The trade reversal boosted a strong rebound in GDP, and the US economy grew 3% in the second quarter

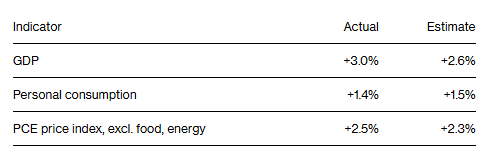

The Zhitong Finance App learned that US economic activity rebounded in the second quarter thanks to a slight recovery in consumer spending and a significant drop in imports after the rush to buy foreign goods at the beginning of the year receded. According to preliminary data released by the US government on Wednesday, the inflation-adjusted gross domestic product (GDP), which measures the output value of goods and services in the US, contracted 0.5% month-on-month in the previous quarter, and then reached an annualized growth rate of 3% in the second quarter.

According to a report by the US Bureau of Economic Analysis, net exports contributed 5 percentage points to GDP — while in the first three months of this year, net exports dragged down GDP in history. It is worth noting that goods and services not produced in the US are deducted when calculating GDP, but are included when counting consumption data.

Leaving aside recent fluctuations caused by tariff policies, overall economic activity in the second quarter was more moderate. Consumer spending, which accounts for two-thirds of total GDP, increased by 1.4%, the lowest growth rate for two consecutive quarters since the pandemic; corporate investment growth has also slowed.

“Economic resilience is the key word this summer,” Heather Long, chief economist at Navy Federal Credit Union analyzed. “Consumers are still supporting the economy, but they are still on thin ice until the dust settles on trade agreements.”

The second-quarter economic data released this time is only the beginning of this week's major data. Monthly reports on consumer spending, inflation, and the job market will be released one after another. Federal Reserve policymakers will end the two-day meeting on Wednesday afternoon local time, and this GDP data suggests that potential demand is weakening.

As fluctuations in trade and inventories continue to distort overall GDP data this year, economists are focusing more on “domestic private final sales”, an indicator that accurately measures domestic demand. The indicator grew by only 1.2% in the second quarter, the lowest level since the end of 2022.

After the data was released, stock index futures trends fluctuated, while US Treasury yields and the US dollar exchange rate both rose. Just before the report was released, Trump announced that the US would impose 25% tariffs on Indian goods.

Trump praised the GDP data on social media for “far exceeding expectations” and once again called on Federal Reserve Chairman Powell and his colleagues to cut interest rates. However, the market generally expects the Federal Reserve to keep interest rates unchanged.

There are signs that policy uncertainty is beginning to subside, which not only boosts the stock market, but also supports consumer confidence. The Trump administration has reached trade agreements with major trading partners such as the European Union and Japan, and other countries will face further increases in import tariffs if they fail to reach a trade agreement with the US by Friday.

The increase in consumer spending is mainly due to a rebound in purchases of durable goods (especially automobiles), and there has also been a certain recovery in service demand. At the beginning of this year, consumer spending growth fell to its lowest level since 2020 due to widespread uncertainty.

As investors gradually absorb the impact of trade policies, some companies are also optimistic that consumer demand will be supported. Chipotle Mexican Grill (CMG.US) and United Airlines (UAL.US) both said during the earnings call that consumer spending has picked up as consumer confidence has improved.

“Although the tariff policy has not yet been finalized, the market and most enterprises can better predict how to respond in limited circumstances. Encouragingly, this increase in certainty has become an important turning point for demand recovery,” United Airlines CEO Scott Kirby said during the July 17 earnings call.

The GDP report also showed that non-residential fixed asset investment, including investment in enterprise equipment and facilities, increased by 1.9%, a marked decline from the peak of three years in the first quarter. Earlier this month, Trump signed a budget bill to perpetuate the 2017 tax cuts and introduce corporate investment incentives.

However, economic concerns remain: Another report on Wednesday showed that corporate recruitment picked up in July after a sharp decline in June, but the overall growth rate still reflects weak labor demand: ADP data showed that the private sector added 104,000 new jobs in July. Furthermore, the real estate market continued to be sluggish, with residential investment falling 4.6% annualized, the biggest decline since 2022. Changes in commercial inventories also dragged down GDP growth by 3.17 percentage points. Coupled with a reversal in net exports due to early purchases by enterprises at the beginning of the year, they also caused inventory contraction in the second quarter.

The US Bureau of Economic Analysis report also showed that the Federal Reserve's core inflation index rose 2.5% in the second quarter, and the growth rate was slower than at the beginning of the year. Detailed inflation and expenditure data for June, which will soon be released, are expected to show that as part of the tariff costs are passed on to consumers, the pressure on core prices may rise slightly.

The current debate among Federal Reserve officials is focused on the extent of the impact of Trump's policies on inflation — some policymakers believe that tariffs will only trigger a one-time price adjustment, while others are concerned that the impact may be more profound.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal