What GE Vernova (GEV)'s Rising Revenue and Declining Profit Reveal About Its Capital Return Strategy

- GE Vernova reported its second quarter and first half 2025 earnings, highlighting year-over-year revenue growth to US$9.11 billion for the quarter and US$17.14 billion for the half, alongside a decrease in net income and earnings per share compared to the prior year.

- Alongside its earnings, the company completed a significant share repurchase tranche, retiring 1.88% of shares for US$1.59 billion, indicating active capital return to shareholders amid mixed profitability trends.

- We'll explore how the profit decline despite higher revenues and share buyback influences GE Vernova's investment narrative going forward.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 25 companies in the world exploring or producing it. Find the list for free.

GE Vernova Investment Narrative Recap

To be a GE Vernova shareholder today, you need to believe in the company’s potential to capitalize on global electrification and grid modernization, leveraging a growing installed base and demand for clean energy infrastructure. The most recent earnings update, higher revenues but declining profitability, does not materially shift the core catalyst of expanding high-margin grid and turbine orders, but it does keep pressure on near-term margin improvement. Meanwhile, persistent weakness in the Wind segment stands out as a major short-term risk and remains unresolved by recent news.

The recently completed buyback tranche, retiring nearly 2% of shares for US$1.59 billion, emphasizes management’s commitment to capital returns even as headline profit and EPS fell this quarter. While repurchases can support per-share metrics and signal confidence, the long-term upside is more closely tied to resolving Wind segment challenges and securing consistent service revenue from GE Vernova’s outsized backlog.

However, despite the upbeat top-line trend, investors should be aware of the risk that continued wind losses and project uncertainty could...

Read the full narrative on GE Vernova (it's free!)

GE Vernova's outlook projects $47.6 billion in revenue and $5.6 billion in earnings by 2028. This assumes annual revenue growth of 9.2% and a $4.4 billion increase in earnings from the current $1.2 billion.

Uncover how GE Vernova's forecasts yield a $631.95 fair value, a 5% downside to its current price.

Exploring Other Perspectives

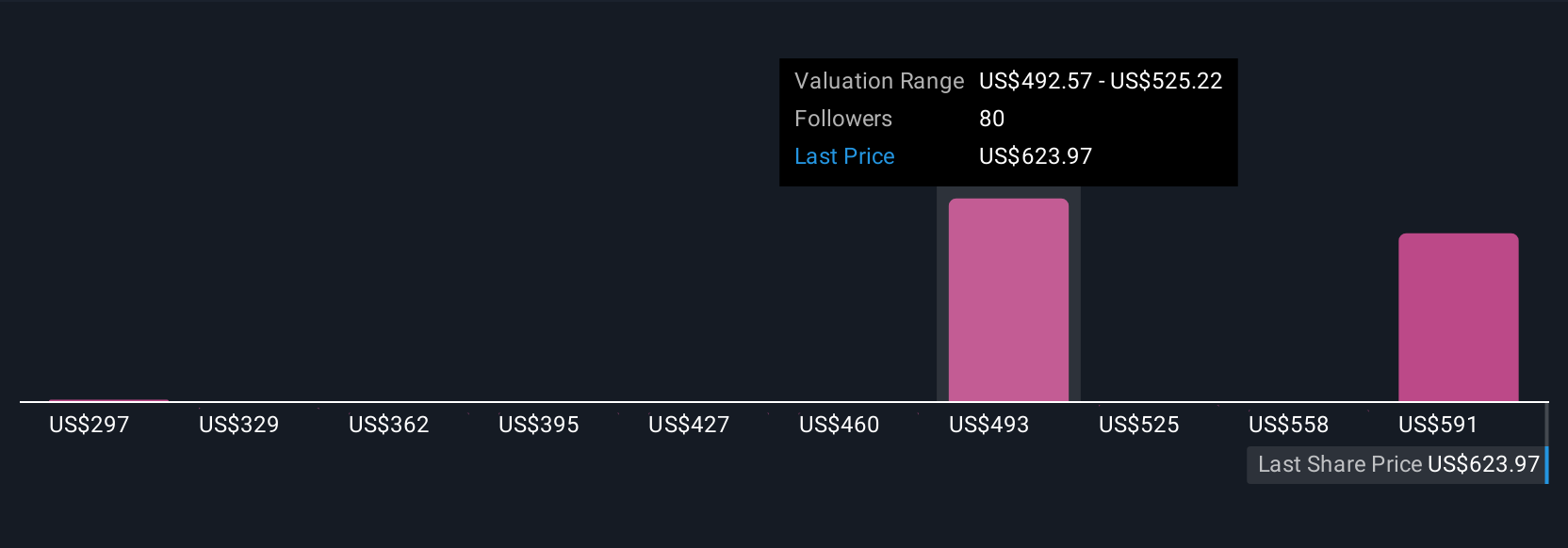

Fifteen member estimates from the Simply Wall St Community put GE Vernova’s fair value anywhere between US$296,688 and US$693,027. While views vary, many are weighing ongoing headwinds in the Wind segment that continue to shape expectations for future profits and overall company stability.

Explore 15 other fair value estimates on GE Vernova - why the stock might be worth as much as $693.03!

Build Your Own GE Vernova Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your GE Vernova research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free GE Vernova research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate GE Vernova's overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal