Will QuidelOrtho's (QDEL) Renewed Cost Discipline Strengthen Its Long-Term Growth Story?

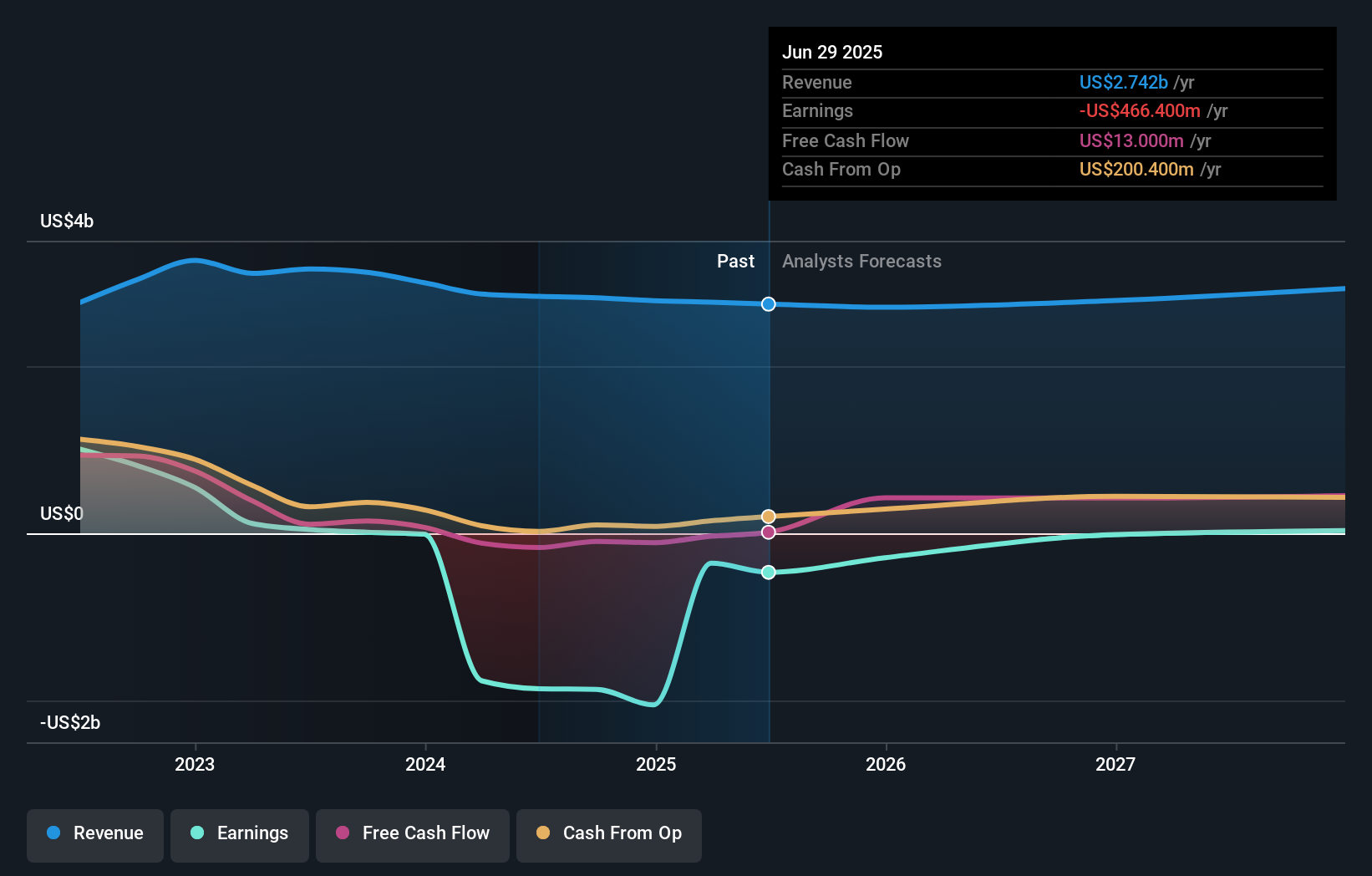

- QuidelOrtho Corporation reported its second quarter 2025 results, with sales of US$613.9 million and a net loss of US$255.4 million, and reiterated its full-year revenue guidance of US$2.60 billion to US$2.81 billion.

- Management actions, including cost controls and exiting underperforming programs, have improved operational discipline and signaled growing confidence in the company’s forward outlook despite ongoing industry challenges.

- We’ll examine how QuidelOrtho’s reaffirmed full-year guidance, amid operational changes, may influence its long-term investment narrative.

AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

QuidelOrtho Investment Narrative Recap

To be a QuidelOrtho shareholder today, you need to believe that the company’s push into international markets, portfolio streamlining, and cost containment can offset steep, ongoing COVID testing revenue declines and return the business to sustainable margin growth. While the company’s reaffirmed 2025 revenue guidance suggests ongoing operational discipline, this does little to mitigate the most important near-term risk: whether QuidelOrtho can replace lost high-margin COVID sales with new drivers quickly enough. The impact of the latest results, including another quarter of losses, does not appear to materially change the risk–catalyst balance in the short term.

Among the company’s recent announcements, the reiteration of full-year revenue guidance after Q2 results stands out as most relevant. This signals management’s confidence in ongoing cost actions and program exits, but the need to stem top-line declines remains critical. Whether these measures prove sufficient to counteract headwinds facing diagnostics demand and product mix will be central to upcoming quarters.

Yet, despite the company’s cost reductions, investors should be aware that continued volume pressure and price erosion in international markets could...

Read the full narrative on QuidelOrtho (it's free!)

QuidelOrtho's outlook anticipates $2.9 billion in revenue and $27.2 million in earnings by 2028. This implies an annual revenue growth rate of 2.4% and an earnings improvement of $493.6 million from current earnings of -$466.4 million.

Uncover how QuidelOrtho's forecasts yield a $43.14 fair value, a 77% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members estimate QuidelOrtho’s fair value from US$43.14 up to US$76.67, reflecting three distinct outlooks. Take into account that execution risk from recent integrations remains a key challenge as you weigh these varied viewpoints.

Explore 3 other fair value estimates on QuidelOrtho - why the stock might be worth just $43.14!

Build Your Own QuidelOrtho Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your QuidelOrtho research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free QuidelOrtho research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate QuidelOrtho's overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 18 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal