ASX Dividend Stocks To Consider In August 2025

As the Australian market navigates a complex landscape influenced by global tariff tensions and shifting sector performances, investors are keenly observing consumer staples and materials, which have shown resilience amid these fluctuations. In this environment, dividend stocks can offer a degree of stability and income potential, making them an attractive consideration for those looking to balance growth with reliable returns.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Super Retail Group (ASX:SUL) | 7.84% | ★★★★★☆ |

| Sugar Terminals (NSX:SUG) | 8.24% | ★★★★★☆ |

| Nick Scali (ASX:NCK) | 3.12% | ★★★★★☆ |

| New Hope (ASX:NHC) | 9.72% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.57% | ★★★★★☆ |

| Lycopodium (ASX:LYL) | 6.84% | ★★★★★☆ |

| Lindsay Australia (ASX:LAU) | 6.94% | ★★★★★☆ |

| IPH (ASX:IPH) | 6.68% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 3.94% | ★★★★★☆ |

| Accent Group (ASX:AX1) | 6.83% | ★★★★★☆ |

Click here to see the full list of 32 stocks from our Top ASX Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

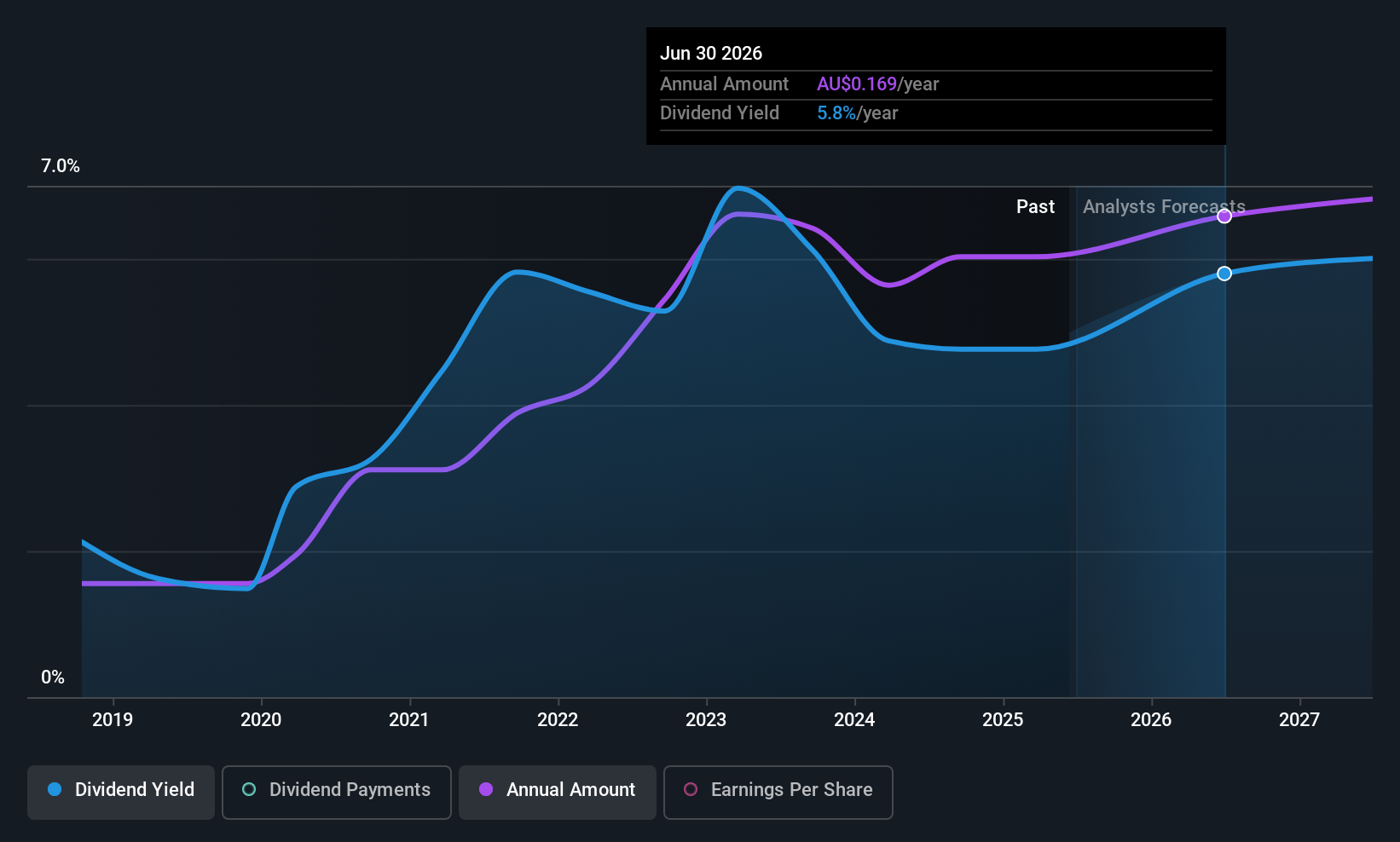

NRW Holdings (ASX:NWH)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: NRW Holdings Limited, with a market cap of A$1.48 billion, offers diversified contract services to the resources and infrastructure sectors in Australia through its subsidiaries.

Operations: NRW Holdings Limited generates revenue through its key segments: MET (A$853.22 million), Civil (A$776.06 million), and Mining (A$1.56 billion).

Dividend Yield: 4.8%

NRW Holdings offers a mixed profile for dividend investors. While its dividends are covered by earnings and cash flows, with payout ratios of 63.4% and 55.3% respectively, the company's dividend history has been volatile over the past decade, featuring significant annual drops. Despite this volatility, dividends have shown growth over ten years. Trading at good value compared to peers and industry benchmarks, NRW's current yield of 4.8% remains below Australia's top-tier payers' average of 5.87%.

- Unlock comprehensive insights into our analysis of NRW Holdings stock in this dividend report.

- Our valuation report unveils the possibility NRW Holdings' shares may be trading at a discount.

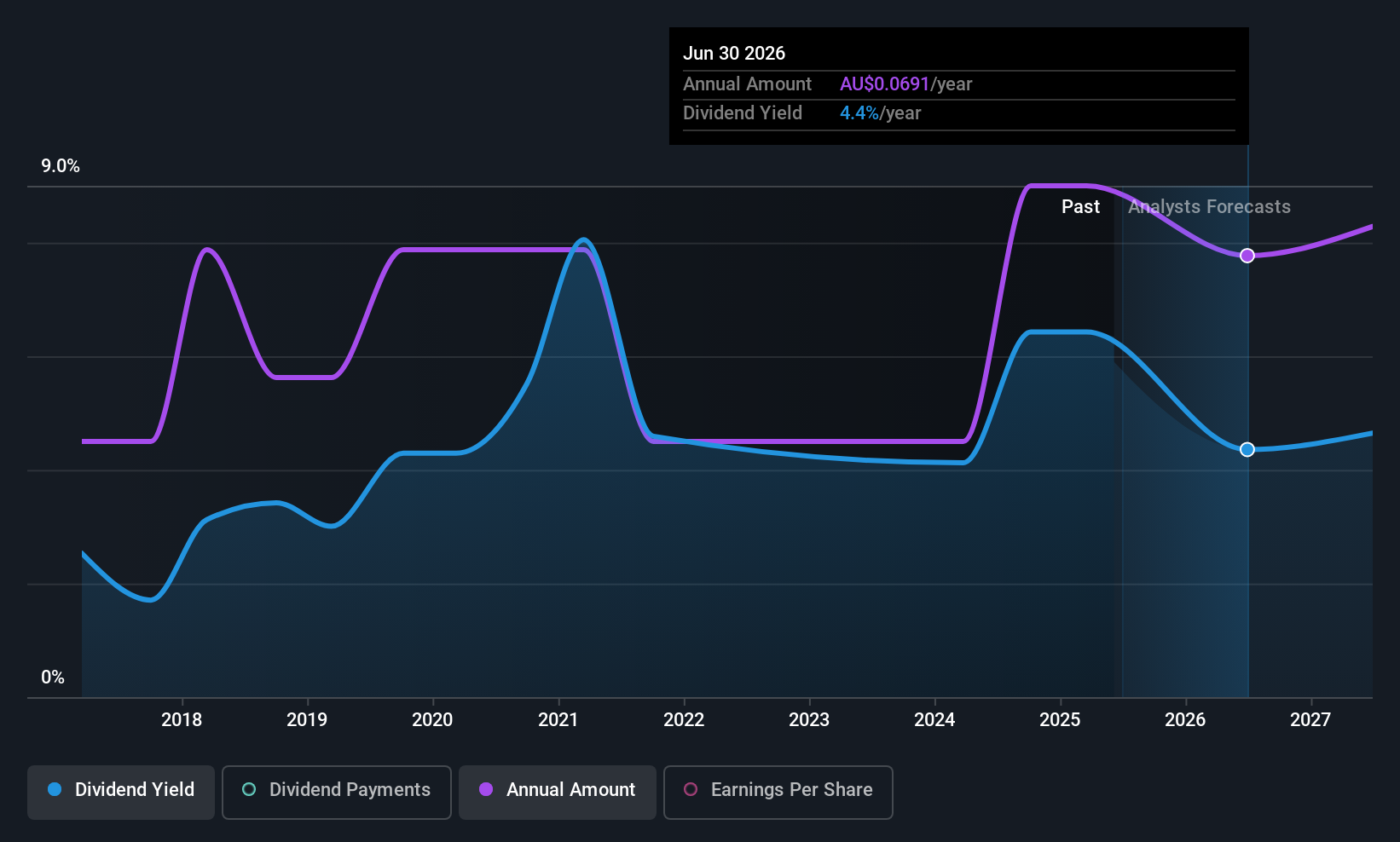

Perenti (ASX:PRN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Perenti Limited is a global mining services company with a market capitalization of A$1.65 billion.

Operations: Perenti Limited generates its revenue from three primary segments: Drilling Services (A$750.65 million), Contract Mining Services (A$2.50 billion), and Mining Services and Idoba (A$229.77 million).

Dividend Yield: 3.9%

Perenti's dividend payments are covered by earnings and cash flows, with payout ratios of 76% and 40.6% respectively, yet its dividend history has been unreliable over the past decade. Despite this volatility, dividends have increased over ten years. The company trades at a significant discount to its estimated fair value but offers a lower yield of 3.94% compared to Australia's top-tier payers' average of 5.87%. Recent corporate guidance reaffirms stable earnings expectations for fiscal year 2025.

- Navigate through the intricacies of Perenti with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential overvaluation of Perenti shares in the market.

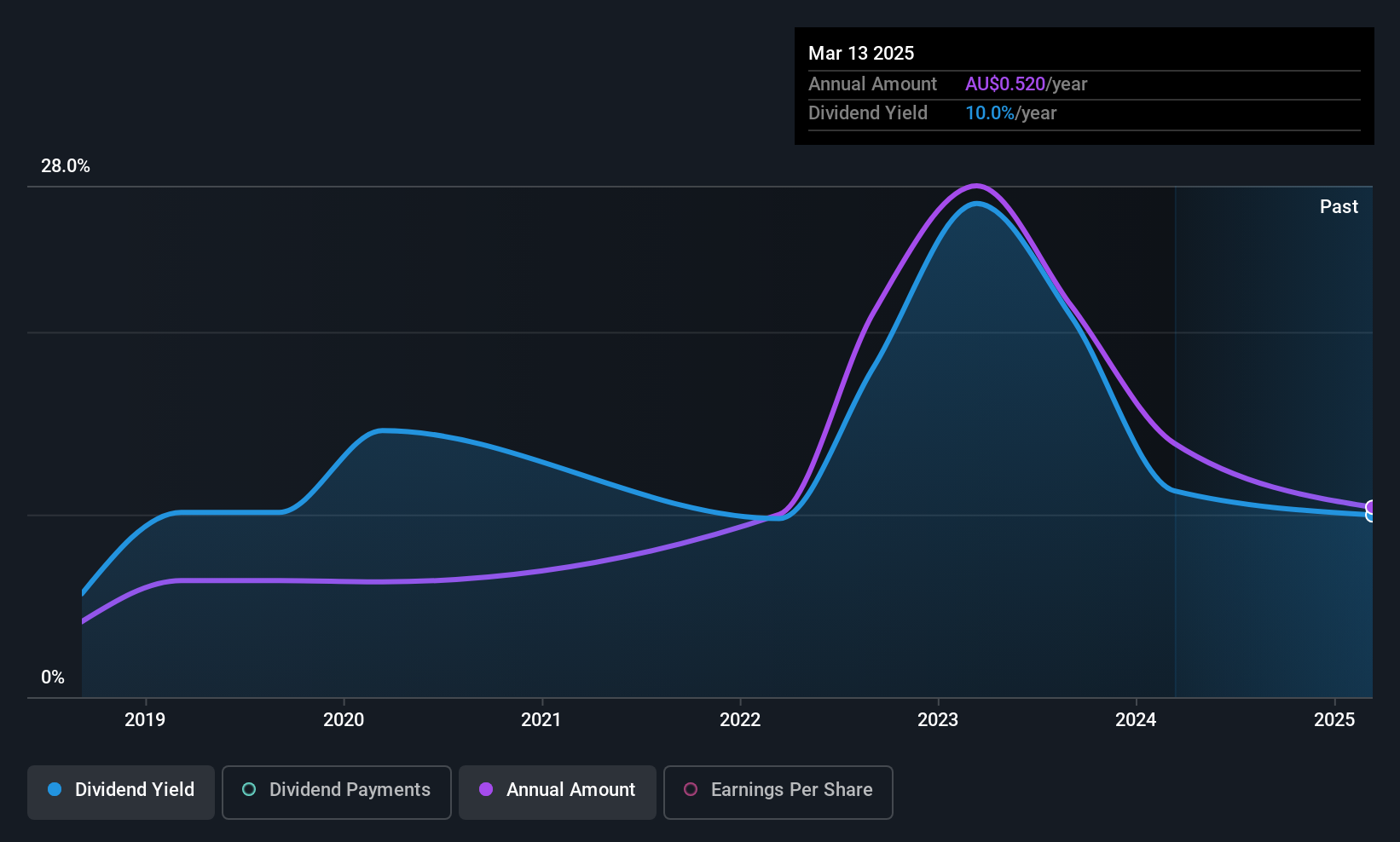

Yancoal Australia (ASX:YAL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Yancoal Australia Ltd is involved in the exploration, development, production, and marketing of metallurgical and thermal coal across various countries including Australia and several in Asia and Europe, with a market cap of A$8.31 billion.

Operations: Yancoal Australia's revenue primarily comes from its coal mining operations, with A$6.18 billion generated in New South Wales and A$584 million in Queensland.

Dividend Yield: 8.3%

Yancoal Australia's dividend payments are covered by earnings and cash flows, with payout ratios of 56.3% and 48.1%, respectively, but have been volatile over the past seven years. Despite this instability, its dividend yield is in the top 25% of Australian payers at 8.27%. The company trades at a favorable value with a P/E ratio of 6.8x compared to the market's 18.9x, although recent results show declining sales volumes and average realized prices per tonne year-on-year.

- Get an in-depth perspective on Yancoal Australia's performance by reading our dividend report here.

- Our expertly prepared valuation report Yancoal Australia implies its share price may be lower than expected.

Next Steps

- Delve into our full catalog of 32 Top ASX Dividend Stocks here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal