What Leonardo DRS (DRS)'s Strong Q2 Results and Upgraded Revenue Outlook Mean For Shareholders

- Leonardo DRS recently reported second-quarter results, highlighting sales of US$829 million and net income of US$54 million, both up from the previous year, alongside an accelerated share repurchase program and reaffirmed dividend payment.

- The company also raised its 2025 revenue guidance to a range of US$3.53 billion to US$3.60 billion, reflecting optimism around its performance outlook.

- We'll examine how the improved financial results and raised full-year outlook could reshape Leonardo DRS's investment narrative and sector position.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Leonardo DRS Investment Narrative Recap

To see value in Leonardo DRS, a shareholder must focus on demand for advanced defense technologies linked to US and allied military budgets, as well as the company’s ability to win and execute government contracts. The latest news, rising revenue and profit, a higher 2025 revenue outlook, and an accelerated share buyback, reinforces the company's bullish short-term catalyst: persistent defense spending and premium contract awards. The biggest risk remains exposure to raw material cost inflation and supply constraints, which could pressure margins, but the recent announcements do not materially alter this risk in the near term.

Among the new developments, the completion of a US$13.29 million accelerated buyback stands out. This move signals continued management confidence in the business amid strengthening earnings and strong contract momentum, but does not address operational margin pressures that stem from the company’s concentrated supplier base, a risk highlighted in many recent industry updates.

Yet, even as profits climb, lingering supply uncertainties and future raw material cost spikes remain information investors should be aware of, especially if...

Read the full narrative on Leonardo DRS (it's free!)

Leonardo DRS is projected to generate $4.1 billion in revenue and $341.9 million in earnings by 2028. This outlook assumes annual revenue growth of 6.6% and an earnings increase of $91.9 million from current earnings of $250.0 million.

Uncover how Leonardo DRS' forecasts yield a $48.67 fair value, a 17% upside to its current price.

Exploring Other Perspectives

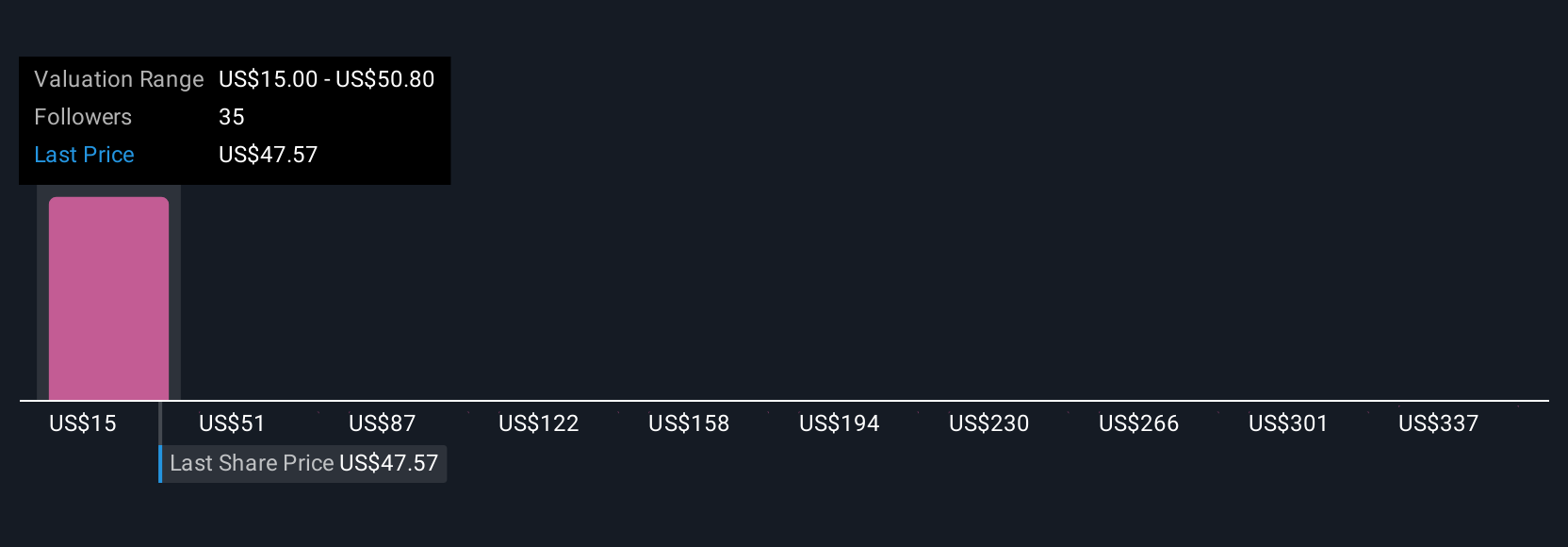

Nine individual fair value estimates from the Simply Wall St Community range from US$15 to US$372.97, showing sharply different outlooks. Against this background, keep in mind that persistent demand from defense modernization remains a critical driver shaping future outcomes and could invite several other perspectives on DRS's prospects.

Explore 9 other fair value estimates on Leonardo DRS - why the stock might be worth less than half the current price!

Build Your Own Leonardo DRS Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Leonardo DRS research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Leonardo DRS research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Leonardo DRS' overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal