3 Middle Eastern Penny Stocks With Market Caps Below US$20M

The Middle Eastern stock markets have recently experienced gains, driven by earnings optimism and anticipation of the U.S. Federal Reserve's policy outlook. For investors willing to explore beyond the well-known names, penny stocks—often smaller or newer companies—can offer intriguing possibilities. While the term might seem outdated, these stocks remain relevant for their potential mix of affordability and growth when backed by strong financials.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Big Tech 50 R&D-Limited Partnership (TASE:BIGT) | ₪1.391 | ₪14.76M | ✅ 0 ⚠️ 5 View Analysis > |

| Thob Al Aseel (SASE:4012) | SAR3.84 | SAR1.54B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪4.05 | ₪286.25M | ✅ 4 ⚠️ 2 View Analysis > |

| Mega Polietilen Köpük Sanayi ve Ticaret Anonim Sirketi (IBSE:MEGAP) | TRY4.69 | TRY1.29B | ✅ 2 ⚠️ 3 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.53 | AED3.06B | ✅ 3 ⚠️ 3 View Analysis > |

| Katmerciler Arac Üstü Ekipman Sanayi ve Ticaret (IBSE:KATMR) | TRY2.56 | TRY2.76B | ✅ 2 ⚠️ 1 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.30 | AED381.15M | ✅ 2 ⚠️ 4 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED2.93 | AED12.5B | ✅ 2 ⚠️ 3 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.815 | AED495.73M | ✅ 2 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.49 | ₪185.11M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 78 stocks from our Middle Eastern Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Hub Girisim Sermayesi Yatirim Ortakligi (IBSE:HUBVC)

Simply Wall St Financial Health Rating: ★★★★☆☆

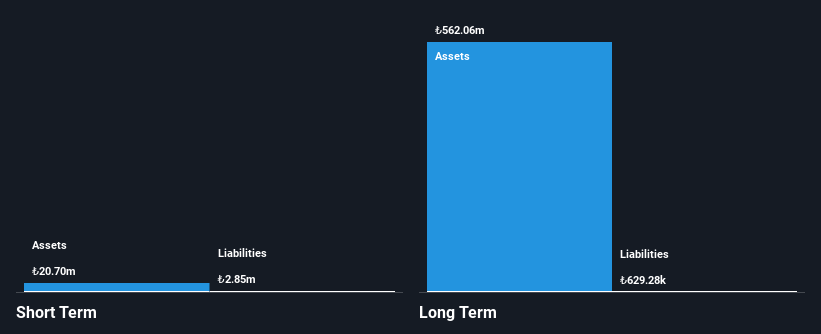

Overview: Hub Girisim Sermayesi Yatirim Ortakligi A.S. operates as a venture capital investment company, with a market capitalization of TRY728 million.

Operations: Hub Girisim Sermayesi Yatirim Ortakligi A.S. does not report distinct revenue segments.

Market Cap: TRY728M

Hub Girisim Sermayesi Yatirim Ortakligi, with a market cap of TRY728 million, is pre-revenue and unprofitable, making it challenging to compare its growth to the broader Capital Markets industry. Despite having no debt and short-term assets exceeding liabilities, the company faces financial strain with less than a year of cash runway. Its share price has been highly volatile recently. The board's experience averages 3.8 years; however, management tenure details are insufficient. While shareholders haven't faced significant dilution recently, the company's negative return on equity and increased losses over five years highlight ongoing challenges.

- Click to explore a detailed breakdown of our findings in Hub Girisim Sermayesi Yatirim Ortakligi's financial health report.

- Examine Hub Girisim Sermayesi Yatirim Ortakligi's past performance report to understand how it has performed in prior years.

Big Tech 50 R&D-Limited Partnership (TASE:BIGT)

Simply Wall St Financial Health Rating: ★★★★★★

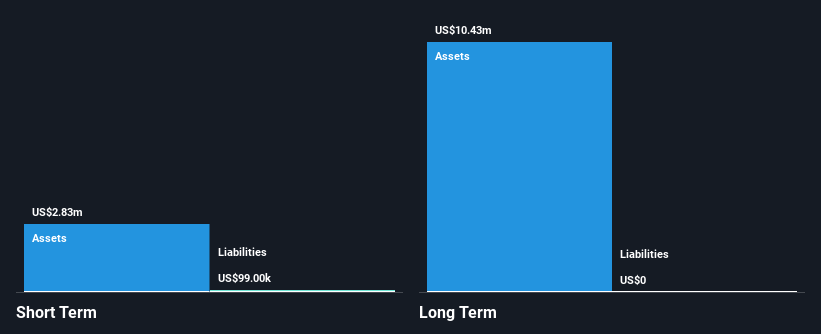

Overview: Big Tech 50 R&D-Limited Partnership focuses on investing in technology companies in Israel and has a market cap of ₪14.76 million.

Operations: Big Tech 50 R&D-Limited Partnership does not currently report any positive revenue from its segments.

Market Cap: ₪14.76M

Big Tech 50 R&D-Limited Partnership, with a market cap of ₪14.76 million, is pre-revenue and unprofitable, complicating comparisons with the broader Capital Markets industry. Despite its lack of debt and sufficient short-term assets to cover liabilities, the company has experienced increasing losses at a rate of 50.4% annually over five years. The cash runway exceeds three years if free cash flow growth persists at historical rates. Recent dividend announcements indicate financial commitments despite earnings challenges; however, its share price remains highly volatile. The board's average tenure is 4.3 years, but management experience details are lacking.

- Jump into the full analysis health report here for a deeper understanding of Big Tech 50 R&D-Limited Partnership.

- Gain insights into Big Tech 50 R&D-Limited Partnership's past trends and performance with our report on the company's historical track record.

SavorEat (TASE:SVRT-M)

Simply Wall St Financial Health Rating: ★★★★★★

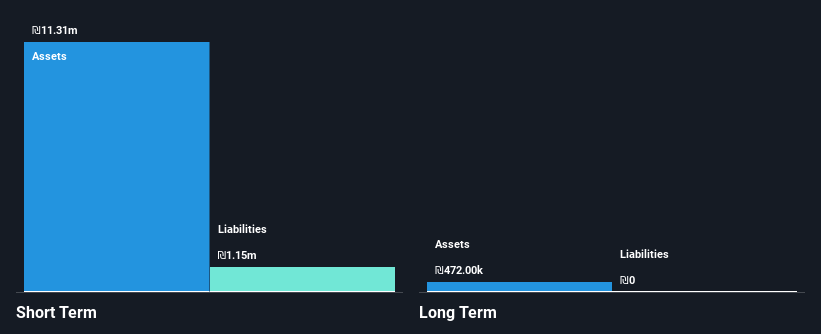

Overview: SavorEat Ltd. is a company specializing in cellulose-based meat substitutes that aim to replicate the eating experience of traditional meat, with a market cap of ₪7.23 million.

Operations: As of the latest report, SavorEat Ltd. has not disclosed any specific revenue segments.

Market Cap: ₪7.23M

SavorEat Ltd., with a market cap of ₪7.23 million, is pre-revenue and unprofitable, making direct comparisons challenging within its sector. The company has no debt and maintains sufficient short-term assets to cover liabilities, providing some financial stability. Recent strategic collaborations in the U.S., including partnerships with The Moseley Group and a commercial management firm, aim to accelerate the commercialization of its Robot-Chef 2.0 platform in North America. Despite these efforts, SavorEat's share price remains highly volatile, reflecting investor uncertainty amid increasing losses over the past five years at 15.2% annually.

- Take a closer look at SavorEat's potential here in our financial health report.

- Gain insights into SavorEat's historical outcomes by reviewing our past performance report.

Make It Happen

- Take a closer look at our Middle Eastern Penny Stocks list of 78 companies by clicking here.

- Looking For Alternative Opportunities? Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal