Maximus (MMS) Is Up 6.0% After Winning $77 Million Air Force Cybersecurity Contract – What's Changed

- In late July 2025, Maximus announced it had secured a new US$77 million contract from the United States Air Force Life Cycle Management Center's Cryptologic and Cyber Systems Division to provide cybersecurity, cloud-based services, and engineering support, with performance spread across a potential five-and-a-half-year term.

- This award highlights Maximus’s expanding position as a federal technology supplier as the Department of Defense seeks robust and adaptable cybersecurity solutions across multiple domains.

- We'll explore how this new Air Force contract adds momentum to Maximus's investment narrative, particularly its technology modernization and government partnership strengths.

AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Maximus Investment Narrative Recap

Maximus appeals to investors who believe in the ongoing digitization and modernization of government services, with federal technology contracts driving near-term opportunities. The recent US$77 million Air Force deal reinforces Maximus’s position in federal tech, but given the company’s reliance on government clients, the biggest catalysts remain securing and maintaining large-scale contracts, while the greatest risk continues to be policy changes and potential budget constraints; this new contract adds support but does not materially reduce exposure to those risks.

The most relevant recent announcement is the re-award of Medical Disability Exam contracts in January 2025, ensuring continued revenue from a core government partnership. Securing major contracts in different federal domains, like the Air Force cybersecurity award, adds to the momentum but does not eliminate the underlying challenges facing all government service providers.

However, while these wins are encouraging, investors should stay alert to the possibility of future procurement delays or shifting government priorities that could ...

Read the full narrative on Maximus (it's free!)

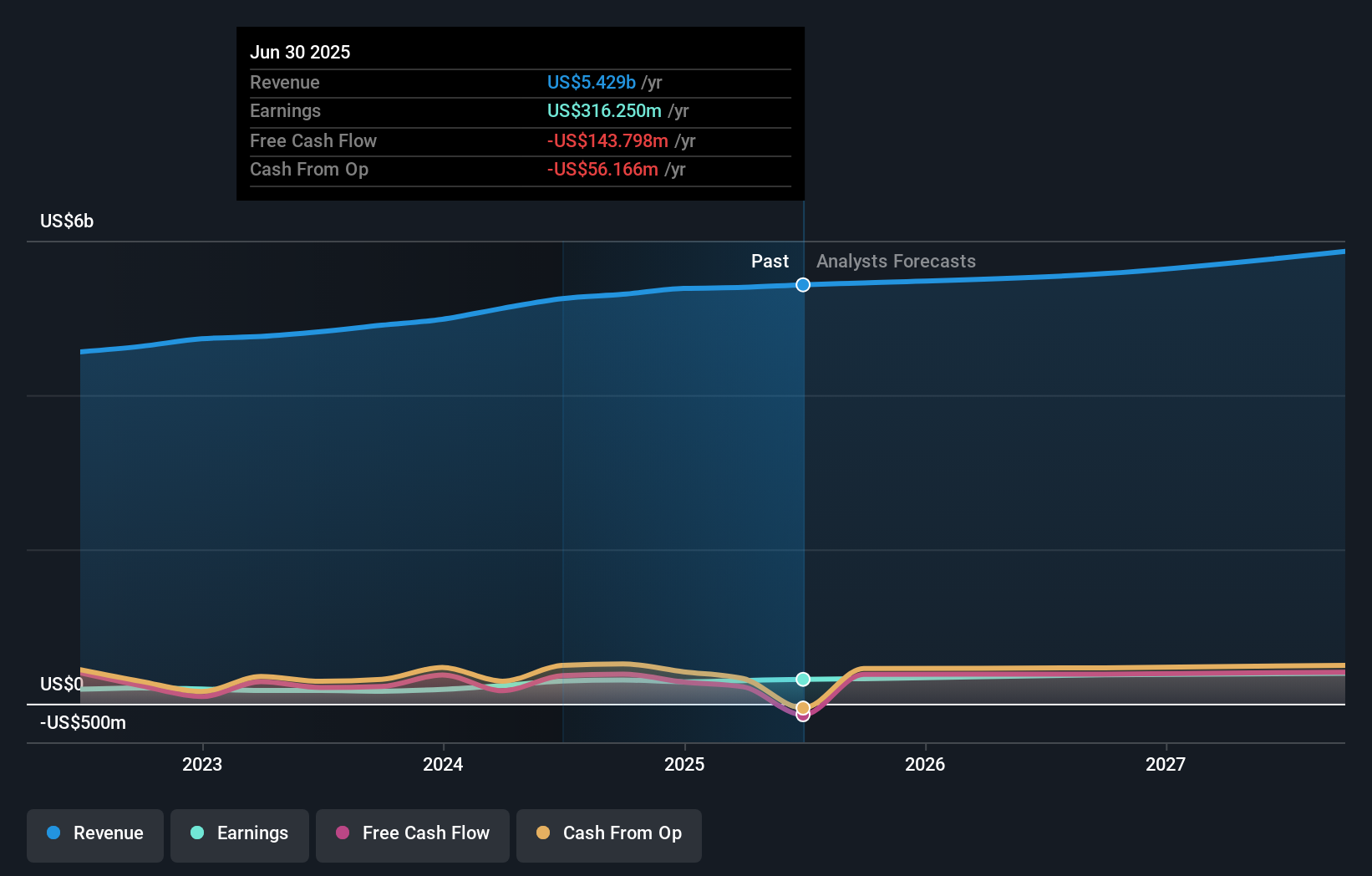

Maximus' outlook projects $5.7 billion in revenue and $342.6 million in earnings by 2028. This is based on a 1.7% annual revenue growth rate and a $42.6 million increase in earnings from the current $300.0 million.

Uncover how Maximus' forecasts yield a $103.00 fair value, a 35% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided two fair value estimates for Maximus, spanning from US$69.05 to US$103 per share. With perspectives this broad, it’s clear opinions differ especially as government contract risks remain front of mind for many watching the company’s revenue streams.

Explore 2 other fair value estimates on Maximus - why the stock might be worth as much as 35% more than the current price!

Build Your Own Maximus Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Maximus research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Maximus research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Maximus' overall financial health at a glance.

Seeking Other Investments?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal