Did Snowflake's (SNOW) Expanded Data Partnerships Just Redefine Its AI Cloud Ambitions?

- In recent days, Snowflake unveiled several partnerships, including new integrations with Cint, Bloomreach, Parameta Solutions, and Quantiphi, aimed at expanding its marketplace data offerings and cloud platform capabilities. These collaborations enable Snowflake users to access high-integrity and privacy-protected data directly within the Snowflake AI Data Cloud, boosting data-driven analytics and compliance workflows for enterprise clients.

- These developments highlight how Snowflake is strengthening its ecosystem and increasing the breadth of value it delivers to financial institutions, marketers, and organizations modernizing data infrastructure.

- We'll examine how broader access to privacy-focused, integrated data across Snowflake's marketplace could influence the company's outlook and support its AI growth strategy.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Snowflake Investment Narrative Recap

To be a Snowflake shareholder, you have to believe in the company’s ability to drive future revenue through accelerating adoption of AI-driven data solutions, while also remaining wary of competitive threats from other data cloud and AI providers. The latest wave of partnerships expands Snowflake’s marketplace data offerings and platform integrations, but the near-term impact on its key catalyst, new product adoption and subsequent revenue growth, remains limited, as these integrations alone may not shift underlying adoption trends. The most pressing risk continues to be potential inconsistencies in revenue recognition if large customers move between contracted and on-demand usage.

Among recent client announcements, the Parameta Solutions collaboration stands out for its potential influence on Snowflake’s growth catalysts. By enabling seamless access for financial institutions to high-integrity OTC market data directly within Snowflake’s AI Data Cloud, this partnership supports workflow enhancements that could reinforce platform stickiness and appeal for enterprise users, building toward the company’s ambition for deeper AI and analytics integration.

However, investors should also be mindful that, in contrast to the partnerships and integrations, emerging revenue recognition risks could surface if...

Read the full narrative on Snowflake (it's free!)

Snowflake's outlook anticipates $7.3 billion in revenue and $460.3 million in earnings by 2028. This reflects a 23.6% annual revenue growth rate and a $1.86 billion increase in earnings from the current level of -$1.4 billion.

Uncover how Snowflake's forecasts yield a $231.60 fair value, a 4% upside to its current price.

Exploring Other Perspectives

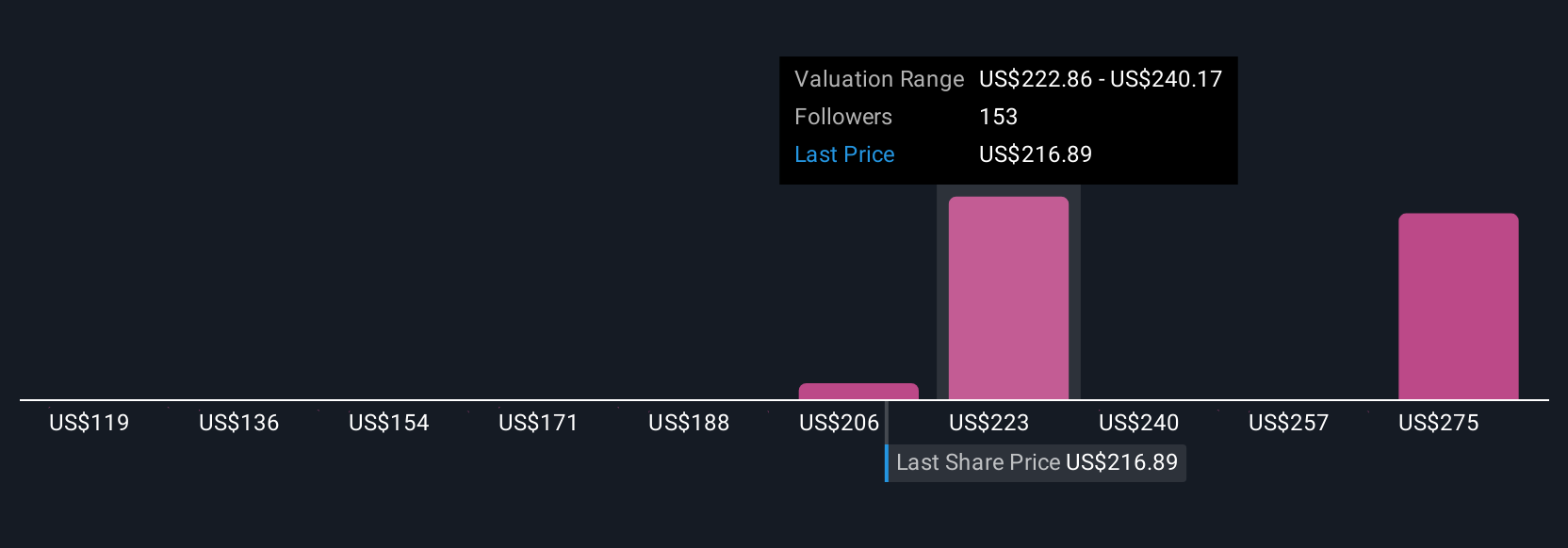

Fifteen retail investors in the Simply Wall St Community estimated Snowflake’s fair value to span from US$118.99 to US$290.60 per share. While many draw confidence from Snowflake’s focus on AI-driven product adoption, shifts in customer usage patterns make broad agreement on growth projections far from certain, see how your view compares.

Explore 15 other fair value estimates on Snowflake - why the stock might be worth 47% less than the current price!

Build Your Own Snowflake Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Snowflake research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Snowflake research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Snowflake's overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal