Should Sunoco’s (SUN) Latest Dividend Increase Prompt a Closer Look From Investors?

- Sunoco LP's Board of Directors recently approved a quarterly distribution increase to US$0.9088 per common unit for the quarter ended June 30, 2025, raising the annualized payout to US$3.6352 and marking a 1.25% rise over the prior quarter's distribution.

- This distribution hike underscores Sunoco’s ongoing commitment to returning value to shareholders and signals management’s confidence in the company’s operational strength.

- We’ll explore how Sunoco’s latest dividend increase could influence the company’s investment narrative and outlook for shareholder returns.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 25 companies in the world exploring or producing it. Find the list for free.

Sunoco Investment Narrative Recap

To be a Sunoco shareholder, you need to believe in the company's ability to sustain and grow its fuel distribution operations while maintaining disciplined capital management as it expands globally. The latest 1.25% quarterly distribution increase highlights a continued focus on regular returns, but it does not materially change the near-term catalyst, successful integration and cash flow realization from recent acquisitions, nor does it fully offset the ongoing risk of declining fuel volumes, which remains significant. Amidst these developments, Sunoco’s June 2025 credit facility amendment, extending maturity and increasing commitments, stands out as directly relevant. This improvement in financial flexibility supports Sunoco’s acquisition-driven growth strategy, potentially giving the company more room to manage debt associated with the Parkland and TanQuid deals, two key drivers influencing both upcoming catalysts and risks. In contrast, investors should be aware that even with higher distributions, persistent declines in core fuel volumes could ...

Read the full narrative on Sunoco (it's free!)

Sunoco's outlook anticipates $27.6 billion in revenue and $1.2 billion in earnings by 2028. This projection is based on annual revenue growth of 7.2% and an earnings increase of approximately $511 million from current earnings of $689 million.

Uncover how Sunoco's forecasts yield a $64.83 fair value, a 18% upside to its current price.

Exploring Other Perspectives

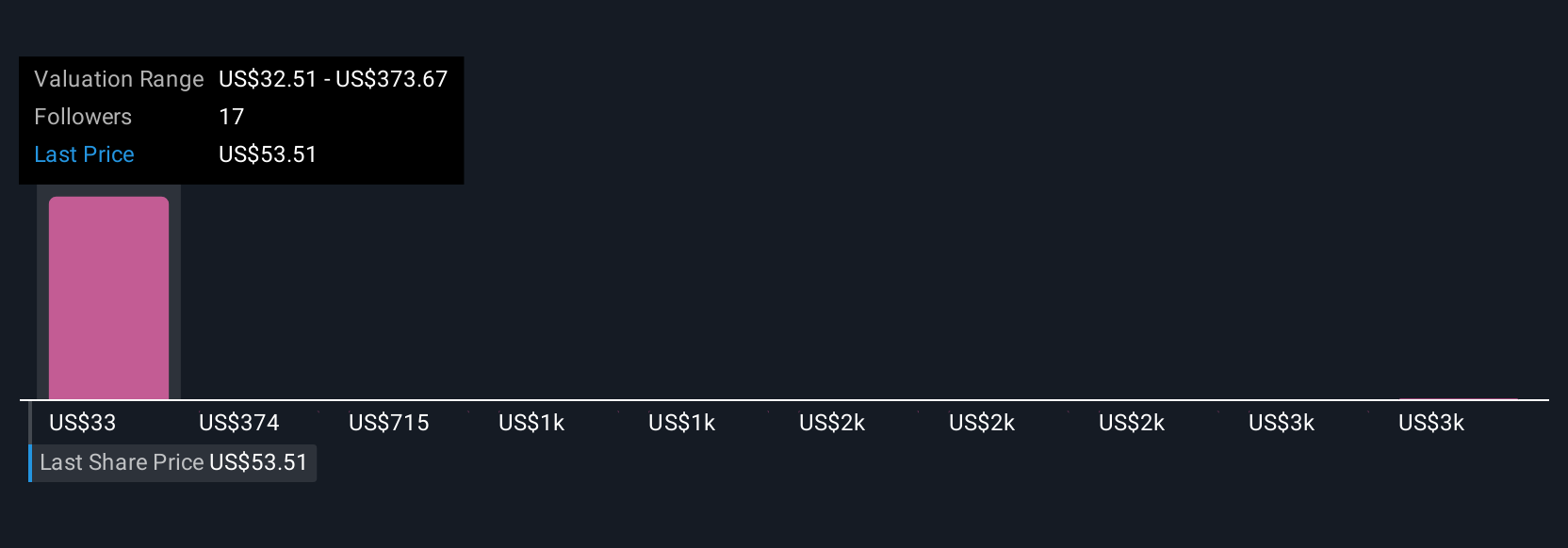

Five members of the Simply Wall St Community estimate Sunoco’s fair value from US$32.51 to a striking US$3,444.12. While some analysts focus on the impact of new acquisitions, your view may differ widely, see how others interpret Sunoco’s prospects.

Explore 5 other fair value estimates on Sunoco - why the stock might be worth 41% less than the current price!

Build Your Own Sunoco Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sunoco research is our analysis highlighting 4 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Sunoco research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sunoco's overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal