The Bull Case for Kaspi.kz (KSPI) Could Change Following Reaffirmed 2025 Net Income Growth Guidance

- Kaspi.kz recently reported second quarter revenue of KZT967.50 billion, exceeding analyst forecasts and leading management to reiterate its 2025 guidance for around 15% net income growth year-over-year, excluding Türkiye.

- This underscores Kaspi.kz's continued momentum in core markets as it balances expansion and innovation with sustained profitability targets.

- We'll explore how Kaspi.kz's reaffirmed 2025 earnings guidance impacts its investment case, particularly around continued revenue and net income growth.

These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Kaspi.kz Investment Narrative Recap

To be a Kaspi.kz shareholder, it's crucial to believe in the company's ability to keep driving robust revenue and net income growth while maintaining a strong foothold as Kazakhstan's dominant payments and fintech ecosystem. The recent Q2 earnings beat and reaffirmed 2025 guidance reinforce optimism around short-term growth, but the most important catalyst, execution of new merchant product rollouts, remains unchanged. The largest risk continues to be regulatory unpredictability in Kazakhstan, which was not materially impacted by this latest update.

The Q2 earnings release, which showed revenue of KZT967.50 billion exceeding analyst estimates, is the most relevant announcement, as it provides quantitative support for management's confidence in its 2025 guidance. This result is particularly timely amid ongoing efforts to deepen merchant product penetration and expand into higher frequency retail segments, both of which underpin Kaspi.kz’s growth narrative.

However, investors should also be aware that, despite this momentum, regulatory shifts in Kazakhstan could...

Read the full narrative on Kaspi.kz (it's free!)

Kaspi.kz's narrative projects KZT 4,842.3 billion revenue and KZT 1,782.7 billion earnings by 2028. This requires 20.0% yearly revenue growth and a KZT 710.5 billion earnings increase from the current earnings of KZT 1,072.2 billion.

Uncover how Kaspi.kz's forecasts yield a $113.38 fair value, a 31% upside to its current price.

Exploring Other Perspectives

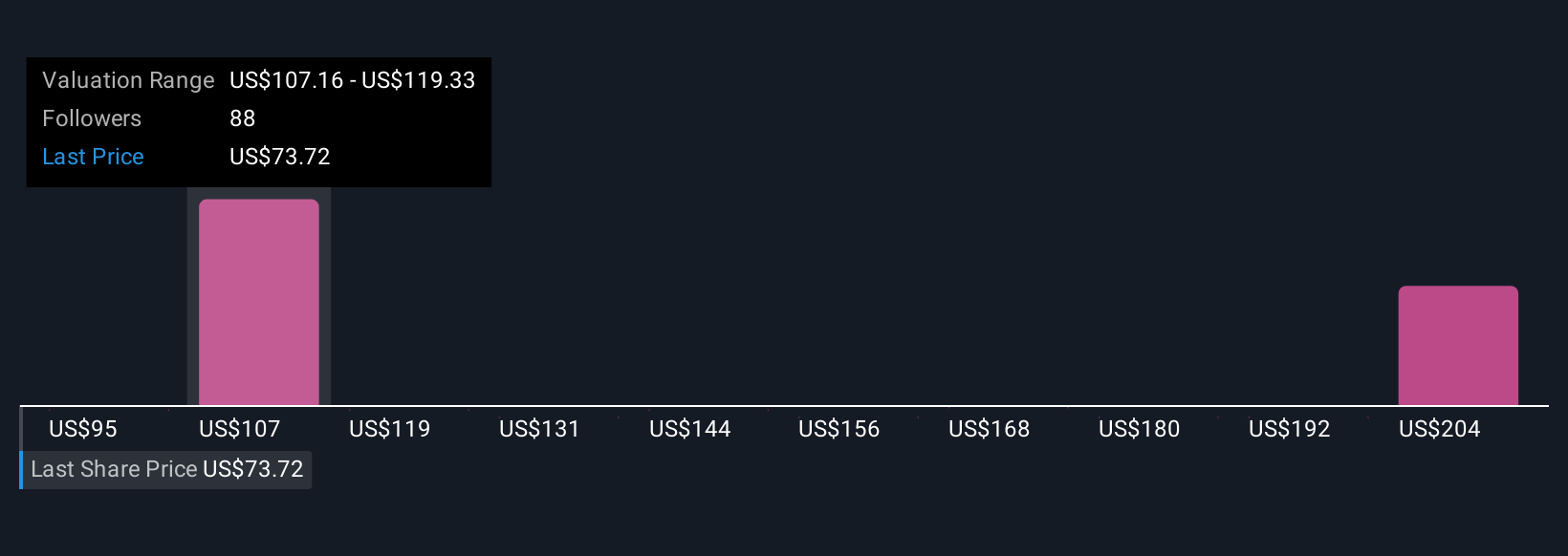

Fifteen fair value estimates from the Simply Wall St Community range from KZT95.00 to KZT214.97 per share. As excitement over management’s commitment to net income growth continues, opinions on future regulatory shifts may drive further discussion about Kaspi.kz’s trajectory.

Explore 15 other fair value estimates on Kaspi.kz - why the stock might be worth just $95.00!

Build Your Own Kaspi.kz Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kaspi.kz research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Kaspi.kz research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kaspi.kz's overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal