Why Are Analysts Growing More Bullish on BridgeBio Pharma (BBIO) Ahead of Q2 2025 Earnings?

- BridgeBio Pharma recently announced it would report its Q2 2025 results after market close on August 5, 2025, with an earnings call scheduled for the same day.

- Recent increases in revenue and earnings estimates, along with a favorable brokerage outlook, highlight shifting expectations for BridgeBio Pharma's future performance.

- We'll examine how analyst optimism surrounding improved earnings and revenue forecasts shapes BridgeBio Pharma's current investment narrative.

The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is BridgeBio Pharma's Investment Narrative?

For someone considering BridgeBio Pharma, the essential story revolves around belief in the company's ability to convert its strong pipeline, highlighted by advances like acoramidis and infigratinib, into commercial success. The recent news of increased analyst estimates and a favorable brokerage outlook coupled with a steady climb in share price emphasizes shifting sentiment, but doesn't fundamentally alter the immediate catalysts or risks. Short-term attention remains fixed on regulatory decisions for key drug candidates and tangible progress toward profitability. The pressure is on to sustain revenue growth after recent volatility, particularly following a sharp drop between Q1 2024 and Q1 2025. While losses are expected to shrink and revenue forecasts appear optimistic, the company’s negative equity and lack of dividends mean operational execution and capital management will be under close scrutiny once Q2 results are out. Investor focus should remain on trial outcomes and regulatory milestones, as these continue to drive the major investment narrative well beyond this earnings call.

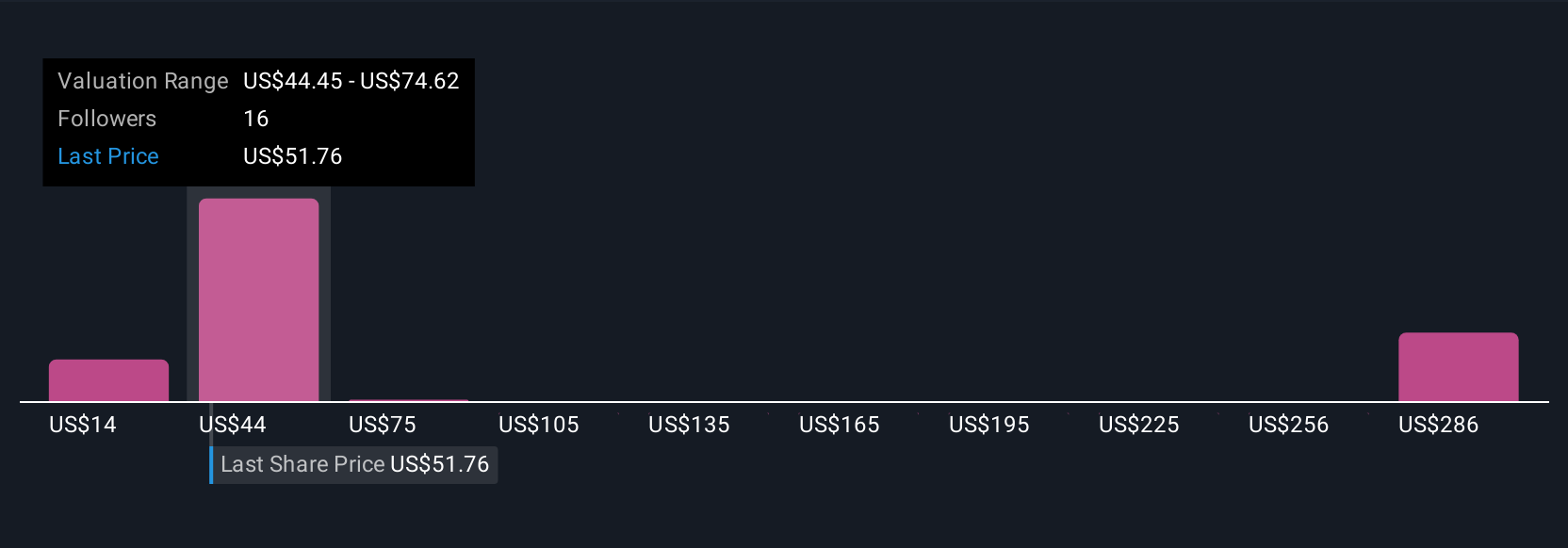

But with continued losses and negative equity, capital risk remains a key detail investors should not overlook. BridgeBio Pharma's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 4 other fair value estimates on BridgeBio Pharma - why the stock might be worth less than half the current price!

Build Your Own BridgeBio Pharma Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BridgeBio Pharma research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free BridgeBio Pharma research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BridgeBio Pharma's overall financial health at a glance.

Interested In Other Possibilities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal