James Halstead And 2 Other Leading UK Dividend Stocks

As the United Kingdom's FTSE 100 index faces headwinds from weak global cues and disappointing trade data from China, investors are increasingly looking for stability in dividend stocks. In such a volatile environment, companies with a strong track record of consistent dividend payouts can offer a measure of reliability and income potential amidst broader market uncertainties.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| WPP (LSE:WPP) | 9.81% | ★★★★★★ |

| Treatt (LSE:TET) | 4.02% | ★★★★★☆ |

| Pets at Home Group (LSE:PETS) | 5.78% | ★★★★★★ |

| OSB Group (LSE:OSB) | 6.01% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 5.00% | ★★★★★☆ |

| MONY Group (LSE:MONY) | 6.26% | ★★★★★★ |

| Keller Group (LSE:KLR) | 3.77% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 4.15% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 6.52% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 4.78% | ★★★★★☆ |

Click here to see the full list of 57 stocks from our Top UK Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

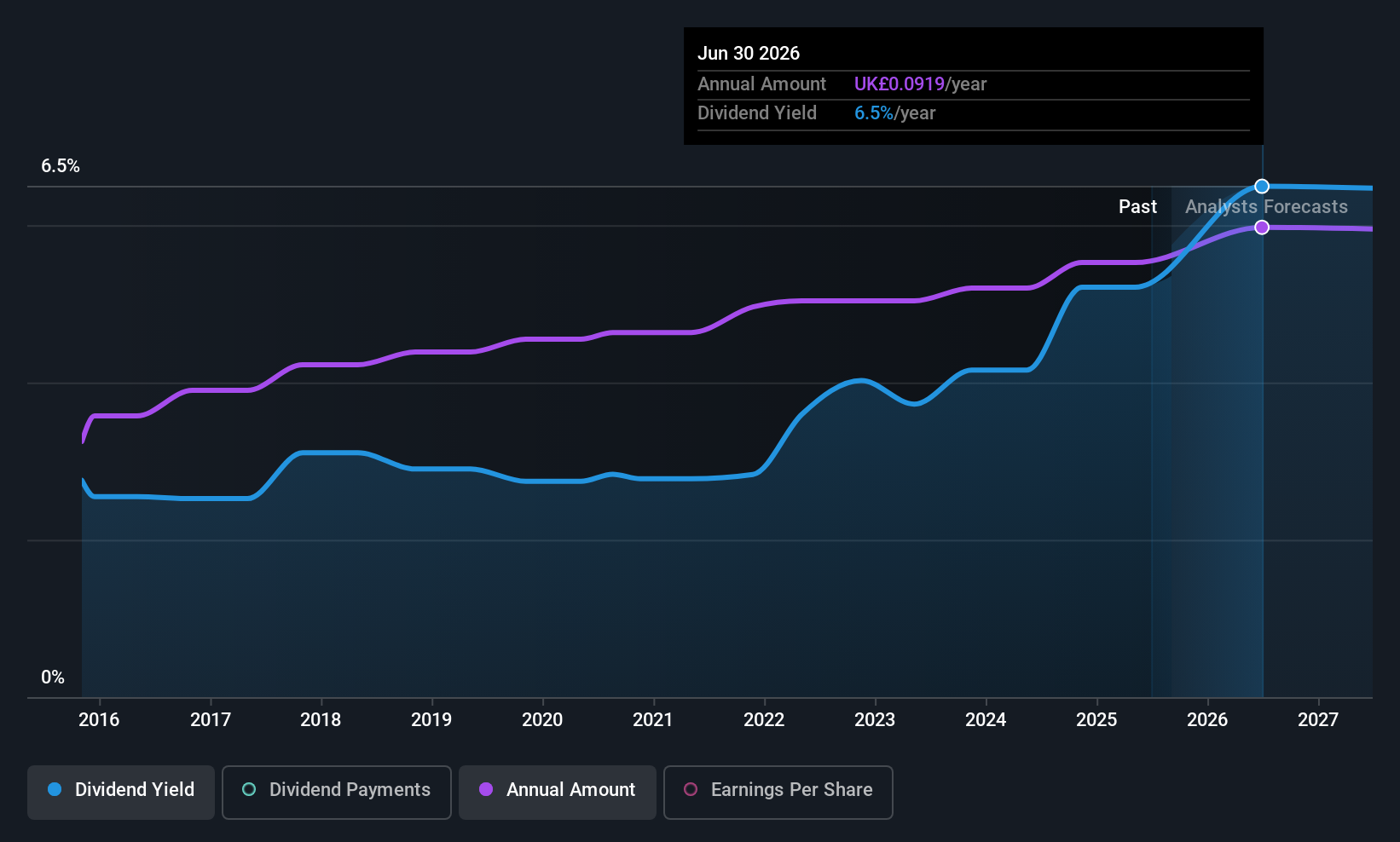

James Halstead (AIM:JHD)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: James Halstead plc manufactures and supplies flooring products for both commercial and domestic markets across the UK, Europe, Scandinavia, Australasia, Asia, and other international regions with a market cap of £616.84 million.

Operations: The company's revenue is primarily generated from the manufacture and distribution of flooring products, totaling £268.52 million.

Dividend Yield: 5.7%

James Halstead offers a dividend yield of 5.74%, placing it among the top 25% of UK dividend payers. The company's dividends have been reliable and growing over the past decade, although they are not well covered by free cash flow, with a high cash payout ratio of 95%. Despite trading at a discount to its estimated fair value, the sustainability of its dividends is questionable due to insufficient coverage by earnings and cash flows. Recent guidance suggests stable financial health with strong reserves supporting an ungeared balance sheet.

- Take a closer look at James Halstead's potential here in our dividend report.

- Our expertly prepared valuation report James Halstead implies its share price may be lower than expected.

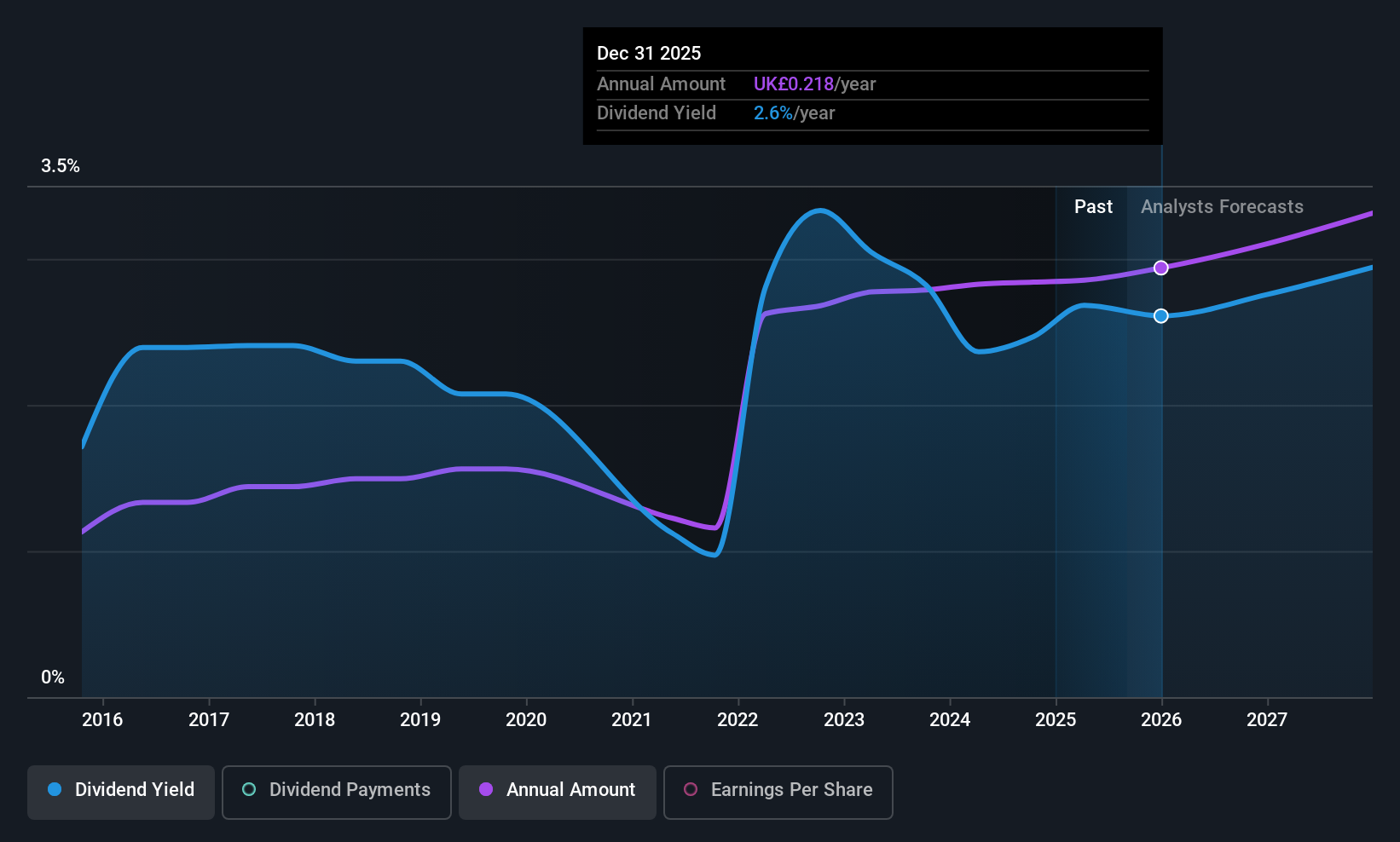

Howden Joinery Group (LSE:HWDN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Howden Joinery Group Plc supplies kitchen, joinery, and hardware products across the United Kingdom, France, Belgium, and the Republic of Ireland with a market cap of £4.66 billion.

Operations: The Howden Joinery Group generates revenue primarily through its Howden Joinery segment, which accounted for £2.32 billion.

Dividend Yield: 3.1%

Howden Joinery Group's dividends have been volatile over the past decade, though recent increases reflect a positive trend. The dividend yield of 3.07% is modest compared to top UK payers, but dividends are well covered by both earnings and cash flows with payout ratios of 46.5% and 51.5%, respectively. Recent interim dividend growth to 5 pence per share indicates cautious optimism despite historical instability, supported by solid earnings growth and improved sales figures reaching £997.6 million in H1 2025.

- Get an in-depth perspective on Howden Joinery Group's performance by reading our dividend report here.

- Our valuation report here indicates Howden Joinery Group may be undervalued.

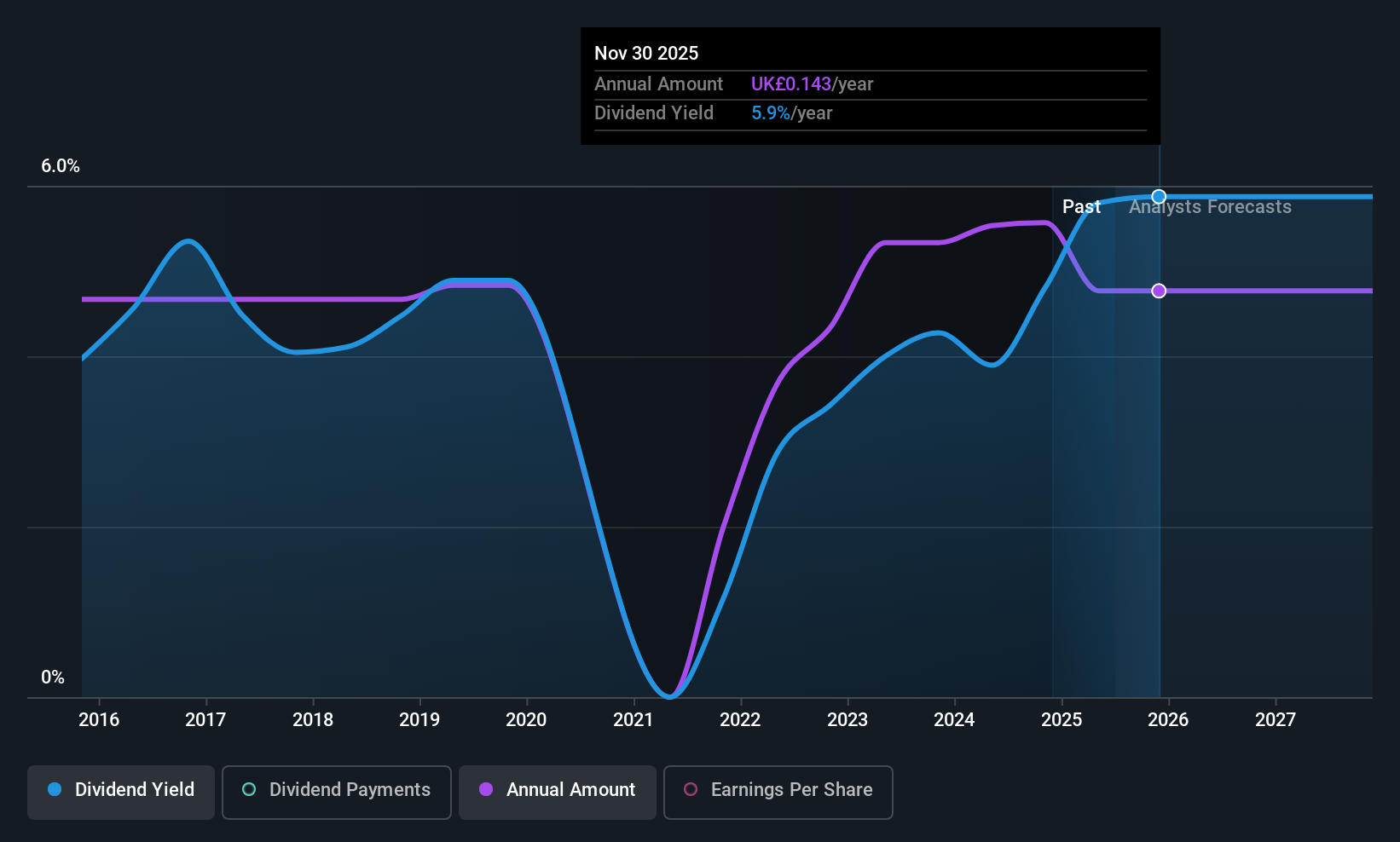

SThree (LSE:STEM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SThree plc offers specialist recruitment services in the STEM fields across various countries including the UK, US, and several European and Middle Eastern nations, with a market cap of £258.35 million.

Operations: SThree plc's revenue segments are comprised of the USA (£285.13 million), DACH region (£422.24 million), Rest of Europe (£320.10 million), Middle East & Asia (£40.00 million), and Netherlands (including Spain) (£310.85 million).

Dividend Yield: 7.0%

SThree's dividend yield of 6.98% ranks in the top UK payers, yet it faces sustainability concerns due to a high cash payout ratio of 146.7%. Earnings cover dividends reasonably with a payout ratio of 65.1%, but recent profit margins have declined from last year, impacting overall financial health. Despite stable interim dividends at 5.1 pence per share and strong cash generation, historical volatility raises reliability issues for long-term dividend investors.

- Click to explore a detailed breakdown of our findings in SThree's dividend report.

- According our valuation report, there's an indication that SThree's share price might be on the cheaper side.

Seize The Opportunity

- Reveal the 57 hidden gems among our Top UK Dividend Stocks screener with a single click here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal