Does Capital Power’s (TSX:CPX) Dividend Hike Reflect Enduring Confidence Despite a Swing to Losses?

- Capital Power Corporation reported its second-quarter 2025 financial results in late July, posting sales of CA$407 million and a net loss of CA$132 million, compared to a net income of CA$75 million in the same period last year.

- Despite the decline in financial performance, Capital Power’s board announced a 6% increase to its quarterly common share dividend, signaling an ongoing commitment to shareholder returns.

- We’ll explore how the shift from profitability to a net loss shapes Capital Power’s investment narrative amid evolving sector expectations.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Capital Power Investment Narrative Recap

To be a shareholder in Capital Power, you’d want to believe that long-term demand for electricity, driven by trends like electrification and data centers, will overcome near-term earnings volatility, and that the company’s diversified North American fleet will support growth and cash flows. The recent quarter’s net loss is a setback, but unless there’s a persistent shift in market or operating conditions, it does not immediately alter the core catalyst of benefiting from rising power demand. For now, the biggest risk remains execution on project delivery and the pace of demand growth.

Among recent announcements, the 6% increase to the common share dividend stands out in light of the quarter’s weaker results. This move draws attention to management’s ongoing emphasis on rewarding shareholders, even as current profitability faces pressure, and may reassure those focused on the sustainability of returns while sector expectations evolve.

Yet, despite the boost to payouts, investors should be aware that...

Read the full narrative on Capital Power (it's free!)

Capital Power's outlook anticipates CA$4.1 billion in revenue and CA$521.7 million in earnings by 2028. This implies a 5.0% annual revenue growth, but a CA$92.3 million decrease in earnings from the current CA$614.0 million.

Uncover how Capital Power's forecasts yield a CA$66.73 fair value, a 11% upside to its current price.

Exploring Other Perspectives

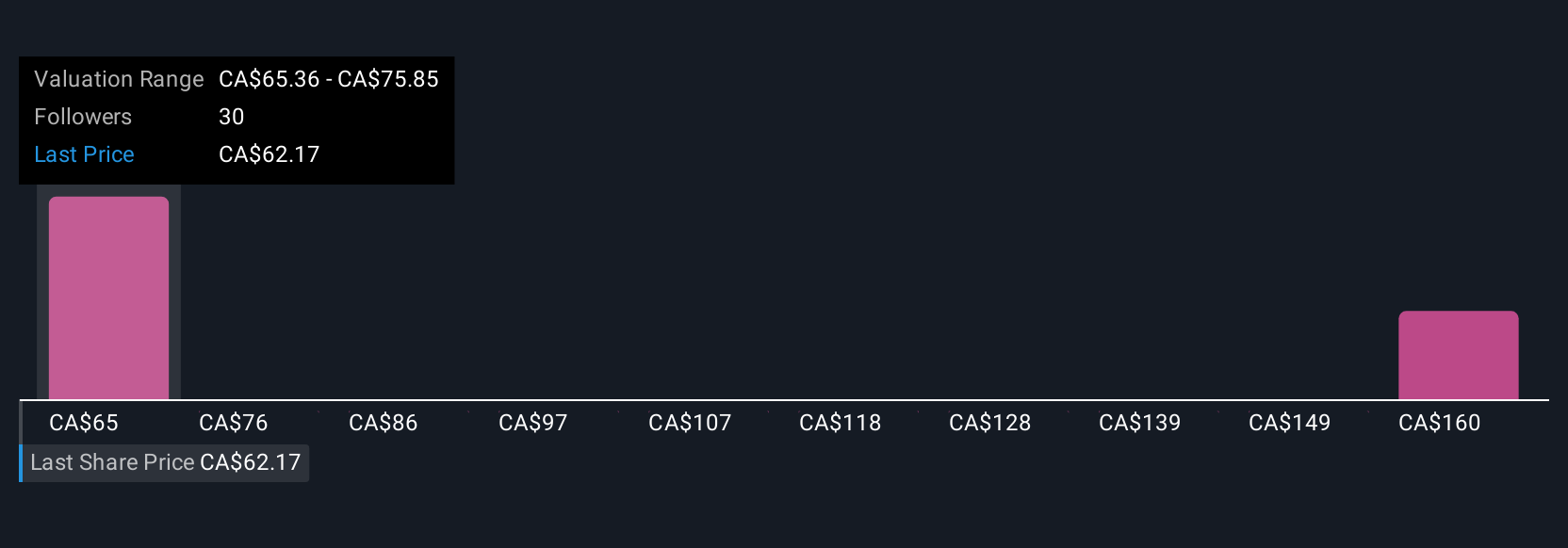

Simply Wall St Community members provided fair value estimates for Capital Power ranging from CA$66.73 to CA$154.64, reflecting two distinct outlooks. While the estimates are varied, continuing uncertainty around electricity demand growth may shape future confidence, so review a range of community viewpoints before making assumptions.

Explore 2 other fair value estimates on Capital Power - why the stock might be worth just CA$66.73!

Build Your Own Capital Power Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Capital Power research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Capital Power research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Capital Power's overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 24 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal