Top 3 European Dividend Stocks To Watch

As the European markets experience tentative optimism surrounding a potential EU-U.S. trade deal, with the STOXX Europe 600 Index rising modestly, investors are keenly observing how these developments might influence dividend stocks. In such an environment, selecting robust dividend stocks involves looking for companies with stable earnings and a strong history of returning value to shareholders, making them attractive options amidst economic uncertainties.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.49% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.22% | ★★★★★★ |

| OVB Holding (XTRA:O4B) | 4.63% | ★★★★★★ |

| Les Docks des Pétroles d'Ambès -SA (ENXTPA:DPAM) | 5.67% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.78% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.86% | ★★★★★★ |

| ERG (BIT:ERG) | 5.24% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.04% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.63% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.47% | ★★★★★★ |

Click here to see the full list of 224 stocks from our Top European Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

TF1 (ENXTPA:TFI)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: TF1 SA operates in broadcasting, studios and entertainment, and digital sectors both in France and internationally, with a market cap of €1.82 billion.

Operations: TF1 SA generates its revenue primarily from its Media segment, including digital, which accounts for €2.03 billion, and its Studios TF1 segment, contributing €408.40 million.

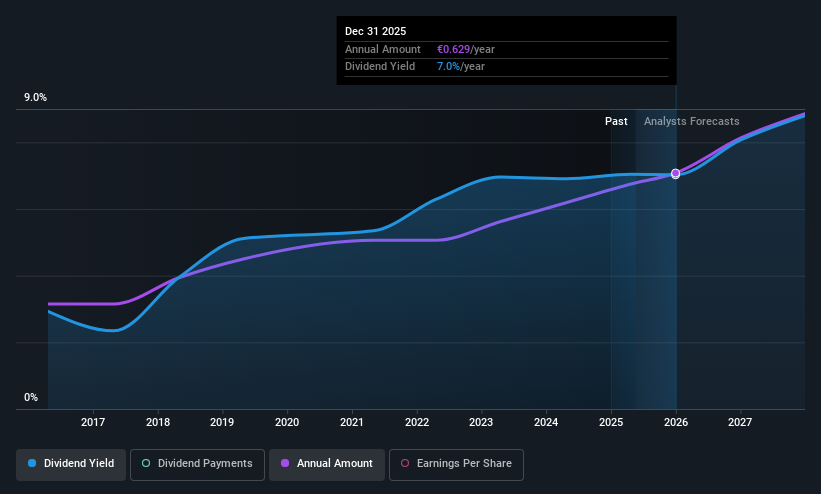

Dividend Yield: 7.0%

TF1's dividend yield is among the top 25% in France, offering an attractive option for income-focused investors. However, its dividend history has been volatile over the past decade, with periods of significant fluctuations. Despite this instability, dividends are currently covered by both earnings and cash flows with a payout ratio of 66.4% and a cash payout ratio of 84.1%. Recent strategic partnerships, such as with Netflix in France, may support future revenue streams but do not directly impact current dividend stability.

- Take a closer look at TF1's potential here in our dividend report.

- Our expertly prepared valuation report TF1 implies its share price may be lower than expected.

Burgenland Holding (WBAG:BHD)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Burgenland Holding Aktiengesellschaft, with a market cap of €219 million, is involved in the generation and sale of electricity in Austria through its investment in Burgenland Energie AG.

Operations: Burgenland Holding's revenue is primarily derived from its investment in Burgenland Energie AG, focusing on electricity generation and sales within Austria.

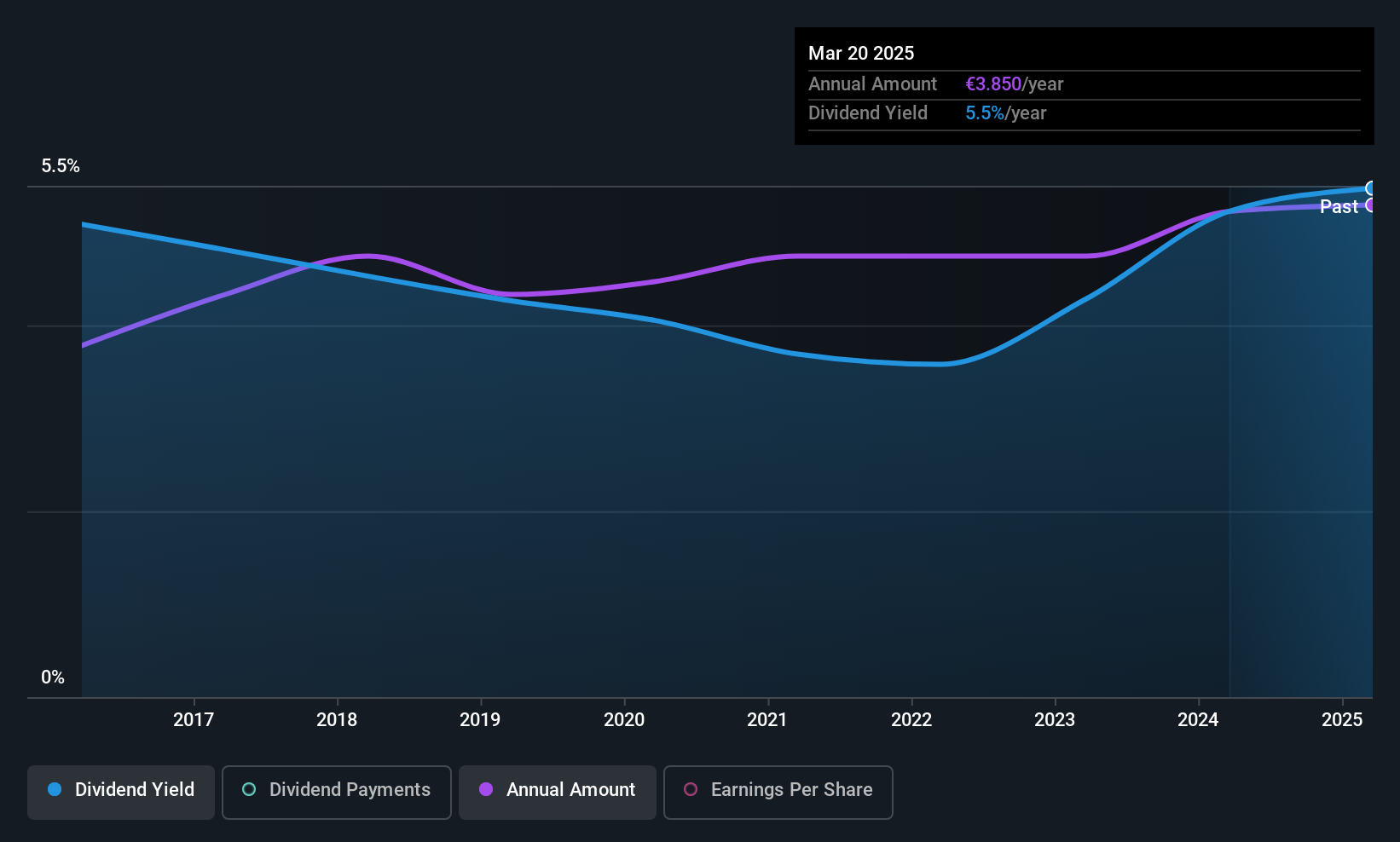

Dividend Yield: 5.3%

Burgenland Holding offers a dividend yield of 5.27%, placing it in the top 25% of Austrian dividend payers. Despite a high payout ratio of 94.9%, dividends have been stable and reliable over the past decade, though coverage by earnings remains weak. The company reported net income of €11.81 million for the half year ending March 31, 2025, reflecting modest growth from €11.31 million previously but lacks sufficient data to assess cash flow coverage or sustainability fully.

- Click to explore a detailed breakdown of our findings in Burgenland Holding's dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Burgenland Holding shares in the market.

Strabag (WBAG:STR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Strabag SE, along with its subsidiaries, operates in construction projects across transportation infrastructures, building construction, and civil engineering, with a market cap of €9.61 billion.

Operations: Strabag SE's revenue is primarily derived from its North + West segment (€7.35 billion), South + East segment (€7.28 billion), and International + Special Divisions segment (€3.06 billion).

Dividend Yield: 3.1%

Strabag SE's dividend payments have been volatile over the past decade, despite a low payout ratio of 34%, indicating strong coverage by earnings and cash flows. The stock trades at a favorable price-to-earnings ratio of 11.7x compared to the Austrian market average, but its dividend yield of 3.08% is below top-tier levels. Recent guidance suggests an improved EBIT margin for 2025, yet earnings are expected to decline by 2.6% annually over the next three years.

- Delve into the full analysis dividend report here for a deeper understanding of Strabag.

- The valuation report we've compiled suggests that Strabag's current price could be quite moderate.

Summing It All Up

- Get an in-depth perspective on all 224 Top European Dividend Stocks by using our screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal