Pipeline Milestones and Setbacks Could Be a Game Changer for Vertex Pharmaceuticals (VRTX)

- Vertex Pharmaceuticals recently announced second quarter results, revealing a return to profitability with net income of US$1.03 billion on revenue of US$2.96 billion, and confirmed its full-year 2025 revenue guidance between US$11.85 billion and US$12 billion.

- The company also received Health Canada approval for ALYFTREK in cystic fibrosis while discontinuing VX-993 monotherapy in acute pain after a Phase 2 trial miss, reflecting both progress and challenges in its therapeutic pipeline.

- We'll explore how recent pipeline developments, particularly the discontinuation of VX-993 in acute pain, may impact Vertex's investment narrative.

The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Vertex Pharmaceuticals Investment Narrative Recap

Investors in Vertex Pharmaceuticals usually share a belief in the company's ability to diversify beyond cystic fibrosis and deliver continued growth through new approvals and pipeline advancement. This quarter’s return to profitability and confirmation of full-year guidance reinforce that outlook. While the discontinuation of VX-993 in acute pain was a setback, it does not materially alter the most important near-term catalyst: the continued global rollout and uptake of ALYFTREK in cystic fibrosis. The biggest risk remains executional challenges in launching new products and controlling rising expenses, particularly given pressure on net margins.

Among recent announcements, Health Canada’s approval of ALYFTREK stands out as especially relevant. This once-daily CFTR modulator expands Vertex’s patient reach in cystic fibrosis and offers convenience benefits that could further support adoption, closely tying into the primary investment thesis. The discontinuation of VX-993, although disappointing, was not flagged as a key risk in short-term analyst outlooks, and its impact is limited when compared to the progress demonstrated with CF therapies like ALYFTREK and long-term studies of PrCASGEVY.

By contrast, investors should also be aware that should payer negotiations for new CF drugs like ALYFTREK prove more challenging than anticipated...

Read the full narrative on Vertex Pharmaceuticals (it's free!)

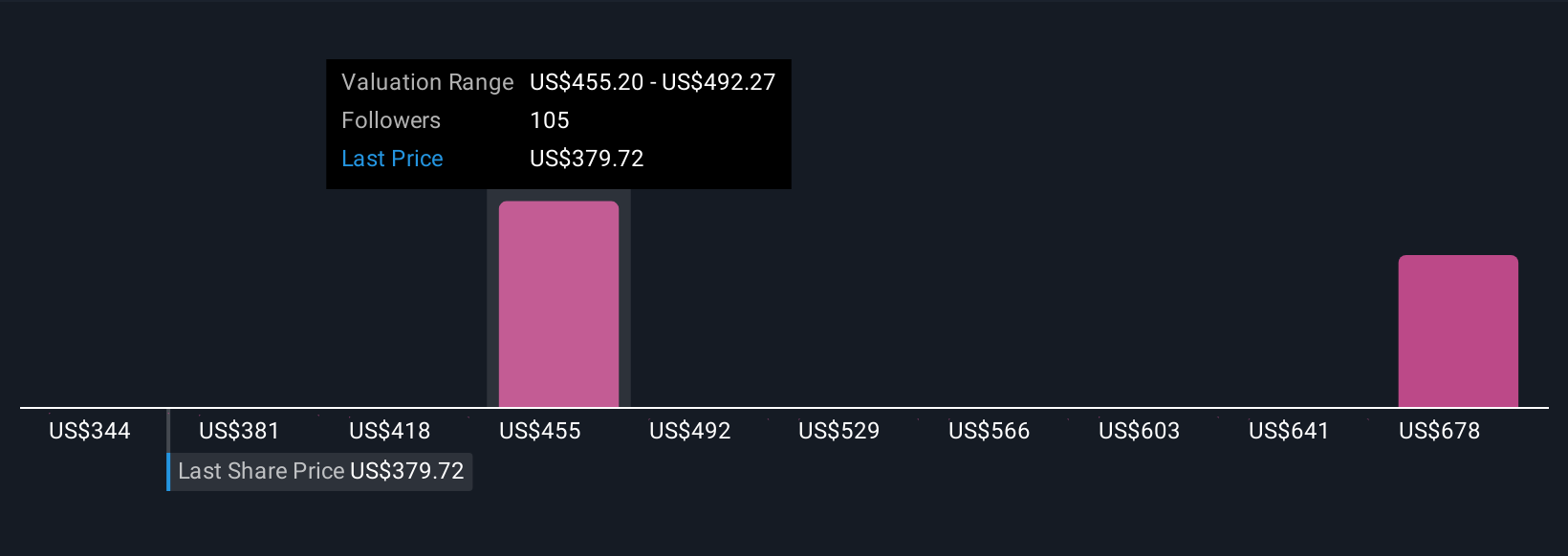

Vertex Pharmaceuticals' outlook projects $14.7 billion in revenue and $5.4 billion in earnings by 2028. This implies a 9.8% annual revenue growth rate and an earnings increase of about $6.4 billion from current earnings of -$988.9 million.

Uncover how Vertex Pharmaceuticals' forecasts yield a $505.19 fair value, a 7% upside to its current price.

Exploring Other Perspectives

Some of the highest analyst estimates were forecasting Vertex’s revenue to rise 15.0 percent a year and see earnings near US$9.0 billion by 2028. These outlooks are much more optimistic, especially around pipeline expansion outside CF and boosted profitability as more patients transition to lower-royalty drugs. Analyst opinions can vary considerably, so it is important to compare these bullish expectations with the latest developments for a fuller understanding.

Explore 8 other fair value estimates on Vertex Pharmaceuticals - why the stock might be worth 23% less than the current price!

Build Your Own Vertex Pharmaceuticals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Vertex Pharmaceuticals research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Vertex Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Vertex Pharmaceuticals' overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 25 companies in the world exploring or producing it. Find the list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal