Will Rising Revenue and Profit in Q2 2025 Change TransMedics Group's (TMDX) Narrative?

- TransMedics Group, Inc. recently announced second-quarter 2025 results, reporting revenue of US$157.37 million and net income of US$34.91 million, both up from the same period last year.

- The company's earnings per share also saw a substantial rise in the first half of 2025, highlighting improved profitability and operational performance.

- We’ll explore how TransMedics’ surging revenues and net income growth may enhance its investment narrative and long-term outlook.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 25 best rare earth metal stocks of the very few that mine this essential strategic resource.

TransMedics Group Investment Narrative Recap

For investors considering TransMedics Group, the central focus is the belief in the expanding adoption of innovative organ transplant solutions, supported by consistent growth in revenue and earnings. The recent Q2 2025 results showcase strong financial performance, but the short-term catalyst remains the launch of the Next-Gen Heart and Lung programs later this year; the primary risk is lingering market sensitivity from prior short reports, which the latest earnings have not materially altered.

Among recent corporate actions, the company's upward revision of its full-year 2025 revenue guidance following the latest quarterly results stands out. This reinforces expectations for accelerating operational scale, especially with new clinical program launches on the horizon, but also spotlights how execution and market perception will shape near-term momentum.

In contrast, investors should be aware of potential ongoing repercussions from short seller allegations, especially if...

Read the full narrative on TransMedics Group (it's free!)

TransMedics Group's narrative projects $860.3 million in revenue and $136.6 million in earnings by 2028. This requires 20.8% yearly revenue growth and an $87.7 million increase in earnings from $48.9 million today.

Uncover how TransMedics Group's forecasts yield a $140.57 fair value, a 31% upside to its current price.

Exploring Other Perspectives

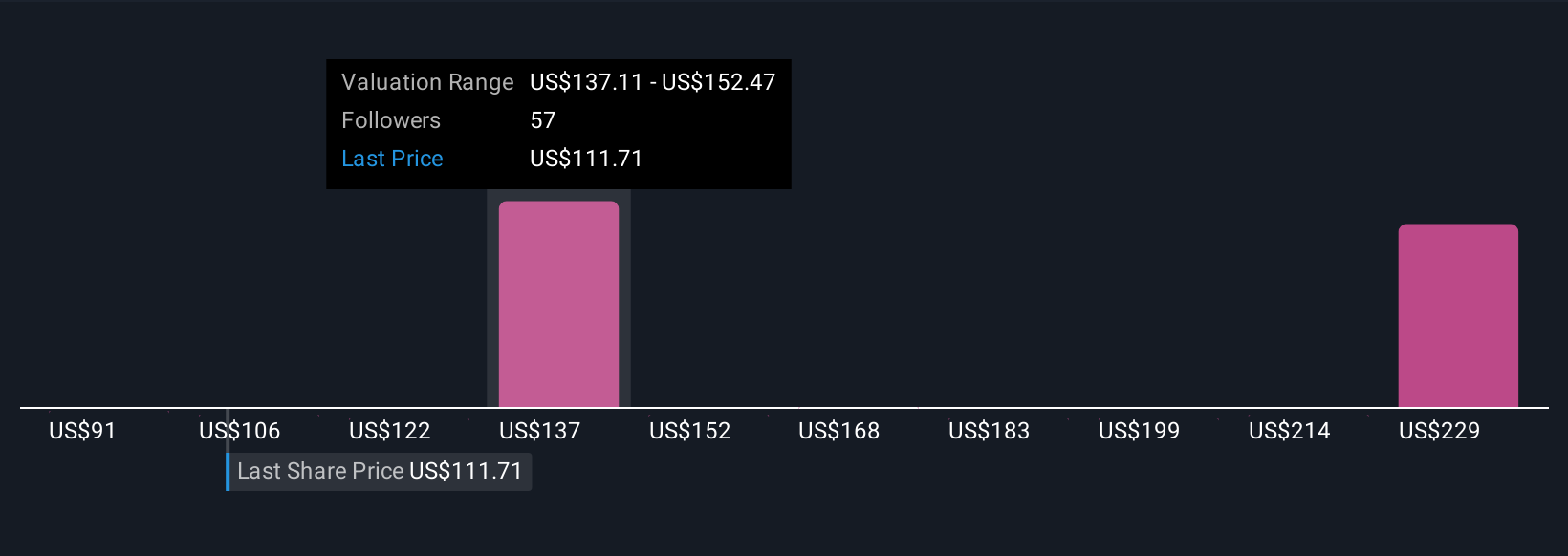

Eight fair value estimates from the Simply Wall St Community for TransMedics Group range widely from US$65.24 to US$269.06 per share. While many expect near-term growth on new clinical initiatives, these differing views remind you to consider multiple outlooks on both opportunity and risk.

Explore 8 other fair value estimates on TransMedics Group - why the stock might be worth 39% less than the current price!

Build Your Own TransMedics Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TransMedics Group research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free TransMedics Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TransMedics Group's overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 21 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal