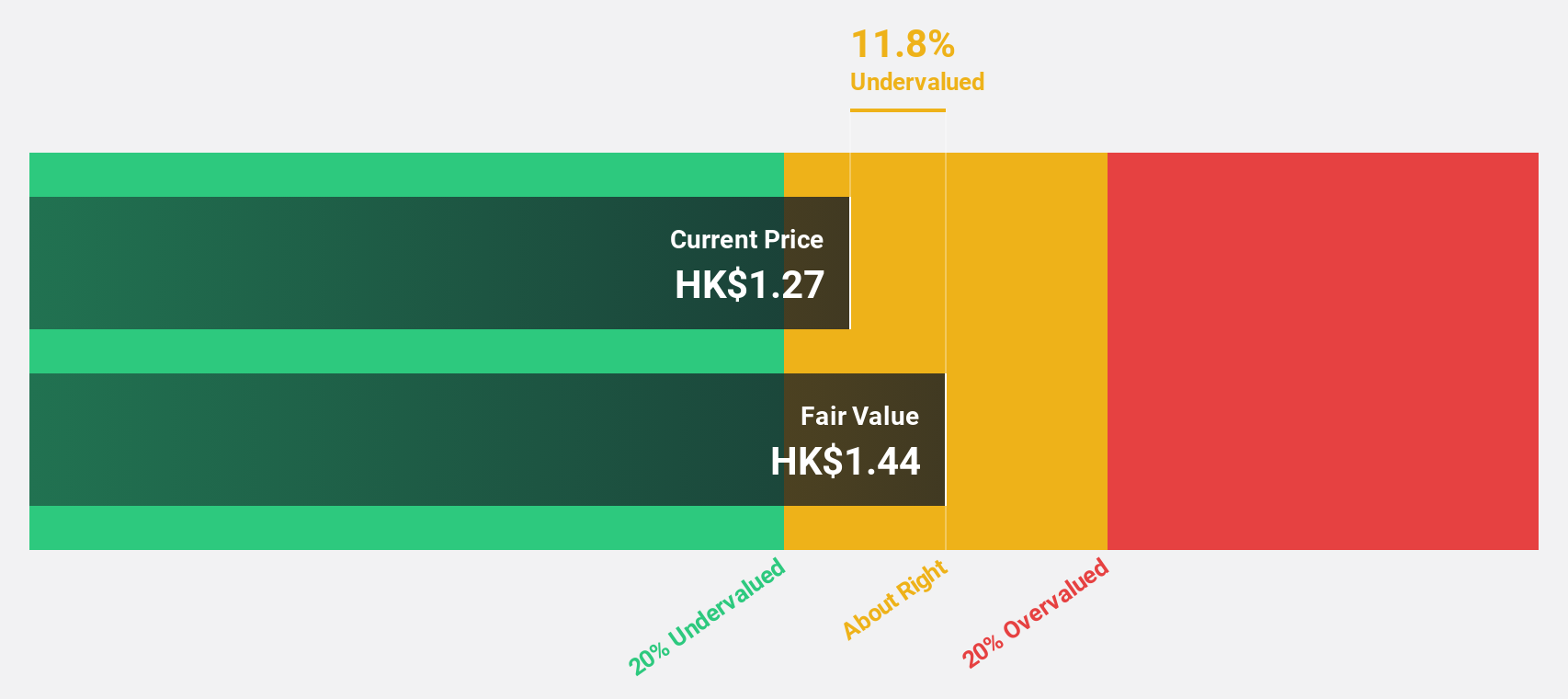

Damai Entertainment Holdings (SEHK:1060)

Overview: Damai Entertainment Holdings Limited is an investment holding company engaged in content, technology, and IP merchandising and commercialization businesses in Hong Kong and the People's Republic of China, with a market cap of approximately HK$35.25 billion.

Operations: The company's revenue segments include CN¥2.06 billion from Damai, CN¥499.92 million from Drama Series Production, CN¥1.43 billion from IP Merchandising and Innovation Initiatives, and CN¥2.71 billion from its Film Technology and Investment, Production, Promotion and Distribution Platform.

Estimated Discount To Fair Value: 20.9%

Damai Entertainment Holdings, trading at HK$1.18, is undervalued with a fair value estimate of HK$1.49, based on cash flow analysis. Despite recent insider selling and share price volatility, the company reported CNY 6.70 billion in sales for the year ending March 2025—up from CNY 5.03 billion—and net income increased to CNY 363.58 million. Earnings are expected to grow significantly at over 40% annually, outpacing Hong Kong market forecasts.

- Our earnings growth report unveils the potential for significant increases in Damai Entertainment Holdings' future results.

- Get an in-depth perspective on Damai Entertainment Holdings' balance sheet by reading our health report here.

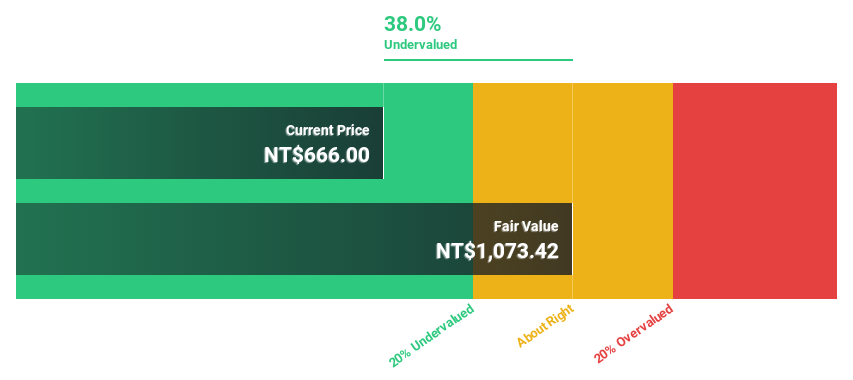

Accton Technology (TWSE:2345)

Overview: Accton Technology Corporation engages in the research, development, manufacturing, and sale of network communication equipment across Taiwan, America, Asia, Europe, and internationally with a market cap of NT$552.76 billion.

Operations: Accton Technology Corporation generates revenue through its research, development, manufacturing, and sales activities in the field of network communication equipment across various regions including Taiwan, America, Asia, Europe, and other international markets.

Estimated Discount To Fair Value: 37.5%

Accton Technology, trading at NT$989, is undervalued with a fair value estimate of NT$1,581.54 based on cash flow analysis. Recent earnings showed significant growth with second-quarter revenue reaching TWD 60.60 billion and net income at TWD 5.03 billion. Despite high share price volatility, the company's earnings grew by 83.2% over the past year and are forecast to grow significantly at 22.8% annually, outpacing Taiwan's market expectations.

- The analysis detailed in our Accton Technology growth report hints at robust future financial performance.

- Take a closer look at Accton Technology's balance sheet health here in our report.

Key Takeaways

- Click through to start exploring the rest of the 274 Undervalued Asian Stocks Based On Cash Flows now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal