Huber+Suhner AG (VTX:HUBN) Stocks Shoot Up 25% But Its P/E Still Looks Reasonable

Despite an already strong run, Huber+Suhner AG (VTX:HUBN) shares have been powering on, with a gain of 25% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 42% in the last year.

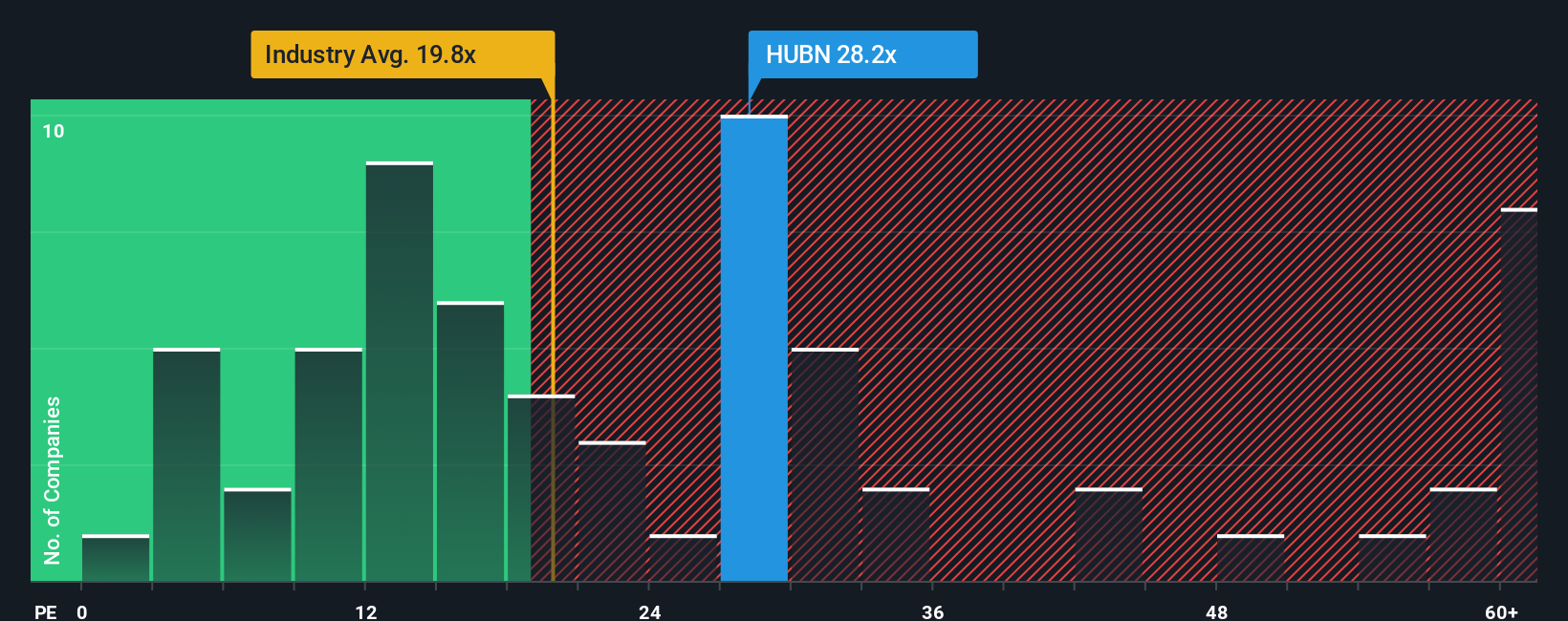

Following the firm bounce in price, Huber+Suhner's price-to-earnings (or "P/E") ratio of 28.2x might make it look like a sell right now compared to the market in Switzerland, where around half of the companies have P/E ratios below 20x and even P/E's below 15x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

There hasn't been much to differentiate Huber+Suhner's and the market's earnings growth lately. It might be that many expect the mediocre earnings performance to strengthen positively, which has kept the P/E from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

View our latest analysis for Huber+Suhner

Does Growth Match The High P/E?

In order to justify its P/E ratio, Huber+Suhner would need to produce impressive growth in excess of the market.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 11% last year. However, this wasn't enough as the latest three year period has seen an unpleasant 13% overall drop in EPS. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Turning to the outlook, the next three years should generate growth of 14% per annum as estimated by the five analysts watching the company. That's shaping up to be materially higher than the 10% each year growth forecast for the broader market.

In light of this, it's understandable that Huber+Suhner's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Huber+Suhner shares have received a push in the right direction, but its P/E is elevated too. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Huber+Suhner's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Huber+Suhner, and understanding should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal