Could Murphy Oil's (MUR) ESOP Stock Offering Reveal a Shift in Long-Term Incentive Strategy?

- Murphy Oil Corporation recently filed a shelf registration to offer 3,885,000 shares of common stock, valued at about US$102.29 million, in an ESOP-related move.

- This type of equity financing can impact ownership structure and may indicate plans to strengthen employee alignment or support future corporate initiatives.

- We’ll explore how this large-scale ESOP-related stock offering could influence Murphy Oil’s long-term growth outlook and shareholder value.

Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

Murphy Oil Investment Narrative Recap

To invest in Murphy Oil, you need to believe in its ability to balance capital-intensive growth projects with shareholder returns, even as operational execution and commodity price fluctuations remain central to its outlook. The new ESOP-related equity offering does not appear to materially affect the most important short-term catalyst, production growth from recent international discoveries, nor does it directly address the largest risk, which is execution risk in major development projects impacting margins and cash flow.

Among recent company developments, the acquisition of the BW Pioneer floating production storage vessel for US$125 million stands out. This purchase signals Murphy Oil's focus on expanding offshore capacity and underpins ongoing production growth guidance, an important catalyst, especially given its investment in large-scale developments across multiple regions. However, sustaining this growth while avoiding delays and cost overruns will remain an important challenge, as reflected in recent performance trends.

By contrast, the scale of Murphy Oil’s ongoing capital expenditures is something investors should be aware of...

Read the full narrative on Murphy Oil (it's free!)

Murphy Oil’s outlook anticipates $2.9 billion in revenue and $534.7 million in earnings by 2028. This is based on a 0.5% annual revenue decline and a $141.9 million increase in earnings from the current level of $392.8 million.

Uncover how Murphy Oil's forecasts yield a $27.21 fair value, in line with its current price.

Exploring Other Perspectives

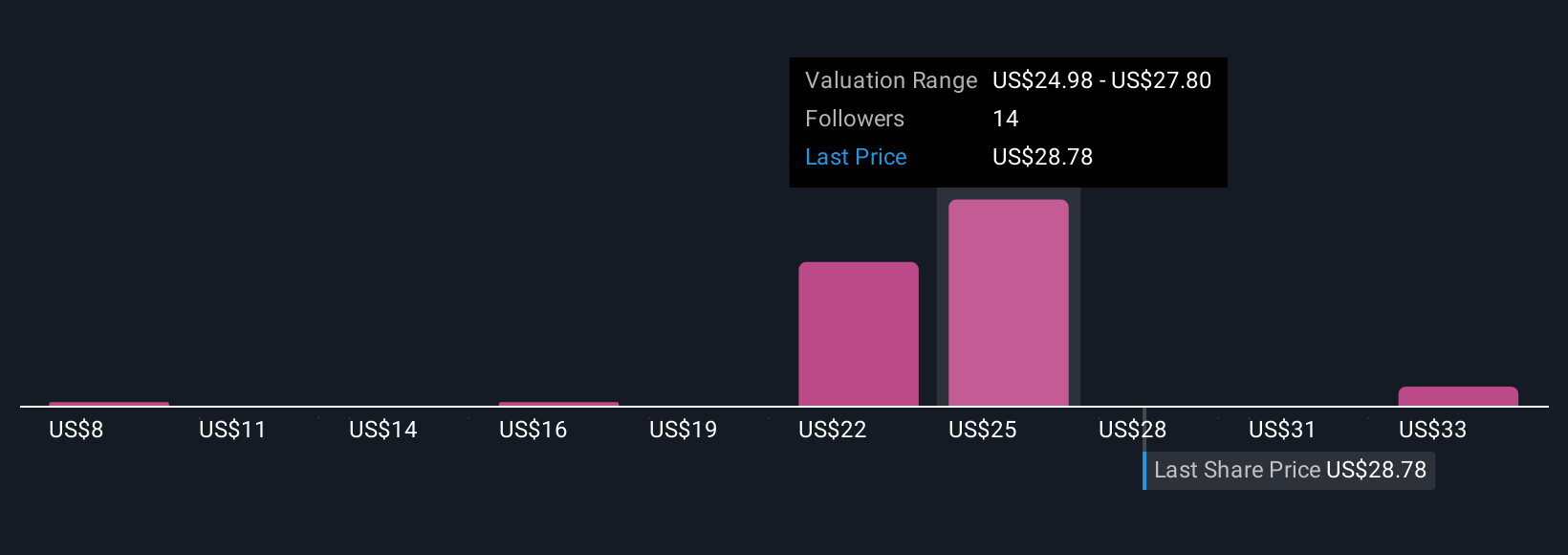

You'll find five individual fair value estimates from the Simply Wall St Community ranging from US$8 to US$34,092, with the top estimates well above recent market prices. Shifting capital commitments and project risks show why opinions on Murphy Oil’s potential can vary so widely, considering different views can help you see the full picture.

Explore 5 other fair value estimates on Murphy Oil - why the stock might be worth as much as 26% more than the current price!

Build Your Own Murphy Oil Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Murphy Oil research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Murphy Oil research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Murphy Oil's overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 19 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal