Rocket Companies (RKT) Is Up 18.6% After Beating Q2 Forecasts and Closing Redfin Deal Has AI Focus Shifted?

- Rocket Companies recently reported second-quarter 2025 results, surpassing analyst revenue forecasts with US$1.34 billion in sales, completed its Redfin acquisition, and raised guidance for the next quarter.

- One unique takeaway is how Rocket continues to leverage technology and successful integrations across its ecosystem to improve loan origination volume and operational efficiency, even amid mixed servicing income results.

- We'll now explore how these strong financial results and Redfin integration impact Rocket Companies’ long-term investment narrative and AI-driven growth focus.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Rocket Companies Investment Narrative Recap

To own Rocket Companies stock, you need to believe that technology-driven efficiency, expanding market share, and scalable acquisitions like Redfin and Mr. Cooper can translate to long-term earnings growth, even if short-term profitability is uneven. The company’s recent earnings beat and revenue outlook may support confidence in AI and integration efforts as the key near-term catalyst, but ongoing net losses and high debt levels remain the central business risks. These results do not materially change the fundamental risk of continued unprofitability given Rocket's ongoing investment cycle.

Among Rocket’s recent updates, the completed Redfin acquisition is the most relevant, as it offers immediate synergies with the core mortgage business, bolstering the short-term catalyst of origination growth and digital adoption. This integration, if managed well, could accelerate client funnel expansion and tech-driven cross-selling, yet will require sustained execution to counteract current margin pressure and offset revenue volatility.

Yet, investors should not overlook that, despite growing sales and expanding technology, the company’s persistent net losses mean ...

Read the full narrative on Rocket Companies (it's free!)

Rocket Companies' outlook anticipates $8.2 billion in revenue and $1.2 billion in earnings by 2028. This scenario assumes 17.5% annual revenue growth and an increase in earnings of about $1.197 billion from the current $2.8 million.

Uncover how Rocket Companies' forecasts yield a $14.55 fair value, a 19% downside to its current price.

Exploring Other Perspectives

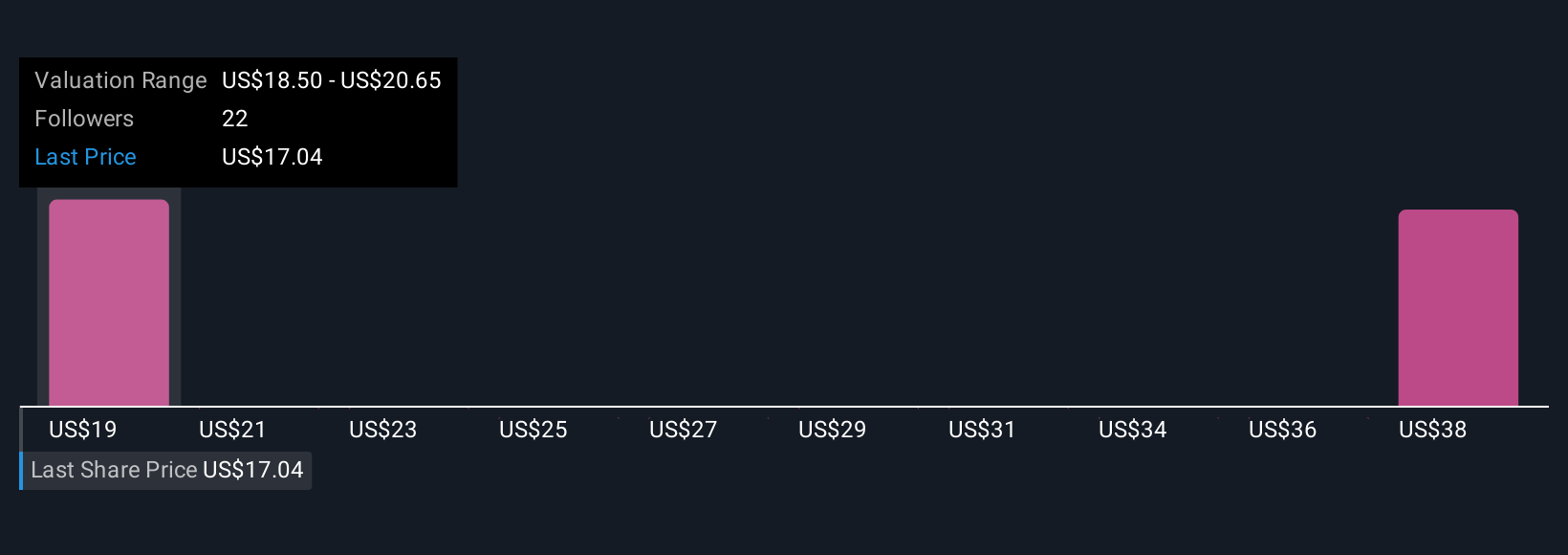

Six members of the Simply Wall St Community value Rocket Companies anywhere from US$7.60 to US$621.33 per share. With earnings still in negative territory, opinions remain split on whether technology investments will justify higher valuations.

Explore 6 other fair value estimates on Rocket Companies - why the stock might be a potential multi-bagger!

Build Your Own Rocket Companies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Rocket Companies research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Rocket Companies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Rocket Companies' overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal