How Investors May Respond To Celestica (TSX:CLS) Strong Earnings and Launch of AI-Focused Storage Controller

- In the past week, Celestica introduced the SC6110, a high-performance, all-flash storage controller targeting enterprise applications such as AI infrastructure and high-performance computing, and reported significantly higher second-quarter sales and net income compared to the previous year.

- The company also raised its full-year revenue outlook, saw a new technology-focused board member join, and resumed share repurchases, pointing to growing confidence in its operations and prospects.

- We'll examine how Celestica's stronger earnings and enterprise product launch reinforce the company's position in the evolving AI and data infrastructure market.

These 19 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Celestica Investment Narrative Recap

If you own Celestica, you’re betting on robust, sustained demand for AI and cloud infrastructure, fueled by hyperscalers and digital transformation in enterprise IT. The launch of the SC6110 and strong second-quarter results underscore near-term momentum, but the company remains heavily reliant on a small group of large customers, meaning any reduction in orders or slower capex from these hyperscalers remains the most important short-term catalyst and risk. For now, the recent product news and raised full-year guidance only strengthen this central narrative. Among all of Celestica’s recent moves, the updated full-year revenue outlook stands out. Management increased full-year guidance to US$11.55 billion from US$10.85 billion, reflecting confidence in current demand trends for both data infrastructure and AI-related product lines, a key point for any investor watching for revenue growth catalysts. However, investors should be aware that even with new enterprise product momentum, concentration among top customers could still pose…

Read the full narrative on Celestica (it's free!)

Celestica's outlook calls for $15.7 billion in revenue and $817.8 million in earnings by 2028. This is based on analysts assuming 13.9% annual revenue growth and a $279.4 million earnings increase from the current $538.4 million.

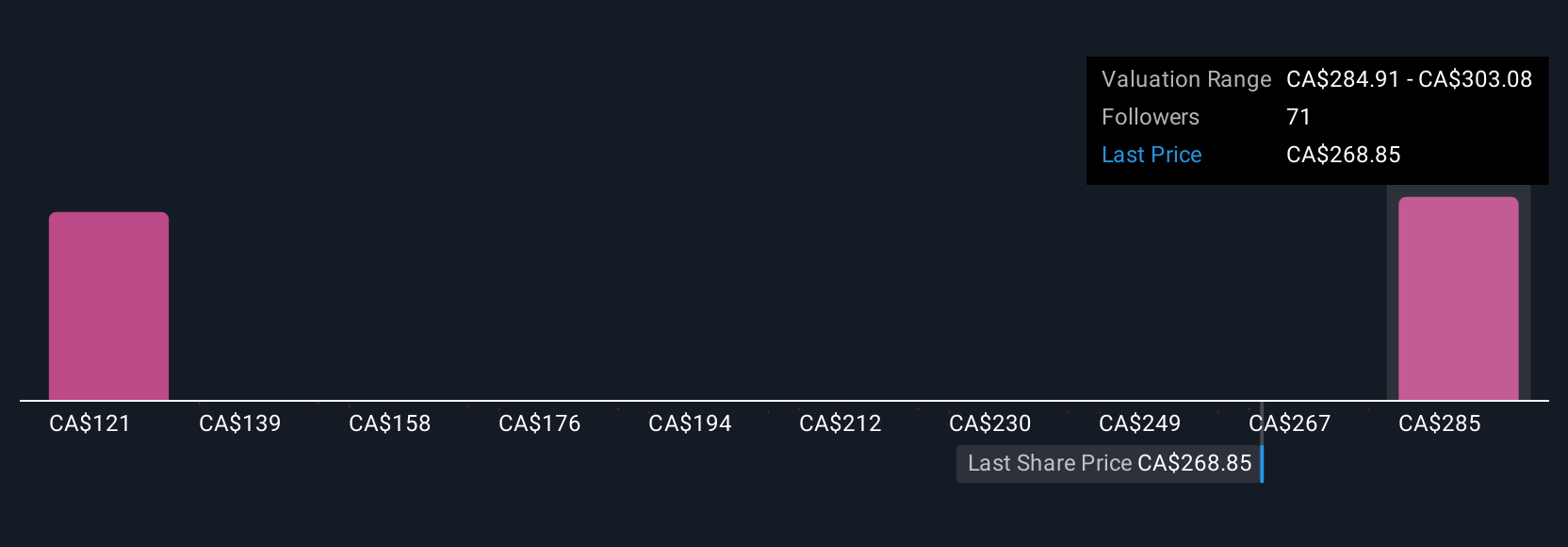

Uncover how Celestica's forecasts yield a CA$303.08 fair value, a 11% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have published 12 fair value estimates for Celestica, ranging widely from US$121.31 to US$303.08. This breadth of opinion exists as hyperscaler-driven demand ramps up, inviting you to explore how differing views interpret both opportunity and risk.

Explore 12 other fair value estimates on Celestica - why the stock might be worth as much as 11% more than the current price!

Build Your Own Celestica Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Celestica research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Celestica research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Celestica's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal