Does Block's Earnings Surge Despite Lower Revenue Change the Bull Case for Block (SQ)?

- Block, Inc. recently announced second quarter 2025 results showing net income of US$538.46 million, up from US$195.27 million a year earlier, even as revenue saw a slight decrease to US$6.05 billion from US$6.16 billion.

- A significant driver behind Block's performance appears to be strong improvements in earnings per share, paired with Cash App's ongoing product innovation including the new 'pools' group payment feature.

- We'll explore how Block's ability to surpass analyst earnings estimates, despite mixed revenue, could reshape its investment outlook.

Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

Block Investment Narrative Recap

To be a shareholder in Block, Inc., you need to believe in the company’s ability to drive sustainable profit growth by expanding its digital payments ecosystem and delivering successful product innovations, especially through Cash App and Square. The recent earnings beat, with net income and earnings per share rising significantly, despite a slight dip in revenue, strengthens short-term confidence but does not materially alter the core risk: ongoing regulatory uncertainty facing Cash App and other fintech offerings.

Of the recent announcements, the launch of the Cash App Pools group payment feature stands out as closely linked to these results. This tool could help Cash App deepen user engagement, an important catalyst for Block as it works to offset potential revenue headwinds and meet growth targets set out by its ecosystem expansion strategy.

Yet, in contrast to the positive headlines, investors should be aware of the persistent compliance and regulatory risks that...

Read the full narrative on Block (it's free!)

Block's outlook anticipates $32.6 billion in revenue and $2.5 billion in earnings by 2028. This is based on an assumed annual revenue growth rate of 11.0% and represents a $1.4 billion increase in earnings from the current $1.1 billion.

Uncover how Block's forecasts yield a $75.72 fair value, in line with its current price.

Exploring Other Perspectives

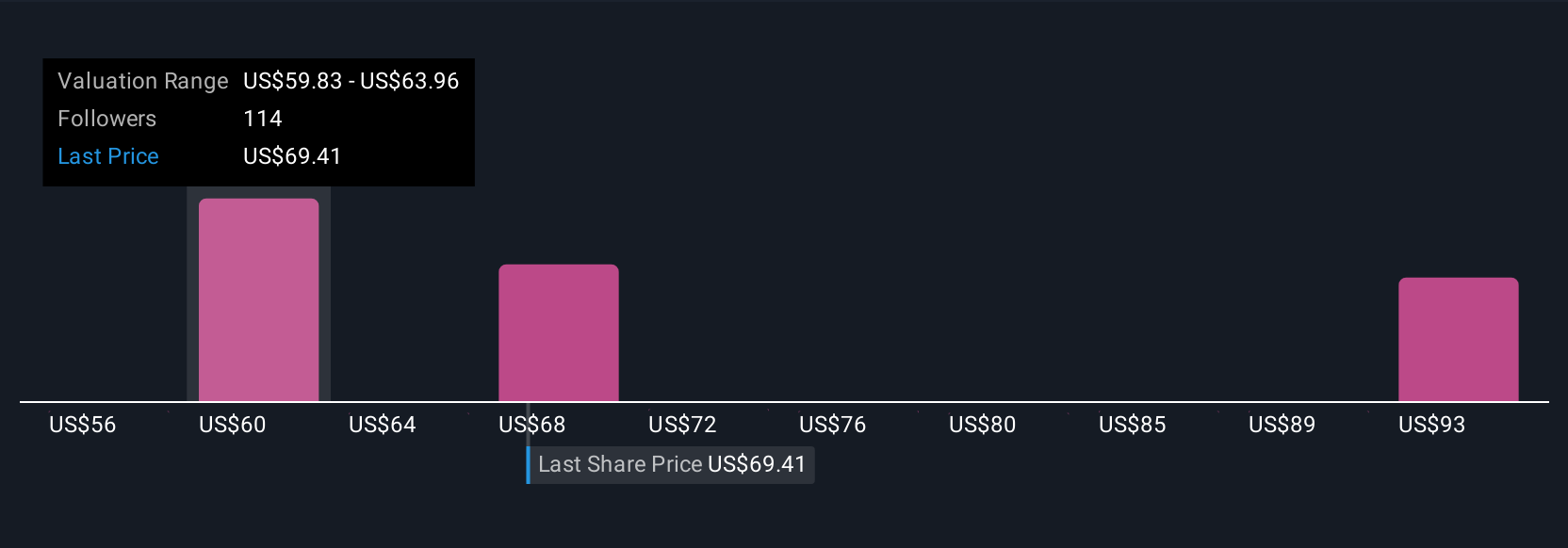

Simply Wall St Community members estimate Block’s fair value between US$60.37 and US$100.22 across 14 different views, highlighting wide divergence in expectations. While some see growth potential from new Cash App features, recurring regulatory risks could have broader implications for future profitability and strategy; explore how these community perspectives stack up against recent developments.

Explore 14 other fair value estimates on Block - why the stock might be worth 21% less than the current price!

Build Your Own Block Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Block research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Block research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Block's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal