Is Merus' (MRUS) Rising Revenue and Widening Losses Changing Its Investment Story?

- Merus N.V. recently reported its second quarter and six-month 2025 earnings, showing revenue of US$8.83 million and US$35.32 million respectively, with net losses widening to US$158.22 million for the quarter and US$254.69 million for the half-year.

- Despite the higher revenue year-over-year, the sharp increase in net losses highlights the company's continued investment and expenditure growth.

- We'll explore how Merus' stronger revenue coupled with widening losses shapes the company's investment narrative and outlook.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is Merus' Investment Narrative?

To own Merus as an investor, you generally have to believe in its long-term potential to translate strong clinical results and rapid revenue expansion into future commercial success, despite heavy near-term losses. The company has seen accelerated revenue growth and attractive product developments, especially with its lead candidate petosemtamab showing encouraging data and earning Breakthrough Therapy Designation from the FDA. However, the most recent quarterly results underscore a serious near-term risk: investment in R&D and operations has outpaced revenue gains, resulting in much steeper losses. With a recent US$300 million follow-on equity raise, near-term liquidity concerns have eased for now, but the wider net loss figures bring ongoing cash burn and future dilution risks back to the forefront. The mild share price response to the earnings suggests that, for now, the widened losses likely don't materially alter the existing catalysts or risks. Instead, much still hinges on clinical milestones and investor patience with unprofitability.

Yet, the prospect of further share dilution is a real consideration for shareholders.

Exploring Other Perspectives

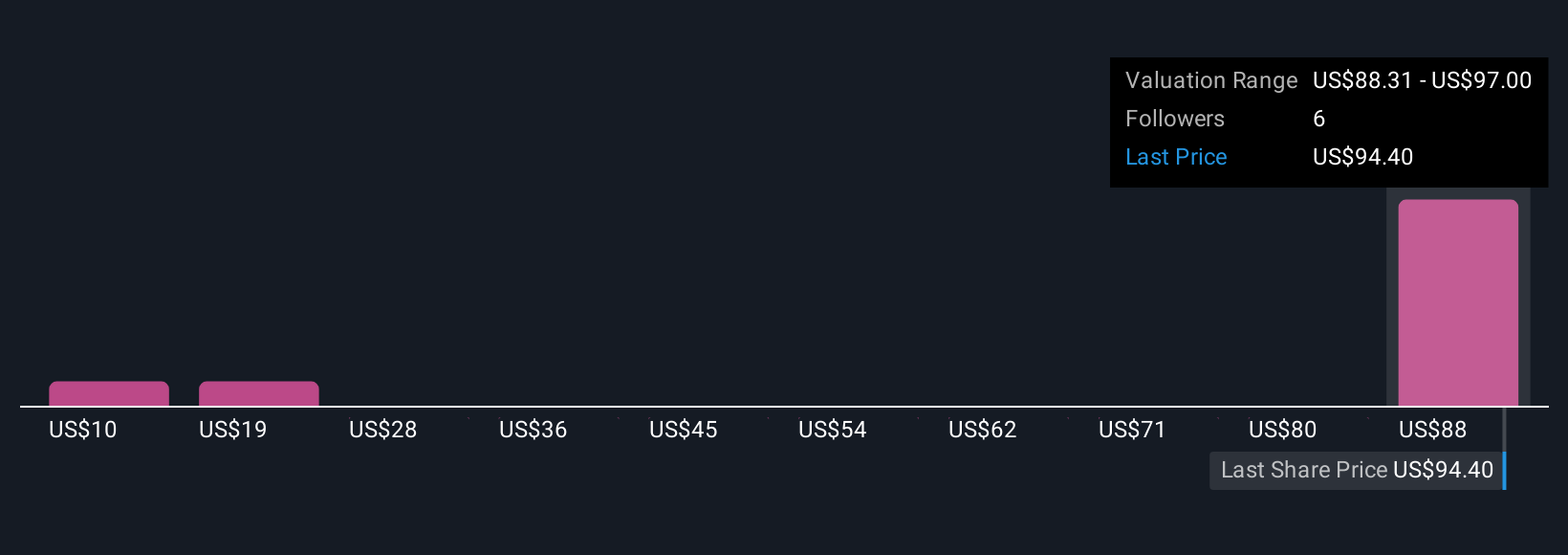

Explore 4 other fair value estimates on Merus - why the stock might be worth less than half the current price!

Build Your Own Merus Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Merus research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Merus research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Merus' overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal