Can Globant's (GLOB) AI Platform Upgrade Deepen Its Competitive Moat in Enterprise Technology?

- On July 31, 2025, Globant announced a major upgrade to its proprietary AI platform, Globant Enterprise AI (GEAI), enabling full interoperability with leading frameworks and seamless integration of enterprise AI agents and tools.

- This update empowers organizations to modernize legacy systems and cut software development costs, reinforcing Globant's influence in advanced enterprise AI infrastructure.

- We'll assess how GEAI’s expanded interoperability and automation capabilities may strengthen Globant's long-term investment narrative.

AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Globant Investment Narrative Recap

To be a Globant shareholder, you need to believe that the company's foundational bets on AI-driven enterprise software and integration technologies will drive substantial operational efficiencies for clients, increasing both revenue and margin potential over time. The recent GEAI upgrade positions Globant more strongly as a provider of next-generation AI infrastructure, but in the short term, addressing margin pressures amid competitive project pricing remains the most immediate challenge, while exposure to large client concentration risk persists and is unchanged by this update.

Among recent corporate events, the resignation of Globant’s Chief Operating Officer and redistribution of her responsibilities stands out, especially given the timing alongside such a major platform release. While this organizational adjustment is unlikely to immediately impact Globant’s rapid innovation cycle, investors may watch how leadership continuity aligns with the company’s ability to capture short-term catalysts created by new AI product rollouts.

Yet, despite operational momentum, investors should be aware that pressure on margins amid intense industry competition...

Read the full narrative on Globant (it's free!)

Globant's outlook anticipates $2.9 billion in revenue and $273.7 million in earnings by 2028. This scenario assumes a 5.9% annual revenue growth rate and an increase in earnings of $122.4 million from the current $151.3 million.

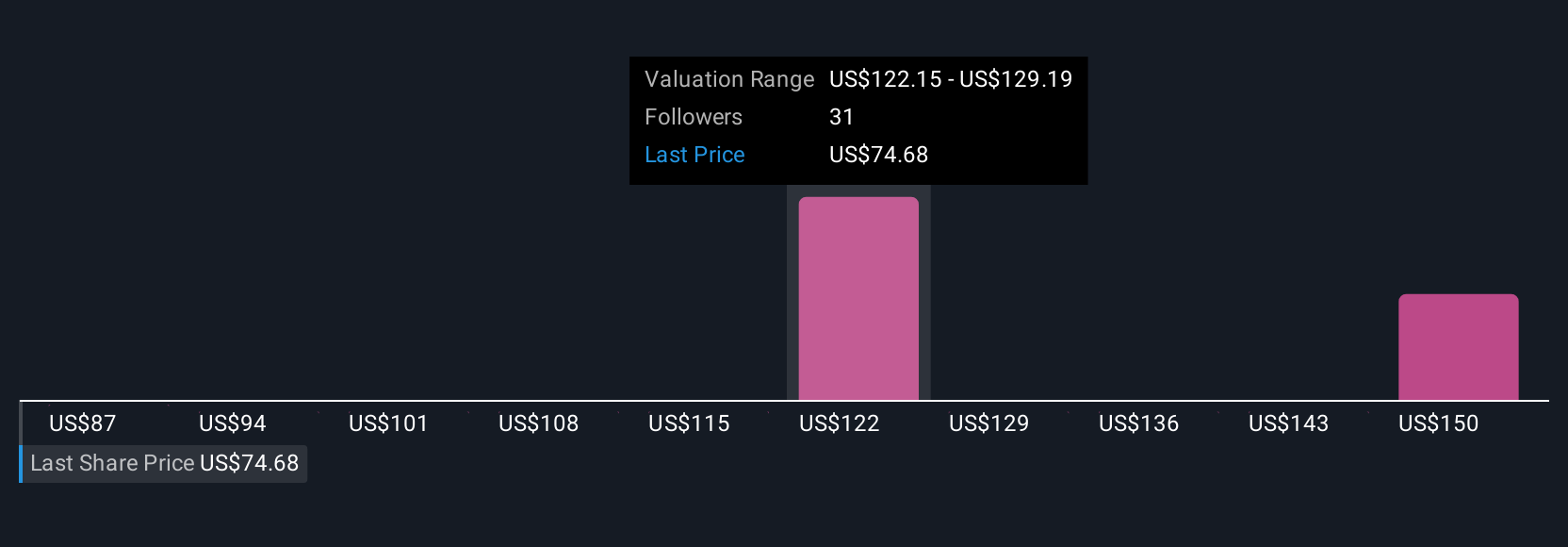

Uncover how Globant's forecasts yield a $127.29 fair value, a 60% upside to its current price.

Exploring Other Perspectives

Three Simply Wall St Community members placed Globant’s fair value between US$87 and US$160.92 per share. While the GEAI upgrade aims to spur more efficient AI deployments, keep in mind that market participants still weigh pricing pressures and margin headwinds when forming their expectations, your own outlook can add to this mix.

Explore 3 other fair value estimates on Globant - why the stock might be worth just $87.00!

Build Your Own Globant Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Globant research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Globant research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Globant's overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 19 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal