Is Legal Scrutiny Over Governance and Disclosure Changing the Investment Case for Telephone and Data Systems (TDS)?

- Johnson Fistel, PLLP recently began investigating potential securities law violations and governance failures by officers and directors at Telephone and Data Systems, Inc., with class action lawsuits filed alleging misleading statements and misrepresentation of financial results.

- This legal scrutiny raises important questions about the company's corporate governance and transparency, which could have significant implications for its reputation and future operations.

- We'll examine how the launch of securities law investigations and lawsuits could impact Telephone and Data Systems' investment outlook and risk profile.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Telephone and Data Systems Investment Narrative Recap

Being a shareholder in Telephone and Data Systems means believing in the company's ability to execute major transactions like the proposed sale of its wireless business to T-Mobile, manage the integration challenges, and shift toward fiber expansion for long-term growth. The recent launch of securities law investigations and allegations of misleading statements adds a layer of reputational and litigation risk, but does not appear to materially change the most immediate catalyst, whether the T-Mobile deal clears regulatory hurdles remains central to the near-term outlook.

The most recent announcement of a $0.04 per share common dividend, alongside preferred share payouts, signals ongoing capital returns to shareholders despite ongoing legal pressures. Regular dividends may reassure some, but investors are likely to stay focused on upcoming milestones tied to the wireless transaction, which could influence both cash flow and strategic flexibility moving forward.

Yet while ongoing dividends may appeal to income-focused investors, the unresolved questions around regulatory approval and legal scrutiny highlight risk factors that every investor should be aware of...

Read the full narrative on Telephone and Data Systems (it's free!)

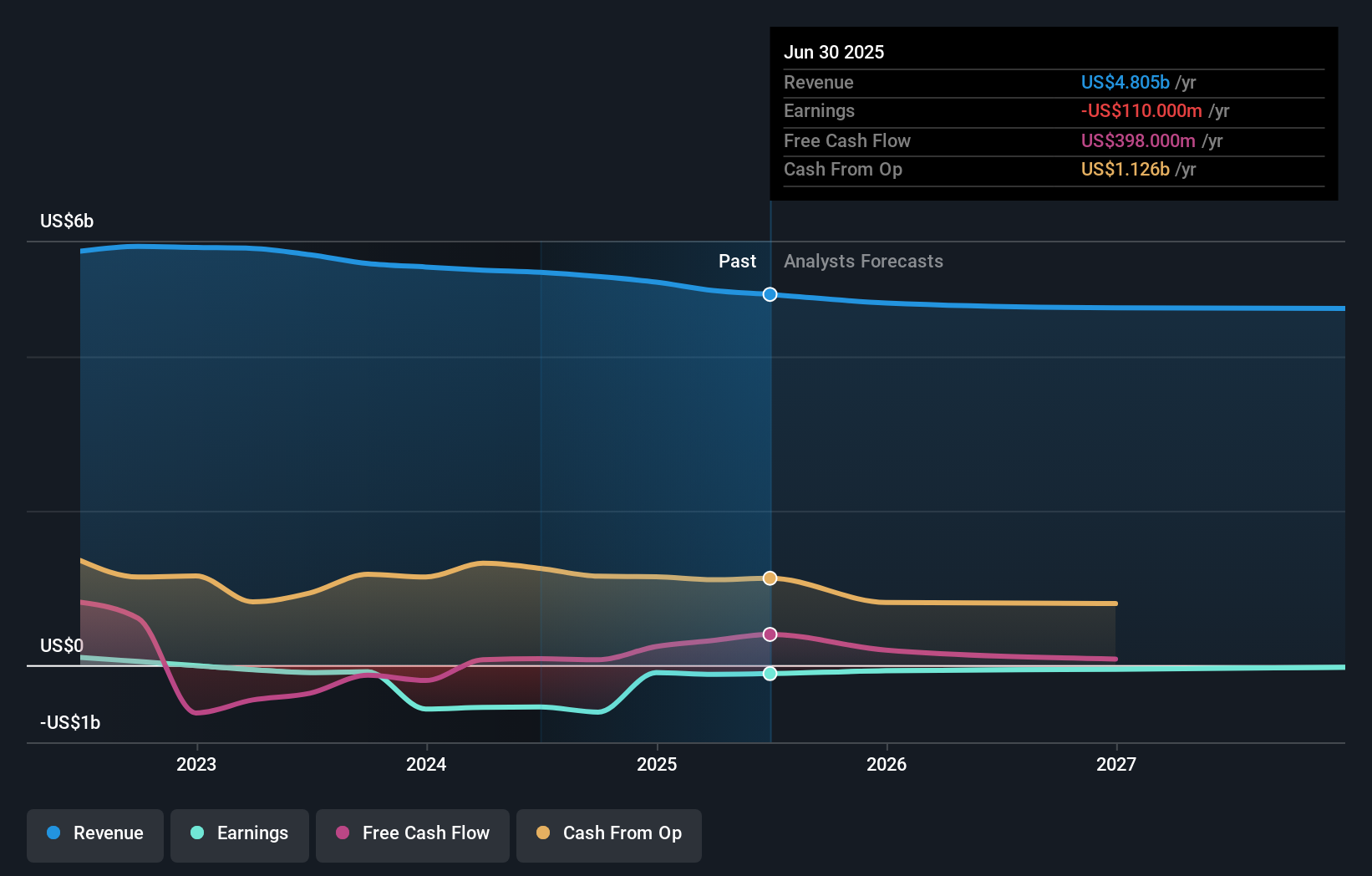

Telephone and Data Systems' narrative projects $4.7 billion revenue and $510.8 million earnings by 2028. This implies a -1.2% annual revenue decline and a $629.8 million earnings increase from -$119.0 million today.

Uncover how Telephone and Data Systems' forecasts yield a $51.00 fair value, a 33% upside to its current price.

Exploring Other Perspectives

Two members of the Simply Wall St Community estimate fair values for TDS between US$11.04 and US$51.00 per share, marking a substantial difference in outlook. These varied opinions contrast sharply with ongoing legal investigations and regulatory risks, inviting you to explore why market participants see things so differently.

Explore 2 other fair value estimates on Telephone and Data Systems - why the stock might be worth less than half the current price!

Build Your Own Telephone and Data Systems Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Telephone and Data Systems research is our analysis highlighting 1 important warning sign that could impact your investment decision.

- Our free Telephone and Data Systems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Telephone and Data Systems' overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 26 companies in the world exploring or producing it. Find the list for free.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal